The cryptocurrency marketplace is growing to incorporate more assets and chains available than in the past. Regrettably, despite the amount of assets playing, most decentralized exchanges (DEXs) continue to be not able to provide and facilitate the regularity and amount of trades essential to fulfill the market. Consequently, these exchanges face too little liquidity and slippage, frequently occurring when fractions of the order are completed in a lower cost and also the rest in a greater and fewer beneficial cost.

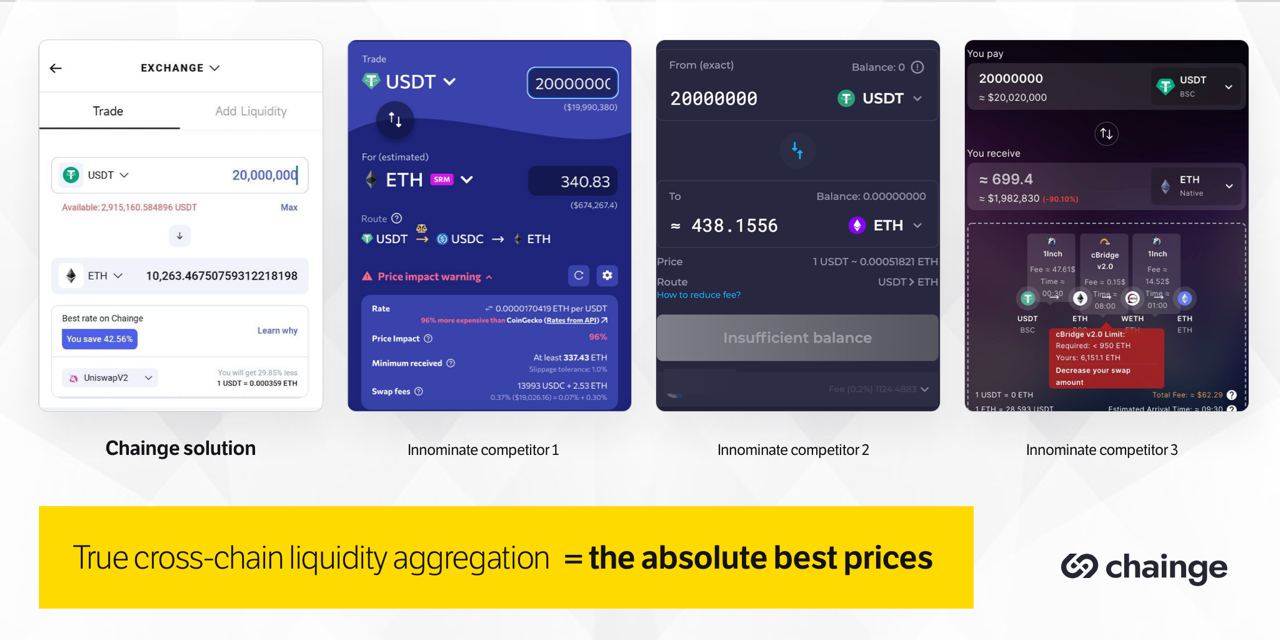

Because of this, investors frequently look for manual workarounds, including checking to find the best buying and selling prices on all DEXs prior to making a transaction. Despite a lot of exchanges playing, the marketplace has yet to determine a real mix-chain liquidity aggregator that may facilitate transactions across multiple chains for any swap. At the moment, aggregators cannot connect to the full breadth of accessible chains, nor could they be user-friendly. For reference, some tools pressure users for connecting multiple wallets or by hand swap them between protocols.

Chainge Finance addresses this pressing DeFi anxiety about the Chainge application, giving users accessibility SUM liquidity of multiple DEXs across several chains simultaneously. Operated by the Fusion DCRM tech, the DEX aggregates liquidity mix-chain to make sure that users obtain the best prices for his or her target swaps.

“The Chainge application may be the door to Web3. An application that gives unmatched security, top buying and selling prices and also the best mix-chain solution available on the market. In addition, advanced integrated DeFi tools like a derivatives market, time-framing and yield farming offer crypto users the way to maximize their wealth’s potential inside a 100% decentralized way,” Dejun Qian, the Chief executive officer of Chainge Finance, shares as a result of the team’s efforts.

As a result Chainge Finance users can make use of extensive mix-chain liquidity having a single tap.

Maximizing liquidity

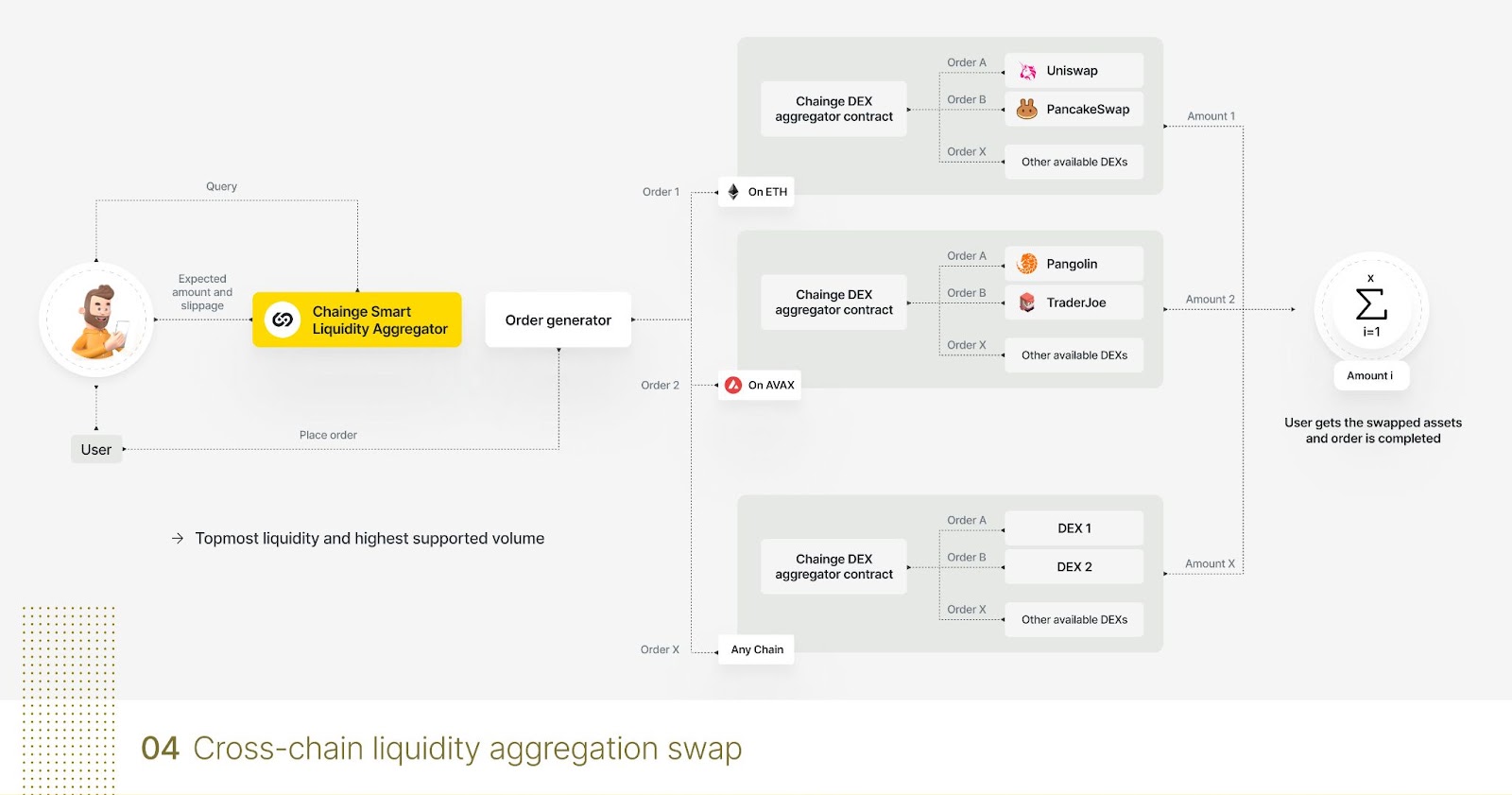

Chainge Finance presently aggregates liquidity across 9 chains and 20 DEXs, including 1inch, Uniswap v1, Uniswap v2 and SushiSwap on Ethereum (ETH) and PanCake, Hamburger, BabySwap, ApeSwap, MDEX and BakerySwap on Binance Smart Chain (BSC), to mention a couple of, with lots of more to become progressively added.

Other exchanges are dispersed across HECO, AVAX, MATIC, CRO, AURORA, ARB, FTM, KLAY and OKT. Together, users may feel the entire breadth of functionality across an exciting-in-one solution which works as a wallet, therefore delivering an optimistic consumer experience and mix-chain aggregated DEX with assorted asset management tools.

To do this, Chainge combines the DCRM technology along with a mix-chain swap pathfinder formula to facilitate traders’ mix-chain swap orders. Upon initiating a swap, the Chainge DEX formula searches the neighborhood database that contains all of the DEXs integrated with supported chains for that given pair. After that it is constantly on the search until it pinpoints the DEXs using the cheapest slippage rate and finest rates for that specific pair and, simultaneously, determine probably the most liquid chains for that asset transfer. Assets will be delivered to the prospective chains, and also the amount indicated is split one of the DEXs after which swapped.

Users then get the most beneficial amount for any given trade, within a few minutes, alongside benefits for example directly buying over 200 crypto assets on any chain inside a cohesive multichain experience. Chainge Finance has formally end up being the most liquid DEX available on the market, guaranteeing its users the very best prices for his or her trades.

Chainge sticks out all other aggregators with being able to access liquidity across multiple chains simultaneously for just about any given asset pair trade. The mix-chain liquidity aggregator has become reside in the most recent form of the Chainge application on the Application Store and Google Play Store.

450,000 and growing

Prior to the integration from the mix-chain liquidity aggregator, they had already achieved a substantial way of measuring success, using its $170 million total value locked (TVL) in liquidity pools inside a total transacting number of 450,000 users. The work has since arrived at an exciting-time high 24-hour buying and selling amount of $4 million, positioning the DeFi platform as the foremost and just one together with a decentralized options DEX and the potential of delivering assets via Twitter handle.

Searching forward, they is working for the discharge of public APIs, allowing assembling your shed to integrate Chainge solutions, overseas accounts and fiat on- and off-ramp. These additions are met having a social module, that will bridge finance and social systems, nonfungible tokens (NFTs) along with a bigger metaverse.

Disclaimer. Cointelegraph doesn’t endorse any content or product in this article. Basically we are designed for supplying you with all of information that people could obtain, readers must do their very own research when considering actions associated with the organization and bear full responsibility for his or her decisions, nor can this short article be looked at as investment recommendations.