You’ve seen it before. An incredibly gifted gaming founder teams track of a high-tier studio, promising to produce a wondrous game experience built around the industry’s most effective engines. However, it takes place: It’s combined with a dubious shitcoin that launches prior to a morsel of game content drops.

Within the not-so-distant past, mainstream media might have known the hype-fueled crypto bull market — but, with Bored Ape floor prices still within the clouds, we’ll professionally refer to it as what it’s: the monkey run. Market volatility aside, Metaverse evangelists still declare that Web3 finance will transform the way in which games monetize. I call BS.

The main focus at this time isn’t on new monetization models. The only real factor these token raises are challenging is the thought of capital formation — not monetization. However tempting, the monkey run has rapidly deluded a lot of our brightest founders into believing they should raise a nonsensically great deal of capital from tokens printed of nothing, like a faulty replacement for a genuine monetization strategy.

We’re ready for something new of mindset. The critical real question is this: exactly how should we result in the hyper-capitalized, hyper-hyped Web3 Metaverse project work — for gamers, for founders, as well as for investors?

Related: Blockchain games undertake the mainstream

Path #1: Shilling is thrilling

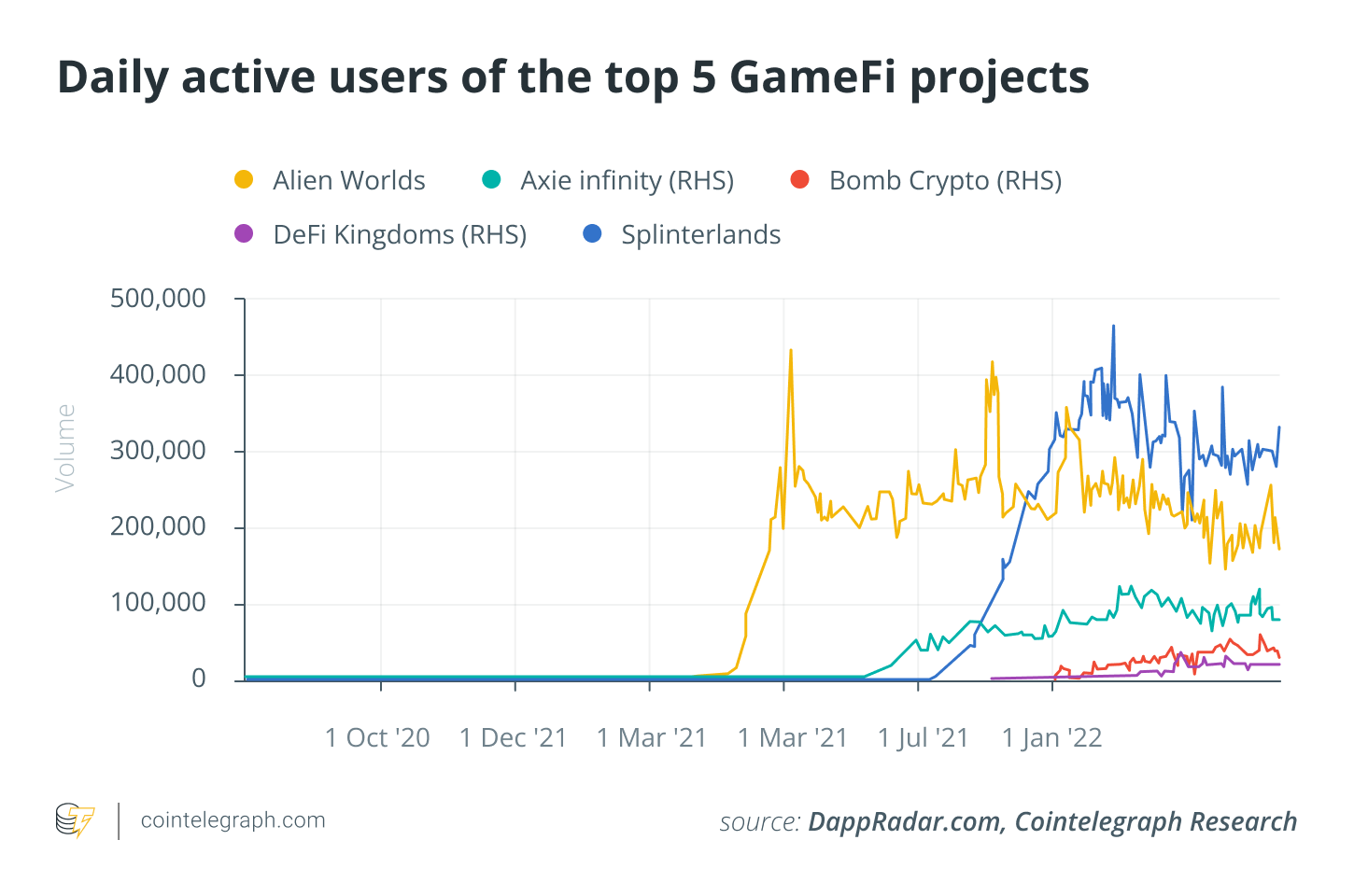

Everybody does well inside a monkey run, financially speaking. From major smart contract platforms to experimental DeFi protocols to another Axie Infinity copycat, the monkey market superbly substantiates the concept there really aren’t any shitcoins — only shit prices.

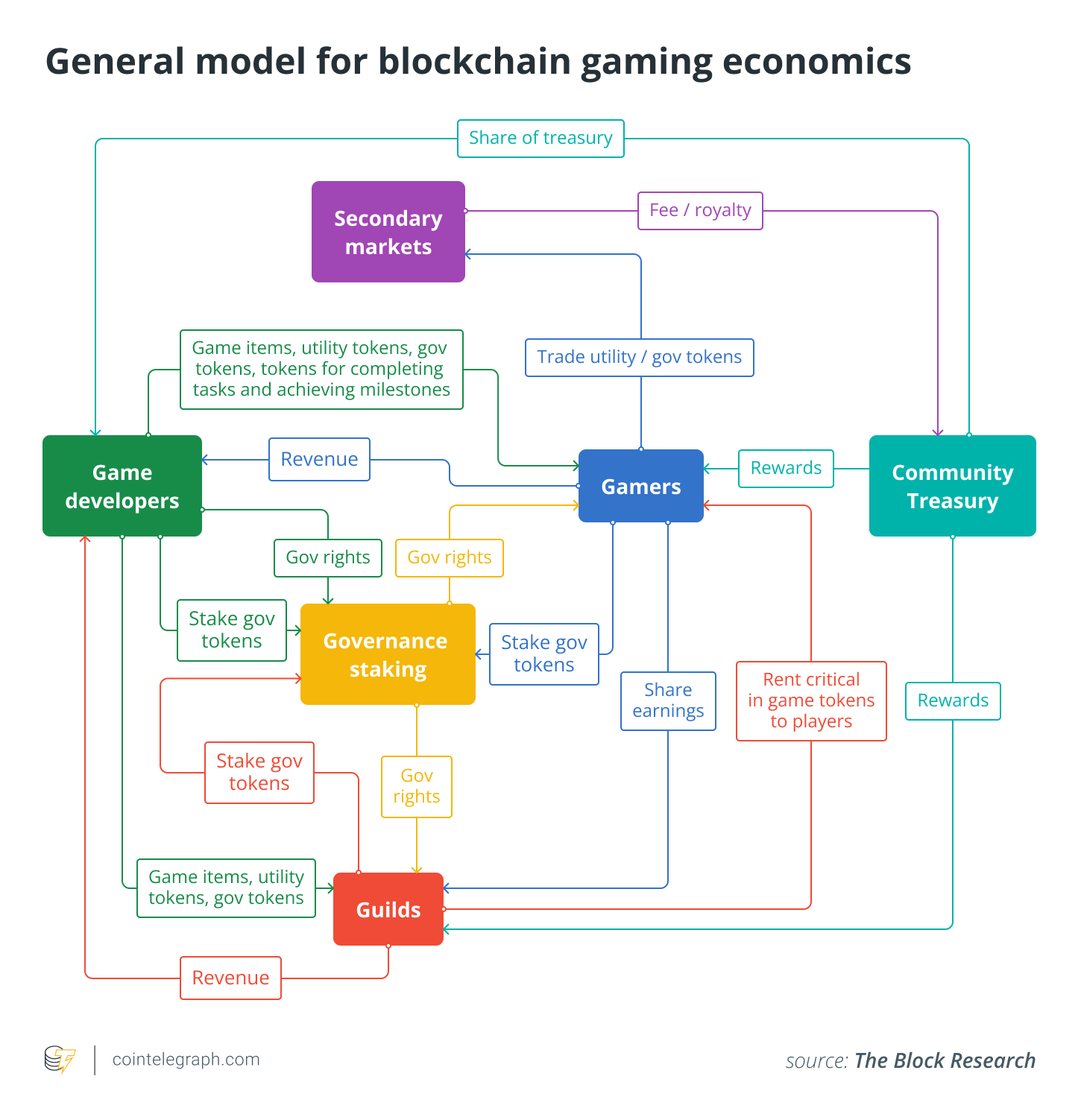

For any clearer picture, journey beside me with the deal pipeline in to the heart of crypto investment capital, where shiny new metaverse and gaming projects non-stop ton inboxes. Links to motion picture trailers, Unreal Engine mockups, and convoluted “token financial aspects diagrams” abound, parroting their requirements to boost millions on simple contracts for future tokens to adequately prepare their token launch(es) and initial decentralized exchange offering.

The game’s launch date, you may well ask? Maybe it’s a “mini-game” planned for Q3, or perhaps a massive triple-A launch in mid-2023. How about the type of utilities the token may have on the first day? Well, you are able to stake them for additional tokens, plus they could even provide you with accessibility game’s first NFT purchase. Sometimes they can advertise a software application-less utility token along with a governance-less governance token — justifying their existences since the big father exchanges decided to list them in a couple of several weeks.

This may read as an exaggeration, and If only it were. However, fundamental essentials most troubling realities facing the present landscape of token launches in the center of a bull — pardon me, a monkey market. They capture short-term enthusiasm with no sustainable arrange for future-building. These pitches capture a minute — although not the best perspective and business design needed for future years of gaming.

Related: Metaverse-as-a-service would be the foundation of the following internet era of Web3

Path #2: Building to last

The GameFi token landscape is amazingly fragmented. While early liquidity is tempting, a premature token launch has serious risks. The balanced exercise of making sticky tokenomics and effective game design really provides a narrower focus for project tokens: user engagement and retention, not pure monetization.

The ultimate optimization problem? Maximize additional user retention and engagement per project token released, susceptible to some degree of existing Web3 revenues and user community.

You don’t immediately need your personal project token to monetize the application. Tokens are merely types of exchange for that assets that the virtual world generates and sells. In case your Web3 game can’t work on a previously liquid, volatile token or, worse, a properly-pegged stable, your game is within trouble. Repeat the process!

Rather, raise enough private capital to easily cope with beta launch. In beta, use your smart contract platform of preference to integrate its native token as well as your stablecoin of preference to your game. Start to observe your core game loops and key revenue streams.

Consider yourself like a data researcher! Can there be user behavior you realize is defensibly fun but nonetheless underperforms? Could it be this type of valuable loop that possibly a subsidy can kickstart things? Is currency volatility something your users avoid? Where are the most engaged users originating from? The number of are under compensated laborers in developing countries? The number of are prosumers searching for the following hip social hangout? The number of are whales driving auctions over the top?

Ultimately, you have to create your token to incentivize users in which to stay your world. For example, much like with foreign currency, you can provide a discount to consumption when compensated for in your project token — however, you cost your digital goods in USD. You might make use of the layered-risk treasury strategy, whereby you accept USD (and equivalents), the L1 or L2 of your liking, as well as your project token. This ensures that you’ve a large, existing audience immediately outfitted to interact together with your world. It may also help safeguard you during crypto and macro downturns, and also the excess may be used to reward investors and users without applying sell pressure in your token — among other massive benefits.

Related: How blockchain games create entire economies on the top of the game play: Report

The most crucial factor that you can do like a gaming founder in Web3 would be to remain focused on enhancing your game. Tokens cannot help make your game — however they can break it.

The best priorities for any sustainable GameFi future

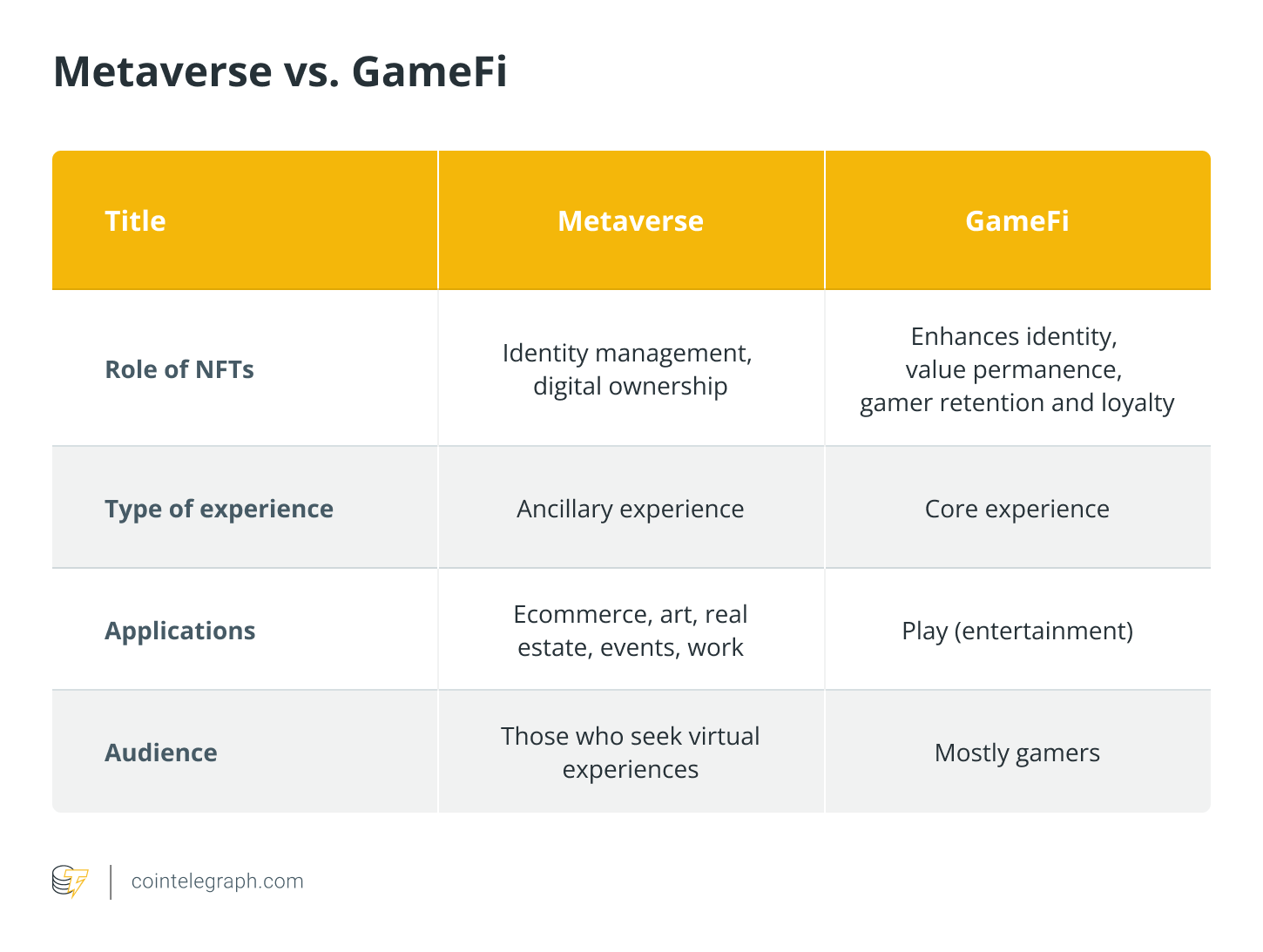

The initial worth of gaming and metaverse applications isn’t the token they circulate. Project value is produced by revenues which, over time, spawn from unique, in-game digital assets. When these NFT-based assets are owned, experienced and understood with a community, value builds and builds — otherwise mentioned, the community’s unwillingness to market increases.

I’m excited during the day if this model becomes the established order — since it means we’ll be nearer to the very best Web3 games we’ve seen. Rather from the market rewarding short-term bag grabs, we’ll see superior game play and tokenomics wrapped into one gaming ecosystem designed for the lengthy term.

Engagement, retention, then monetization. Optimize for individuals things, for the reason that order. Choose the best path.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Alex Ye leads Republic Crypto’s early-stage research, investments, and token financial aspects strategy — helping secure and advance cutting-edge projects for Republic Crypto’s advisory portfolio. Before Republic Crypto, Alex drove fintech and blockchain investments at ZZ Capital, crypto fund research at $7 billion venture fund Top Tier Capital Partners, and also at the endowment from the College of Chicago, his alma mater.