Decentralized exchange (DEX) Uniswap has surpassed its host blockchain Ethereum when it comes to charges compensated more than a seven-day moving average.

The surge seems a part of a current spate of popular for DeFi among the present bear market. Decentralized finance (DeFi) platforms for example AAVE and Synthetix have experienced surges in charges compensated in the last 7 days, while their native tokens, yet others for example Compound (COMP) also have boomed in cost too.

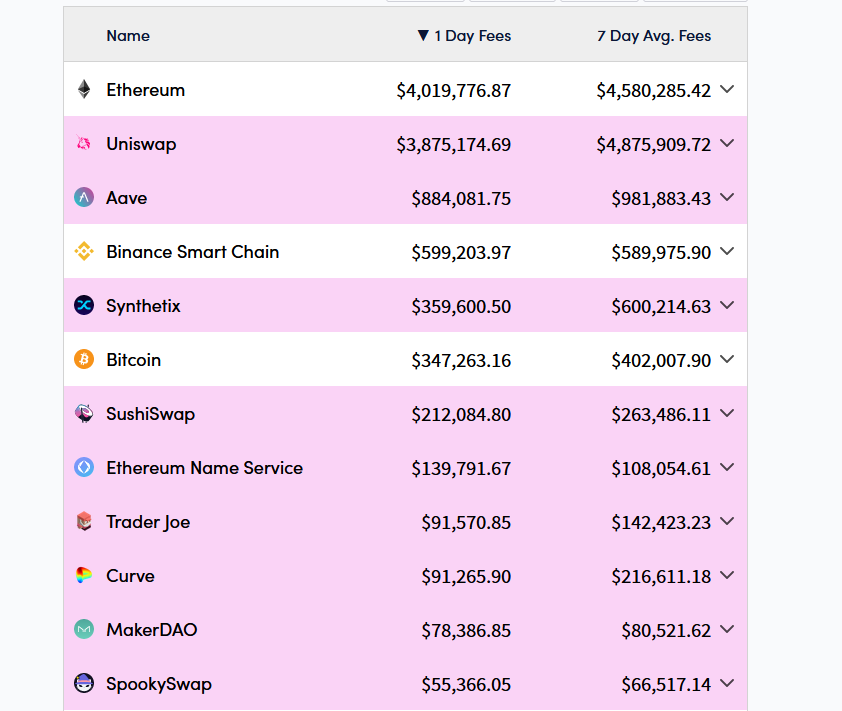

Based on data from Crypto Charges, traders on Uniswap taken into account a typical daily total of $4.87 million price of charges between June 15 and June 21, overtaking the typical charges from Ethereum users which taken into account $4.58 million.

Uniswap’s innovative V3 protocol (in line with the Ethereum mainnet) taken into account the lion’s share from the total charges with $4.4 million, as the V2 variant also contributed a notable $336,556.

During this time period, Ethereum’s total charges only outpaced Uniswap’s on 2 days from the seven. When it comes to an optimum day’s charges generated, Uniswap capped out at $8.36 million on June 15, beating out Ethereum on the day that at $7.99 million.

Uniswap enables peer-to-peer (P2P) swaps of Ethereum-based tokens without getting a main authority to facilitate trades. This is done by automated smart contracts. Under Uniswap’s fee structure, charges are compensated by traders to liquidity providers who receive 100% from the charges around the DEX.

Related: Uniswap breaks $1T in volume — but only has been utilized by 3.9M addresses

Thinking about Ethereum may be the blockchain the place to find nearly all DeFi, and is renowned for its costly fee structure, a DEX for example Uniswap beating the blockchain in charges more than a week is notable.

Based on data from CoinGecko, UNI has pumped 17.4% in the last 7 days to sit down at $5.18 during the time of writing. Recent acquisitions from the NFT marketplace aggregator Genie and also the appointment from the former president from the New You are able to Stock Market Stacey Cunningham as an consultant at Uniswap Labs might have led to this.

DeFi surge

Uniswap isn’t the only platform to determine an outburst in the charges and token cost recently, as information is also showing strong investor interest in several DeFi platforms regardless of the current bear market.

Lending protocol AAVE and artificial derivatives buying and selling platform Synthetix particularly are rated third and fifth when it comes to average charges compensated in the last 7 days with $981,883 and $600,214 each.

Similar to Uniswap, AAVE saw an outburst of charges on June 15, since it’s total elevated by 69% to $1.44 million. Its native token AAVE has additionally pumped 22% since that time.

Sythentix’s rise continues to be the most known. The woking platform saw an astonishing 928% rise in charges compensated between June 11 and June 13 because the figure rose to $843,297. The entire charges then dropped to roughly $400,000 by Next Month, before surging another 150% to roughly $a million on June 19.

The boom may also be seen by observing Synthetix’s native asset SNX, the cost which has acquired 105% since June 19 to sit down at $3.08 during the time of writing. A vital cause of this seems is the Synthetix Improvement Proposal 120 that went live a week ago that allows users to “atomically exchange assets without fee reclamation” therefore growing the rate of buying and selling.

Bucking this trend however, charges on lending platform Compound happen to be declining since April, and generated only seven day moving average of $11,753 in the last week, though its native token COMP has elevated 16.7% within that time period to sit down at $40.50.