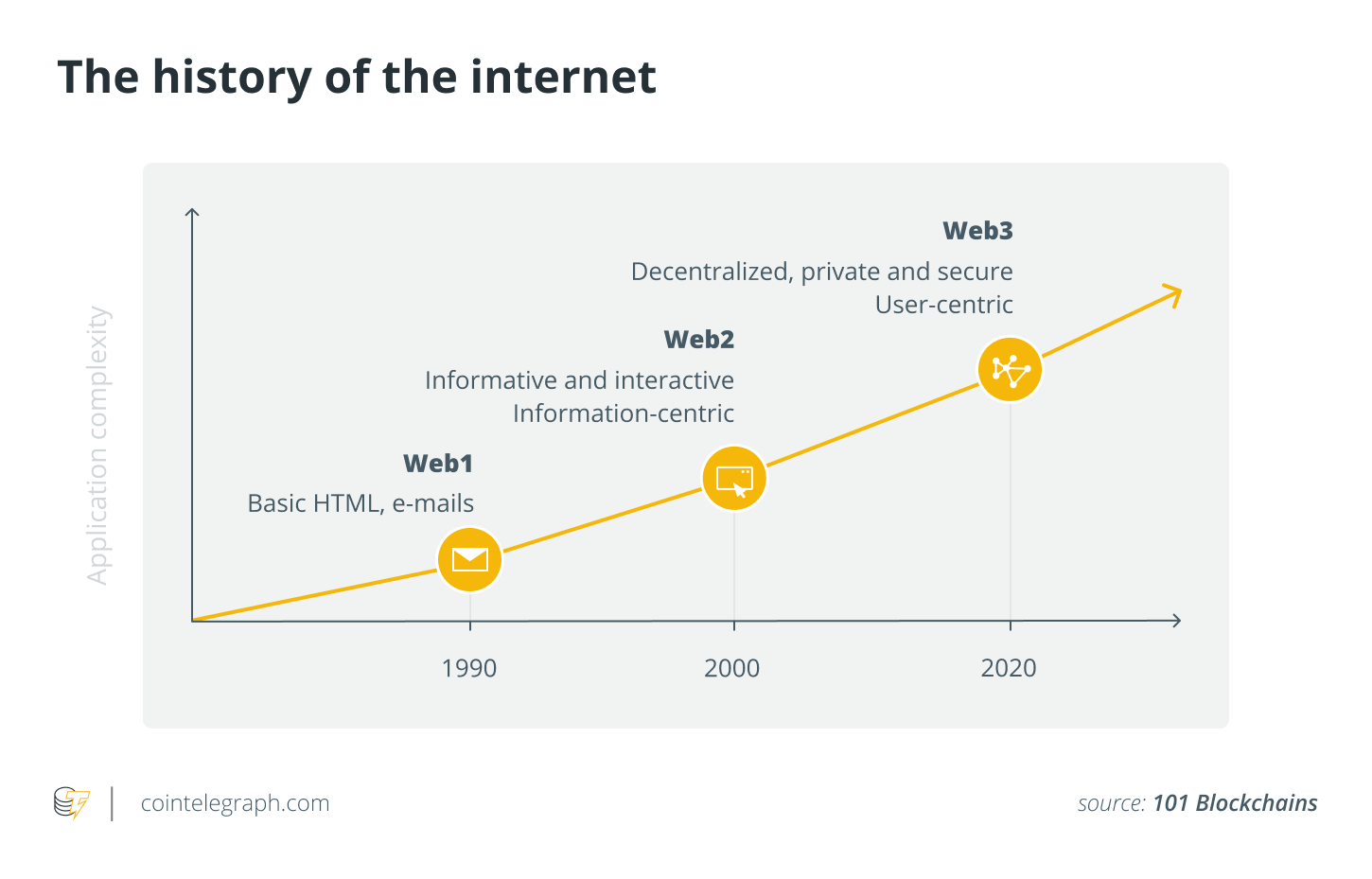

Inside a previous article, I discussed the evolution of Web3 economies and current volatility, concentrating on the participatory nature of Web3, the foundational technology enabling the creator economy.

The word “metaverse” — meta and world — frequently describes the anticipated future iteration or evolution from the internet operated by Web3 technologies like blockchain and decentralized resource distribution and consumption concepts. Even though the focus has frequently been in metaverse modalities for example augmented reality (AR), virtual reality (VR), gaming, Second Existence, avatars and so on, in my opinion, these modalities represent a fascinating evolution or shift in the digital transformation of latest decades towards the “transformation of digital.” That is what the Metaverse aims to attain. It could appear abstract and clunky today, but when we dissect the constituents that comprise the Metaverse, we obtain a peek at a transformed digital future.

Our identity can persist with this avatars and AR/VR representations and become certain, deterministic and applied with non-repudiation. The items we value are symbolized by means of tokenized assets with valuation vehicles that does not only prevent double-spending but additionally leverage blockchain like a transaction system, that can bring the essential tenets of blockchain (trade, trust and possession) towards the Metaverse. The avatars that represent us can communicate with various universes as well as their value systems, so we reserve the best and skill to monetize our data, effort, talent and all sorts of value they cook. And, as our representation traverses various modalities — for example our avatars via VR to in-game representations — we are able to use things we value and apply that for an economic and cost system in our selecting.

Related: Fundamental and peculiar: Exactly what the Metaverse is much like at this time

The vision and first step toward metaverse success depends on seamless interoperability and also the change in value (tokenized or any other semantic web constructs) across universes based on layer-1 and layer-2 systems. All this props up interactive modality I see within the Metaverse. So, there exists a large amount of try to do. We ought to consider the commercial facets of the Metaverse and how it’s monetized today and presents an chance to work tomorrow.

Monetizing the Metaverse: How can we conduct business within the Metaverse?

Because Web3 and also the Metaverse cope with a construct of tokenized value, we have to consider the overall costs like a beginning point. For example, a place of my focus is exactly what financial services mean within the Metaverse. We have seen pervasive financialization of NFTs and also the emergence of other asset classes, what will it mean to monetize the Metaverse? Let’s break it lower into consumable monetization groups to know this better.

Category 1: Commercializing protocols

This category represents the present landscape of infrastructure and projects that depend on community development and broader infrastructure development and support services. These projects monetize within the following ways:

- Token-based models: Operation charges to create towards the blockchain-powered business network’s distributed database.

- Tokens like a medium of exchange: Lending or selling an expression like a “step-through” currency, for example within-network tokens.

- Asset-pair buying and selling: Monetizing margins.

- Commercialization from the protocol: Technology services including cloud and software labs and talking to services.

- The strength of systems: Extrapolating the strength of systems and exponential power co-creation models, leading to start up business models and leading to economic value.

Related: The metaverse can change the paradigm of article marketing

Category 2: Simple token sales

While broad, the 2nd category pertains to nearly all projects that depend on token sales. Tokens are utilized like a funding mechanism to fuel development. Oftentimes, these fit a meaning of security, that is a token purchase having a profit expectation. While these tokens may very well be in-network token currency, the expectation is when they become ubiquitous, that ubiquity subsequently extends itself to fungibility which tokens undertake the status of the currency. These concepts are laden with new terms, definitions and twisted economic models and frequently face regulatory headwinds, but we’re just discussing the condition of the profession because it evolves.

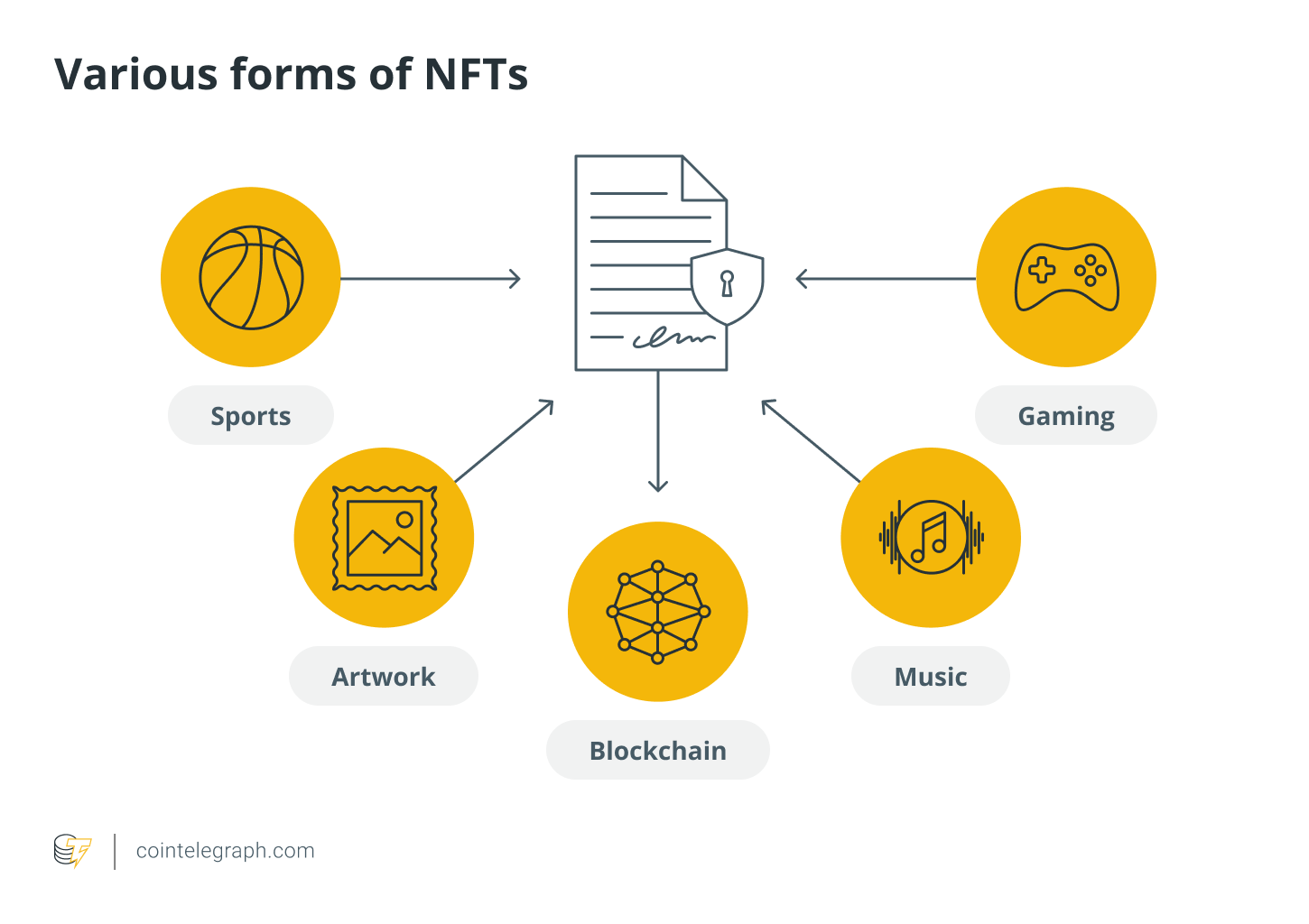

Among the subcategories here’s nonfungible tokens (NFTs), in which the NFT being an asset class starts to surface like a symbol and community belief instrument, valued with a section or subsection from the community. In gaming, for example, you will find game artifacts in other environments, they represent art, identity or perhaps a substrate of the niche social movement. NFTs appear attractive investment instruments with meaning and cultural obscurity. We view this modification fuel the finish objective of the Metaverse, and NFTs have grown to be a de facto representational instrument within the parallel digital realm.

The financialization of NFTs within the digital realm could be when compared with an analog towards the mobile payments movement triggered by M-Pesa — an idea that began almost 2 decades ago as well as in its infancy arrived at a transaction amount of over $22 million per week with simply no financial intermediary, just preloaded conversational minutes traded to maneuver money. While banking institutions salivated in the volume, M-Pesa eventually wound up becoming controlled, and banking institutions experienced it using a telco-bank relationship structure. This modality morphed and required the type of actual payments over cellular devices using telco as rails.

Evaluating this towards the digital realm context, the modality from the Metaverse today is symbolized by aspects of virtual and augmented reality, digital art, gaming and 2nd Existence. The actual financial aspects involving transfers of worth may be the real goal and also the element that has the ability to alter the planet.

Related: Comprehending the systemic shift from digitization to tokenization of monetary services

But, just like the M-Pesa situation, I wish to question and discuss the way the current types of the modality shape the particular type of value transfer and payments.

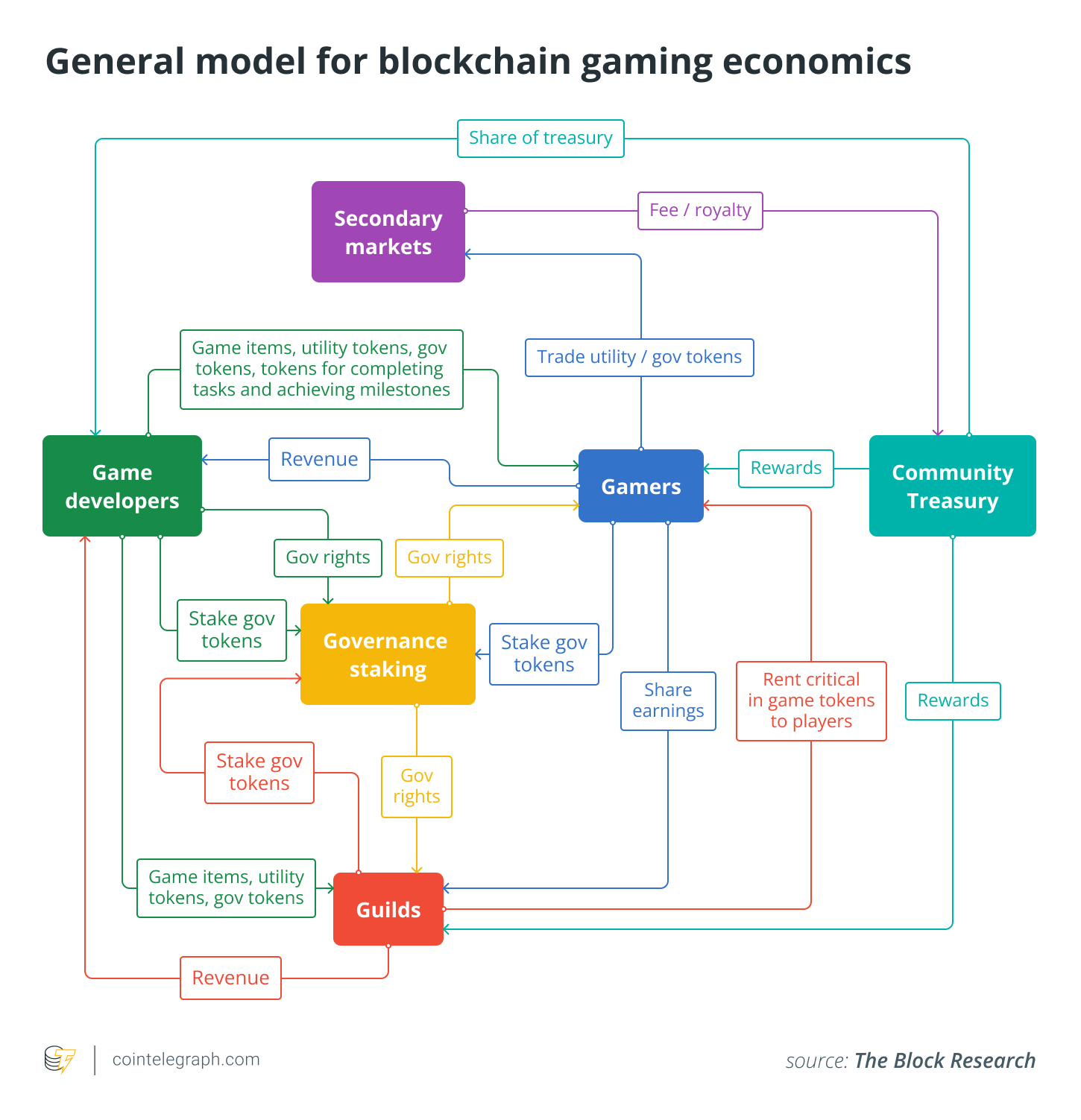

Category 3: The emerging crypto market structure

The 3rd category is a vital one, because it represents the marketplace structure that has the ability to facilitate exchange, interoperability and seamless value transfer — all of the tokens and types of valued assets uncovered to some type of financial primitives. These fundamental financial primitives include buying/selling, borrowing/lending/collateralization yet others.

Just like within the situation of M-Pesa, which became offered by controlled entities but altered the instalments landscape, I expect banking institutions to create inroads in to the Metaverse. Included in this are not just traditional banking institutions but additionally de novo digital banks and decentralized autonomous organizations (DAOs). This transformation brings leverage, financing, loans and so on, however it could have a unique metaverse flavor into it. This means a protocol-driven model that gives exchange, value and collateral locking and borrowing — a peek at which we already see with concepts like DEX (decentralized exchanges), liquidity pools, automated market makers (AMMs) and NFT marketplaces.

Implication and challenges

The process of the Metaverse is complicated and never without pitfalls and uphill battles. As with every startup company, it features a risk component, licensing or regulatory challenges, and staffing issues, which challenges might be particularly acute for that Metaverse. The difficulties include, but aren’t restricted to, the next:

Regulation and compliance: The understands the altering attitudes and regulatory posture around the world. There’s a pervasive insufficient regulatory clearness on fundamental digital assets, because there are many exotic tokens and digital assets emerging and entering the Metaverse. In other words that benefiting from what was once regulatory arbitrage has become disturbing factor within the global movement of numerous asset classes within the Metaverse. The broader industry will have to dedicate some ability to help craft another and fair structure or framework.

Technology or protocol risk: Technological challenges around interoperability and identity continue to be massive roadblocks towards the progress and commitment of blockchain and, eventually, the Metaverse. When we want the Metaverse to visit beyond modality and also have an interchangeable mixture of digital assets, we want so that it is interoperable across various systems and universal ID transactions to become a seamless process with non-repudiation. Incidentally, this will be regulatory simplicity.

Talent: Industry includes a profound lack of talent, including technologists, token economists and business leaders, to produce a team that may remain in spot to build, maintain and improvise on projects. This can be a huge issue. We see a lot capital chasing too couple of projects, which in the past has not been a great good balance to attract talent and incentivize the event, retention and commitment from the right people.

Related: Decentralization revolutionizes the creator’s economy, what does it bring?

Conclusion

The Metaverse today is really a representation from the rhetoric of interaction modalities. The promise to understand the vision depends on robust purchase of Web3 infrastructure, regulatory and compliance frameworks and talent, that will let the change in various value artifacts in one world to a different and adaptation from the value system of numerous systems with exchange, fungibility and interoperability. The seamless movement of user-controlled value in tokenized or data forms will render these modalities effective. We have seen glimpses of those today within the financialization of NFTs and decentralized finance (DeFi) constructs like DEXs, AMMs and DAOs.

So, I’d say a revolution is going ahead. It can be us to know it, see it and monetize it.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Nitin Gaur may be the founder and former director of IBM Digital Asset Labs, where he devises industry standards and employ cases, and works toward making blockchain for that enterprise a real possibility. He formerly offered as chief technology officer of IBM World Wire as well as IBM Mobile Payments and Enterprise Mobile Solutions, and that he founded IBM Blockchain Labs, where he brought your time and effort in creating the blockchain practice for that enterprise. Gaur can also be an IBM-distinguished engineer as well as an IBM master inventor having a wealthy patent portfolio. Furthermore, he can serve as research and portfolio manager for Portal Asset Management, a multi-manager fund focusing on digital assets and DeFi investment opportunities.