Crypto venture fund giant Andreessen Horowitz (a16z) has highlighted that development and demand on Ethereum is “unmatched” regardless of the network’s high transaction charges.

The firm does warn, however, that it is “popularity is another double-edged sword” given Ethereum prioritizes decentralization over scaling, leading to competing blockchains stealing share of the market with “promises of higher performance minimizing charges.”

Your comments ought to came using a blog publish presenting a16z’s 2022 “State of Crypto” report, using the firm’s data researcher Daren Matsuoka, mind of protocol design and engineering Eddy Lazzarin, General Partner Chris Dixon, and mind of content Robert Hackett all cooperating to supply five key takeaways in the study.

Outdoors of Ethereum, the report concentrates on topics for example Web3 development, crypto adoption rates, decentralized finance (DeFi) and stablecoins.

Presenting a16z’s 2022 Condition of Crypto Report

A great deal has altered because we began purchasing crypto nearly about ten years ago.

Listed here are 5 key takeaways in the a16z crypto web3 industry survey and knowledge analysis by @darenmatsuoka, @eddylazzarin, @cdixon & @rhhackett ⬇️ pic.twitter.com/JFLXbNh03u

— a16z (@a16z) May 17, 2022

Based on data in the report, Ethereum towers within the competition when it comes to builder interest, because the network has around 4,000 active monthly developers when compared with second-rated Solana (SOL) at 1,000. Bitcoin (BTC) and Cardano (ADA) are next lined up at roughly 500 and 400 each.

The analysts noted that “Ethereum’s lead has much related to its early start, and, the healthiness of its community” but emphasized the value of development ongoing to surge around the network despite high transaction costs:

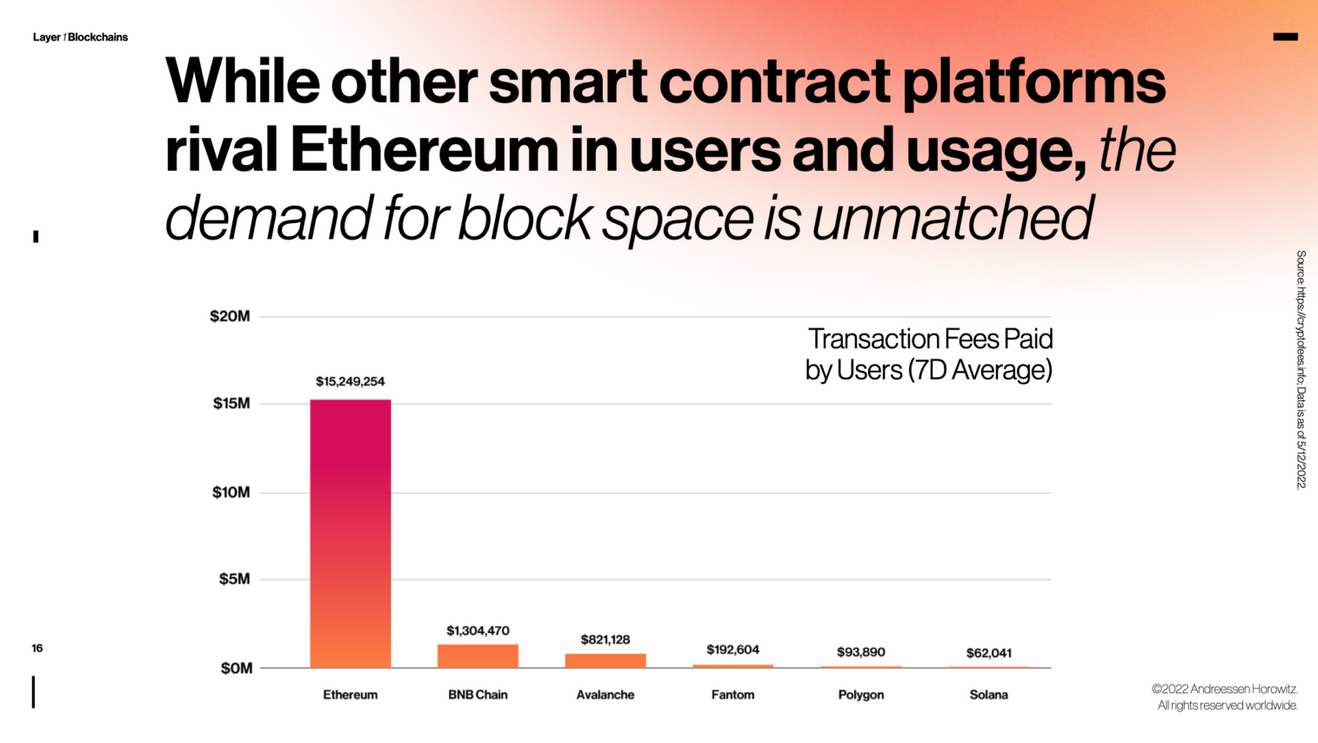

“Ethereum’s overwhelming mindshare helps explain why its users happen to be prepared to pay greater than $15 million in charges each day typically simply to make use of the blockchain — outstanding for this type of youthful project.”

The interest in Ethereum may also be seen over the report’s believed transaction charges compensated on the blockchain more than a seven-day average (calculated by May 12), using the data showing that Ethereum makes up about $15.24 million. To supply contrast, BNB Chain, Avalanche, Fantom, Polygon and Solana take into account roughly $2.5 million price of charges combined.

The report notes that Layer-2 scaling solutions are fighting to create Ethereum’s charges lower and transaction accelerates, whilst mentioning that lengthy-anticipated upgrades are visiting Ethereum to help make the network more effective and price-effective.

The “lengthy anticipated” upgrades can’t happen in no time however and a16z also highlighted within the are convinced that more than a 30-day average (by May 12), active addresses and transactions on competing blockchains including Solana, BNB Chain and Polygon happen to be well in front of Ethereum.

Related: Ethereum analytics firm Nansen acquires DeFi tracker Ape Board

The information implies that Ethereum has 5.5 million active addresses that take into account 1.a million daily transactions, while Solana includes a mammoth 15.4 million active addresses and 15.3 million daily transactions. BNB Chain ranks in third with 9.4 million and 5 million, while Polygon totaled around 2.six million and three.4 million. The analysts concluded it will not be considered a champion-takes-all situation.

“Blockchains would be the hit product of the new computing wave, just like Computers and broadband were within the ‘90s and 2000s, so that as cell phones were within the last decade. There’s lots of room for innovation, so we believe you will see multiple winners.”

Other key takeaways in the report incorporated the DeFi sector’s total value locked of roughly $113 billion will make it 31st largest bank within the U.S., estimations that Web3 adoption could hit 1 billion users by 2031 which NFTs have generated $3.9 billion price of revenue for creators to date.