In the monthly crypto tech column, Israeli serial entrepreneur Ariel Shapira covers emerging technologies inside the crypto, decentralized finance (DeFi) and blockchain space, in addition to their roles in shaping the economy from the twenty-first century.

The publish-mortem consensus around the crypto market crash among industry leaders varying from Polygon co-founder Mihailo Bjelic to millionaire crypto investor Mark Cuban is the fact that bear financial markets are a proper method of cleansing the marketplace. The latter even known a line utilized by lengthy-time crypto critic Warren Buffet to convey his opinion from the matter.

“Only once the tide is out would you uncover who’s been swimming naked.”

Obviously, nobody in the market would dispute the declare that bear markets get rid of the weak, or, within this situation, the nakedly corrupt. But we’d be mistaken to depart case study at this as though greater than $700 billion being easily wiped out overnight is one thing we ought to still accept from crypto markets. It’s vital that you comprehend the major factors within this last bull run that brought to the massive demise, and the way to promote a far more stable market moving forward.

NFTs: Blessing or bygone?

We’re 5 years out of the first monumental crypto crash spurred through the infamous initial gold coin offering (ICO) boom of 2017. Being an industry still in the infancy, the majority of the projects sprouting during this time period and driving investment were random coins claiming is the next Bitcoin (BTC). The is promoting a great deal since that time, which time, other applying blockchain drove the hype.

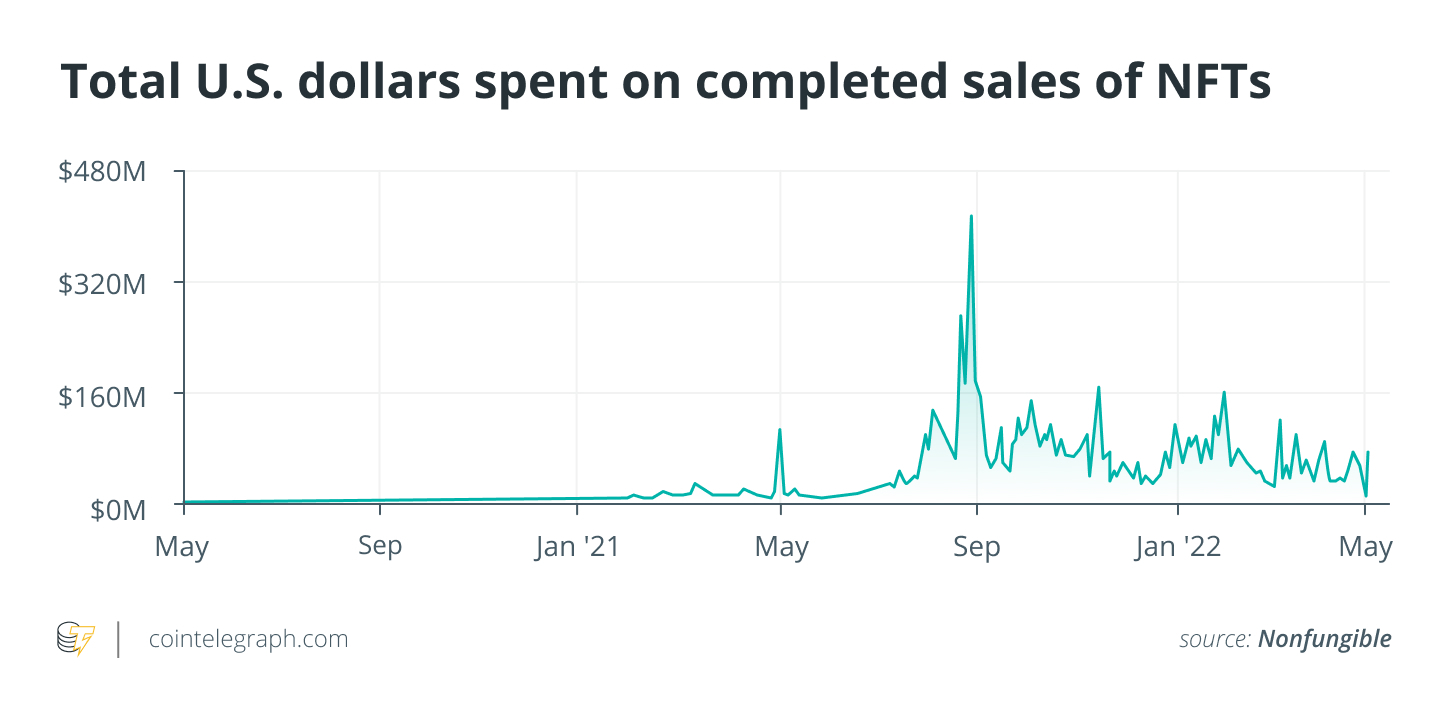

So, that which was the final bull run’s form of scammy ICOs? Several factors led to the most recent market boom that propelled Bitcoin to just about $70,000 per gold coin. But possibly probably the most similar in their core — but frequently more absurd — towards the ICOs of yesteryear were nonfungible tokens (NFT), an industry that arrived at an astonishing $25 billion in 2021. The possibly arrived at peak hype once the NFTs in the Bored Ape Yacht Club (BAYC) collection were selling for thousands and thousands — and then millions — of dollars in Ether (ETH). Celebrities got involved, in addition to industry icons for example Adidas, Coachella as well as the Super Bowl.

Related: Past the hype: NFTs may lead the means by transforming business encounters

It all went south when everybody discovered greater than 80% from the NFTs produced free of charge on OpenSea were either frauds or scams. The money-grab culture was placed on full display personally in the NFT.New york city event at the end of June.

That being stated, it isn’t as if many in crypto deny the technology behind NFTs will redefine possession and play a significant role in Web3. But exactly how should we move toward that future without sams riding innovation’s coattails?

It’s really quite obvious-cut. A way forward for NFTs and also the technology in it would be to tie these to desirable physical assets and harness remarkable ability to authenticate and secure products.

For example, companies within the luxury goods industry happen to be exploring utilizing NFTs as a way to combat the proliferation of counterfeit products. Projects like the Aura Blockchain Consortium, headed by luxury behemoths LVMH and Prada Group, harness the strength of NFT technology for product authentication, logistics transparency and knowledge possession for his or her physical products.

It isn’t always about selling an electronic sneaker but improving the product and brand experience for his or her affluent clientele. Jewellery company Yvel, for instance, launched a securities and buying and selling platform associated with fine jewellery and gold and silver as guarantees — really pegging the NFTs to tangible products rather of JPEGS.

Related: NFT 2.: Generation x of NFTs is going to be streamlined and reliable

Blockchain’s greener pastures

Surviving the bear market isn’t just crucial for NFTs, however for more foundational crypto assets too — which, incidentally, haven’t totally remedied for his or her inclination toward scams either. The collapse of algorithmic stablecoins will probably result in a serious aversion for casual holders and firms from meaningfully exploring how you can tie crypto to traditional assets, but that doesn’t mean all hope sheds. The road forward here does indeed lie in concentrating on creating something that meets a genuine, tangible market need — not unsimilar from the reply to the NFT market collapse.

Related: So what can other algorithmic stablecoins study from Terra’s crash?

That’s a take we have all heard before. So, how can we meaningfully make it happen this time around? Everything dates back towards the basics of economic. To thrive, startups must find an issue that they’re attempting to solve, which problem can’t just be the founder isn’t wealthy enough. So, do you know the sectors which significant coins can focus?

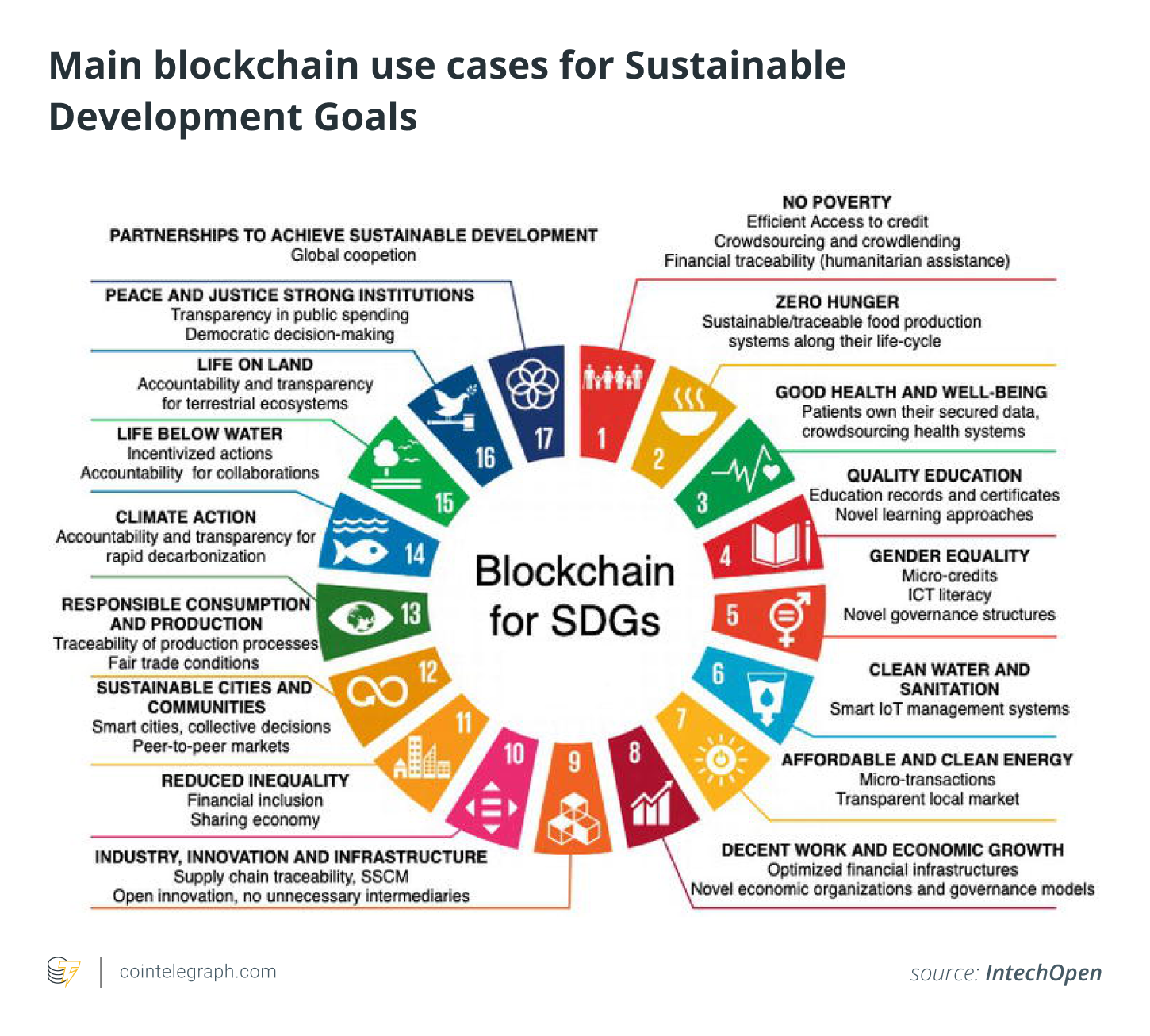

Minimizing ecological impact and operating sustainably has lengthy been a white-colored whale for crypto and blockchain projects. A recurring critique of crypto and also the blockchain in general are they cause serious injury to the atmosphere because of the emissions brought on by token mining along with other crypto byproducts. As of this moment, most projects happen to be not able to get rid of this stigma, but new developments might help spearhead a considerable switch to this narrative.

Within the wider business community, sustainability has rapidly be a core value for any modern company to embody. While a number of these corporate commitments are generally superficial or encompass a nebulous promise to lessen carbon emissions with a certain year, there are other concrete steps that crypto can borrow from. One particular development continues to be the adoption of corporate carbon credits, which, while imperfect, really are a useful method for corporations to offset their emissions and environmental footprint.

Related: Eco-friendly finance needs voluntary carbon markets that actually work

Though there has been major blockchains leading the charge on eco-friendly operations, for example Cardano and Algorand, allowing crypto holders the choice to participate in around the carbon marketplace is a different way to encourage sustainable development. Projects offering crypto-specific carbon credits or tokens associated with exterior carbon credits, for example CC Token, which opens use of purchasing carbon credit futures for companies and people, provide investors tangible value. Other medication is scheming to make the 2nd-largest blockchain by market capital, Ethereum, more eco-friendly.

The crypto and blockchain industry continues to be based on its rambunctious nature and revolutionary ambitions. While any emerging industry is likely to be exposed to volatility, downturns and roadblocks, the most recent bear market should send a obvious signal to projects: It’s about locating a problem that should be solved, and really making use of your product to resolve it.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Ariel Shapira is really a father, entrepreneur, speaker, and cyclist and can serve as the founder and Chief executive officer of Social-Knowledge, a talking to agency dealing with Israeli startups and helping these to establish connections with worldwide markets.