Monitoring cost changes using charts is an excellent method to remain updated available on the market trends. However, technical or fundamental analyses and tracking other market metrics aren’t the only way of being a effective trader. For instance, an organised approach which includes maintaining a buying and selling journal would safeguard you against making emotional decisions relating to your financial investments.

In the following paragraphs, we’ll discuss the advantages of a buying and selling journal and the way to create and employ it.

Exactly what is a buying and selling journal?

A buying and selling journal records your trades as well as their outcomes and provides a listing of your buying and selling experience. However, it’s not a brokerage account statement as one will discover the reason why behind choosing or staying away from a buying and selling strategy.

All successively performed trades are methodically planned, along with a buying and selling journal could be a record from the performance of every buying and selling strategy. It doesn’t matter how the marketplace performs, you are able to adequately assess the potential for a specific trade utilizing a buying and selling journal.

Furthermore, you don’t have to spend much to produce a buying and selling journal. Spreadsheets or Stand out would suffice, also it would enable you to become disciplined and follow consistent buying and selling strategies. You need to record buying and selling records inside your journal if you cannot always adhere to your buying and selling strategy. You are able to learn how to avoid responding exactly the same way to comparable situations later on trades by noting when things fail and why they accomplished it. Exactly why is keeping a buying and selling journal important? Keep studying to discover!

Do you know the advantages of a buying and selling journal?

Keeping a buying and selling journal provides benefits, including allowing you to assess the weaknesses and strengths of the buying and selling strategy. It will help you are making impartial decisions. For instance, it’s possible to determine if crypto derivatives be perfect for their portfolio or maybe you ought to start reinvesting crypto profits. The ultimate decision is different of errors in judgment and then any irrational beliefs, which will help safeguard you from an unconscious affect on neglect the objectives.

Keeping a buying and selling log can help you keep on track together with your buying and selling strategy, regardless if you are each day trader or perhaps a swing trader. Becoming depressed by winnings while buying and selling legitimate money happens easily. Following a run of lucrative transactions, you can begin to make use of sloppy entry ways or find more cryptocurrency than normal. A buying and selling plan can help you stay on the right track and reduces your inclination to create rash, potentially dangerous trades.

Related: Cryptocurrency investment: The best indicators for crypto buying and selling

It’s possible to start buying and selling within the productive zone when they keep an eye on their buying and selling plans and develop confidence within their skills. Talking to a buying and selling journal could be a tremendous motivator for traders to mirror about how well they’ve done, and getting a effective history is definitely an awesome confidence booster. However, unsuccessful traders can study from their mistakes and transform unproductive buying and selling strategies into lucrative ones.

In addition, one can take advantage of what’s effective and shift their attention to the present performance using journal to trace and implement reproducible patterns. This permits traders to develop a steady profit and prevents them from spending some time and sources on unsuccessful ideas, eventually helping these to become lucrative traders.

How to produce a buying and selling journal?

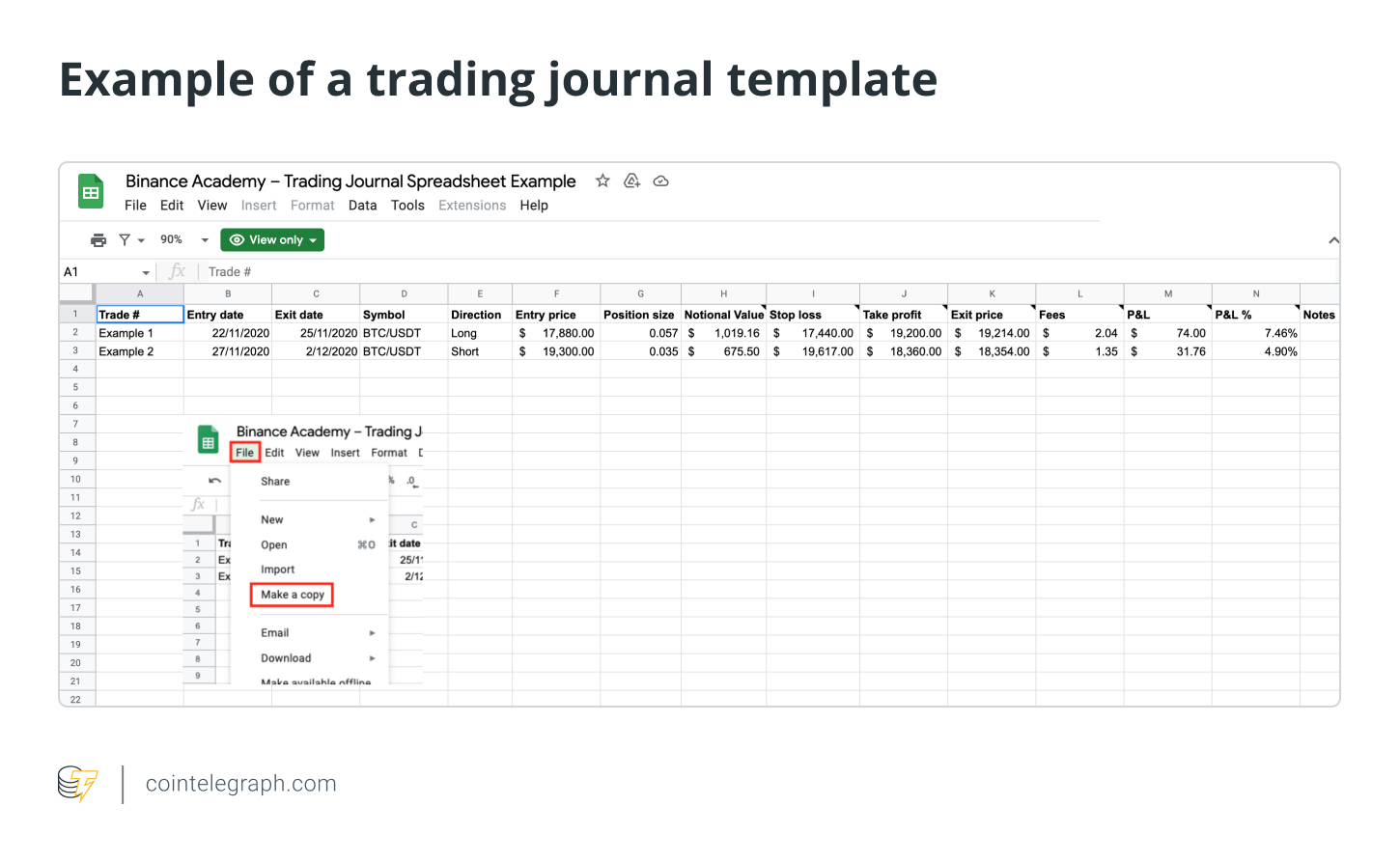

Any spreadsheet application like Microsoft Stand out or Google Sheets that you record your own personal trades along with a written document like Ms Word or Google Docs to include your ideas may be used to produce a buying and selling journal. You may also employ a free buying and selling journal template such as the one prepared by Binance to differentiate between an avoidable along with a lucrative buying and selling strategy.

It doesn’t matter what template you use, make sure that you have the required posts associated with each trade. Furthermore, you might take screenshots from the buying and selling charts you’ve adopted and fasten these to the right trade around the sheet to help make the journal more efficient.

Let us know very well what posts you need to supplment your spreadsheet when designing a buying and selling journal:

Instrument

Add some financial instrument you’ve traded, such as the selected platform for example, Bitcoin (BTC) on Coinbase.

Related: Binance versus. Coinbase: How can they compare?

Time and date

Add any starting time and date-specific factors that permit you to participate in a specific trade. For example, I got myself Cardano (ADA), worth $1,000, throughout a mid-day buying and selling lull when ADA was offered at a lesser cost at 1:00 pm. Throughout the lull, crypto values frequently decline since most prominent news tales happen to be as reported by noon.

Trade direction (lengthy/short)

Record your short or lengthy positions to reflect on your buying and selling strategy. If you take lengthy positions, a trader will get contact with cryptocurrencies with the hope that prices will climb later on, letting them be offered for any profit.

However, when investors sell cryptocurrency “short,” they borrow it then sell it in the ongoing market rate. Once the asset’s value declines, the investor buys it for a cheap price, pays back the cryptocurrency lent and keeps the main difference as profit.

Entry cost, exit cost and prevent loss

The entry cost may be the cost where you’re beginning the trade. The exit cost may be the value where you exit that trade. Investors can set up a stop-loss order in buying and selling to instantly convey a sell order when and when the cheapest cost where they will be ready to sell a good thing is arrived at. Record each one of these metrics inside your buying and selling journal.

Trade size

To know just how much risk you’re taking concerning a specific trade, please record your “tradable amount” within the journal. For example, you risk 70% of the tradable amount on one trade in case your tradable amount is $200 and also you swing trade on ADA with $170.

Profit and loss

It is vital to record the end result of the trade, either profit or loss, to understand works well with you and also exactly what does not.

Notes

As pointed out, incorperate your ideas/notes in Ms Word or Google Docs to mirror on the reason why you decided on a particular buying and selling size or strategy. Keep in mind that qualitative factors are as essential as quantitative ones.

Using a buying and selling journal

A perfect buying and selling journal template is really a myth. Every trader should evaluate the pertinent metrics they require or must avoid using while adding transactions within their personal buying and selling journals. A trade journal must be tailored considering this.

Make use of your written document to include reasons for taking particular positions. It’s also necessary to write lower the symptoms you place on your market watch hrs to prevent negatively impacting your buying and selling performance. You will also argue whether a particular trade concept you implemented is really a solid one out of your written document. Turning your trade proposals thoroughly and backward can help you see the pros and cons of every one.

Then use your spreadsheet, where you have to record your everyday buying and selling activities. Make sure to continue the good work-to-date and arranged to determine your failure or success precisely. Finally, attempt to record trade details after executing the trade to prevent missing any crucial descriptions.

In addition, checking your trade log spreadsheet daily is a great habit for estimating the amount of exposure you presently hold and then any chance of expanding your buying and selling portfolio. But, how you can take a look at buying and selling journal spreadsheet? Go through the documents around the written document and records inside your spreadsheet carefully while assessing your overall trades.

Consequently, traders might have their tactics performance-driven instead of affected by their feelings or conduct by searching back in a buying and selling record and recognizing trends they ought to avoid. Therefore, keeping a buying and selling log allows you to evaluate your trades, place areas for improvement, and usually be a better trader.