The seamless flow of capital between borrowers and lenders is really a key facet of an exciting economy. Anybody by having an extra asset can lend it to place their idle capital to operate, while people requiring it to develop business or meet operational costs can certainly can get on.

Money financial markets are the platforms where borrowers and lenders can meet. Throughout history, money markets happen to be generators of monetary activities. Although the structure of cash markets has altered as time passes, their role has continued to be unchanged.

So how exactly does the cash market work?

Conventionally, money markets were centralized structures facilitating the deals between lenders and borrowers. Borrowers would approach money markets to obtain a short-term loan (within year) that may be collateralized. When the borrowers can’t repay their loans, lenders sell the collateral to recuperate the loaned funds. Once the loan is paid back, the collateral is came back.

Borrowers are needed to pay for interest towards the lenders (for supplying them capital) along with a fee towards the money market (for facilitating the offer). The eye rate provides sufficient liquidity for borrowers in addition to lenders. The charge compensated towards the money market enables them to meet their operating expenses.

There’s an issue with centralized structure, though. It really puts an excessive amount of power and influence regarding user funds at the disposal of just one entity that may alter the conditions and terms for other stakeholders within an arbitrary manner. Worse, they even siphon from the funds within their child custody gains. A decentralized structure supplies a robust option to centralized money markets.

Exactly what is a decentralized money market?

Operated by blockchain technology, a decentralized money marketplace is a self-propelled structure operated by a good contract, an application program. Once it’s running, a smart contract can’t be interfered with, thus which makes it free from human prejudices.

Managed with a global community of stakeholders via a highly decentralized network of nodes, the marketplace rules out any role for intermediaries. In popular lingo, the cash marketplace is placed directly under the domain of decentralized finance (DeFi).

Related: The DeFi Stack: Stablecoins, exchanges, synthetics, money markets, and insurance

Let’s comprehend the functioning of the decentralized money market with an example. Fringe Finance ($FRIN) is really a decentralized money market that unlocks the dormant capital in most-tier cryptocurrency assets by moving out collateralized loans. The woking platform facilitates decentralized lending and borrowing. Fringe Finance is really a primary lending platform where anybody can lend extra funds and earn interest or collateralize altcoins to have a stablecoin loan.

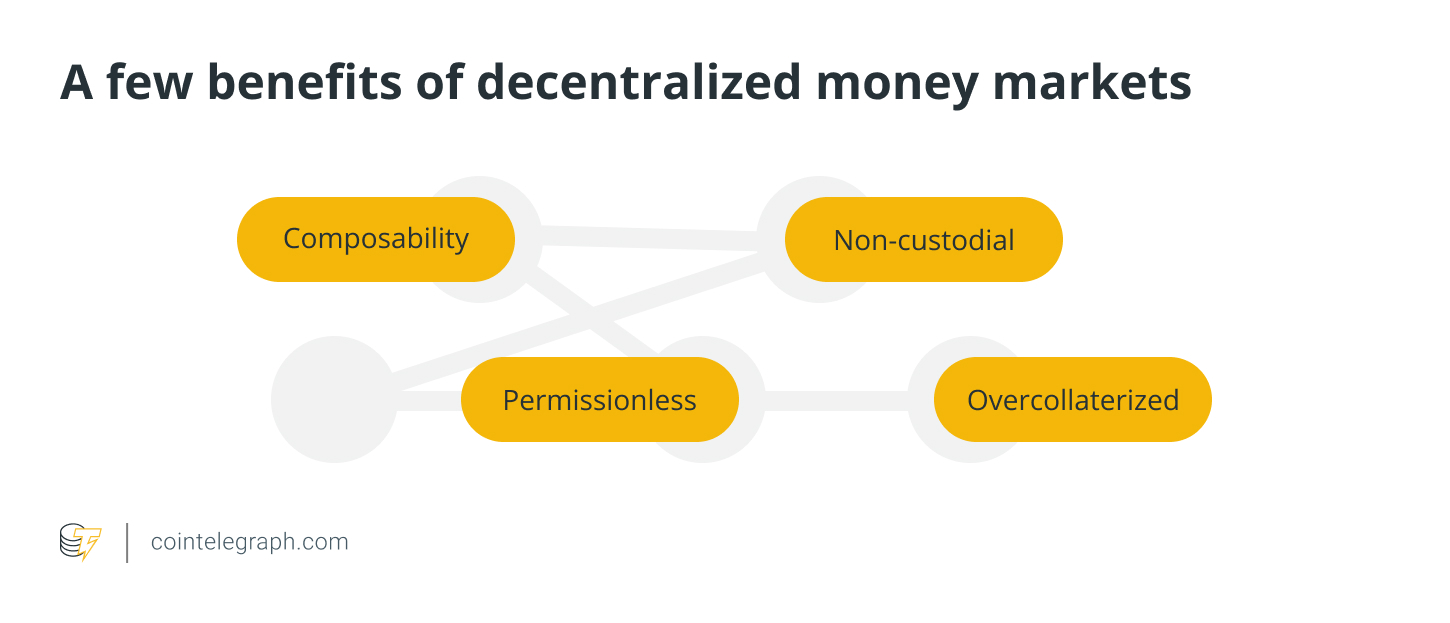

As pointed out, decentralized finance lenders and borrowers operate through on-chain programmatic code controlled by decentralized nodes, thus ending the monopoly of merely one entity in charge and lowering the points of failure. Listed here are a couple of benefits that decentralized money markets generate:

Permissionless

Inside a decentralized atmosphere, users don’t have to ask permission from the central authority before participating in anything market activity. Anybody online can earn interest on their own capital and/or borrow funds for his or her needs seamlessly. The decentralized protocols come with an natural censorship-resistant structure.

Noncustodial

In centralized money markets, users’ funds lie within the child custody from the central gatekeeper. However, DeFi protocols like money financial markets are noncustodial, and money are directly within the charge of borrowers and lenders. On-chain smart contracts, running on pre-defined logic, assure funds that can’t be compromised while users have full control in it.

Overcollateralized

Centralized markets have usually functioned within an undercollateralized and fractional reserve manner. These markets, under pressure from peers to achieve more business, allow borrowers to withdraw more funds than what they’ve deposited as collateral. Decentralized money markets follow overcollateralization, getting stability somewhere. The smart contract simply liquidates the collateral from the borrowers who fail to repay the financial obligations.

Composability

Composability is really a design principle that enables for aspects of a method to interoperate with each other. Various applications and protocols can interact seamlessly inside a permissionless way. DeFi apps are composable, developing a blank canvas with endless options for novel mechanisms like yield extraction and sophisticated derivatives.

How approaching decentralized money financial markets are walking into untouched territory

Within the initial many years of DeFi, money market protocols were tilted in support of also known cryptocurrencies with large market capitalizations and liquidity. Approaching money markets, however, are searching to test new models. Fringe Finance, for example, concentrates on altcoins getting smaller sized market capitalizations minimizing liquidity. Most DeFi money market protocols don’t support altcoins which is where Fringe Finance moves in.

Related: What’s an altcoin? A beginner’s help guide to cryptocurrencies beyond Bitcoin

As altcoins affect a distinct segment use situation, they tend to be speculative than large cap digital coins. However, as couple of decentralized finance lenders and borrowers were serving such altcoins, the main city kept in them choose to go untapped. Despite the fact that, Fringe Finance has altered this. Take note that altcoins are inherently more volatile, which does generate some connected stability risks that the potential for profit can balance.

So how exactly does an altcoin money market maintain financial stability?

To neutralize volatility in altcoins, the cash market protocol utilizes a slew of borrowing parameters and relevant mechanisms. Let’s continue the perimeter Finance example to higher comprehend it. The parameters applied by Fringe Finance incorporate a platform-wide maximum borrowing convenience of each collateral asset and automatic computation from the LVR (ltv ratio). For sufficient implementation of those mechanisms, the machine considers the asset’s available liquidity, historic volatility along with other non-subjective metrics.

The woking platform provides a sustained type of economic incentives for those participants like lenders, borrowers, altcoin projects, stablecoin holders, stakers and liquidators. For example, it rolls out incentives for liquidators to assist stabilize the woking platform like allowing native $FRIN token holders to stake coins to earn rewards from charges. To widen its operational base, a DeFi money market could include mix-chain collateralization, lending against NFTs, fixed-interest loans, embedded insurance along with a decentralized UI because the platform grows.

The way forward for decentralized money markets

Within an atmosphere where individuals have grown to be cautious about self-serving biases in centralized money markets, the DeFi protocols have provided them a lucrative option. The second usually provides governance legal rights to any or all holding native coins and presents a blockchain-based ecosystem in the true decentralized ethos.

Like the money markets that used to pay attention to popular cryptocurrency projects with significant market capital, novel projects are actually concentrating on altcoins, unlocking the worth stored there. Moving forward, it may be expected that approaching DeFi money market protocols will explore territories formerly untouched.