Thanks for visiting Finance Redefined, your weekly dose of key decentralized finance (DeFi) insights, a e-newsletter crafted to create you a few of the major developments during the last week.

Earlier this week, the DeFi ecosystem got recognition in the Uk government, because they searched for public feedback on taxation from the DeFi ecosystem, especially staking and lending.

MakerDAO is searching to collaborate using the traditional banks, which may occur following the proposal will get community approval. Aave (AAVE) is intending to launch an overcollateralized stablecoin known as GHO, susceptible to the city decentralized autonomous organization’s (DAO’s) approval. The hacker who exploited Solana-based liquidity protocol Crema Finance on This summer 2 came back the majority of the funds but was permitted to help keep $1.six million like a white-colored hat bounty.

After nearly two days of bearish dominance, the very best 100 DeFi tokens finally began to exchange the eco-friendly. A lot of the DeFi tokens registered double-digit weekly gains.

United kingdom government seeks public input on DeFi taxation

The federal government from the Uk is asking the general public for input around the taxation of crypto-asset loans and staking poor DeFi.

Particularly, the federal government has an interest in gathering info on the taxation of crypto-asset loans and staking. Her Majesty’s Revenue and Customs (HMRC) demand evidence paper, printed on Tuesday, described its intention to review whether administrative hassles and charges might be reduced for taxpayers who have fun playing the emerging industry, in addition to if the tax treatment is much more aligned using the transactions’ fundamental financial aspects.

Aave to produce overcollateralized stablecoin known as GHO

DeFi giant Aave has unveiled intends to launch an overcollateralized stablecoin known as GHO, susceptible to the city DAO’s approval. The announcement is made by Aave Companies, the centralized entity supporting the Aave protocol, on its Twitter page on Thursday.

Based on the governance proposal shared on Thursday, GHO could be an Ethereum-based and decentralized stablecoin pegged towards the U . s . States dollar that may be collateralized with multiple assets from the user’s choice.

MakerDAO voting on collaborating having a traditional bank

MakerDAO is voting on the proposal which will bring a conventional bank into its ecosystem the very first time, allowing the financial institution to gain access to against its assets using DeFi.

In the finish of voting on Thursday, 87.one percent of voters were in support of the proposal. The proposal involves developing a vault with 100 million Dai (DAI) for Huntingdon Valley Bank (HVB) included in a brand new collateral enter in the Maker Protocol.

Crema hacker returns $8M, keeps $1.6M in cope with protocol

The hacker who exploited Solana-based liquidity protocol Crema Finance on This summer 2 came back the majority of the funds but was permitted to help keep $1.six million like a white-colored hat bounty.

The bounty, 45,455 Solana (SOL), may be worth an ample 16.7% from the $9.six million Crema lost initially, which forced the protocol to suspend services. Crema’s team started an analysis to recognize the hacker by tracking their Discord handle and hearing aid technology original gas source for that hacker’s address. Just like it appeared they might have been to the secret identity, it announced that it absolutely was negotiating using the hacker. On Wednesday, the hacker came back 6,064 Ether (ETH) and 23,967 SOL worth roughly $8 million.

DeFi market overview

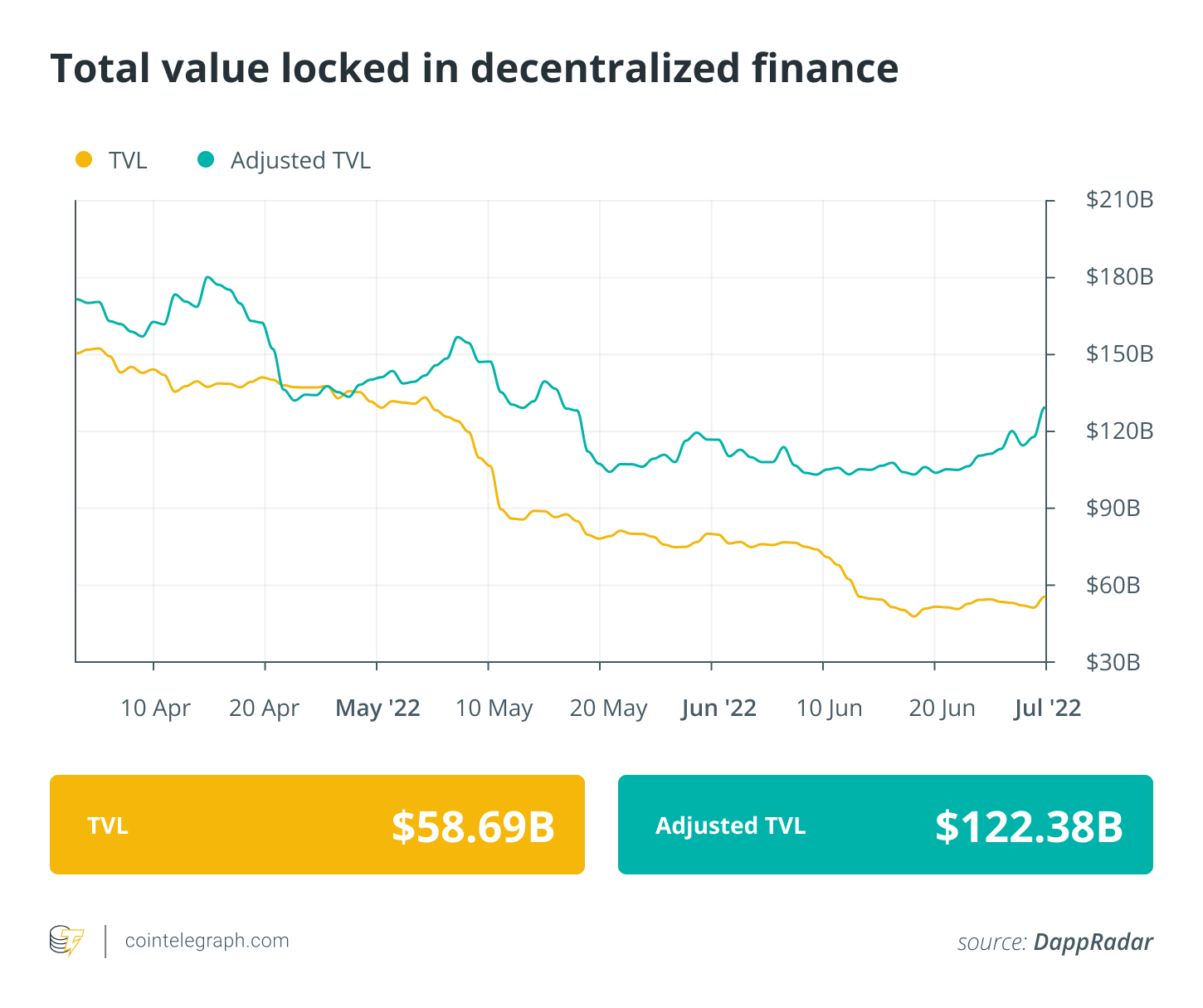

Analytical data reveals that DeFi’s total value locked registered a small rise in the past week, rising to some worth of $58.69 billion. Data from Cointelegraph Markets Pro and TradingView implies that DeFi’s top-100 tokens by market capital demonstrated great indications of recovery with a lot of the tokens buying and selling in eco-friendly with double-digit gains.

Curve (CRV) was the greatest gainer within the top-100 DeFi token list having a weekly rush of 50.18%, adopted by Convex Finance (CVX) with 43.15% weekly gains. ThorChain (RUIN) registered a 28% gain in the last 7 days, while Aave acquired 26% during the same time frame period.

Thank you for studying our review of this week’s most impactful DeFi developments. Come along next Friday for additional tales, insights and education within this dynamically evolving space.