Exactly what is a DAO?

A DAO, or decentralized autonomous organization, is definitely an online-based organization that exists and operates without any single leader or governing body. DAOs are operated by code written on the blockchain like Ethereum (ETH) and therefore are managed by those who rely on them.

You will find various sorts of DAOs, but every one has one factor in keeping: they’re decentralized, and therefore decisions concerning the organization’s future are made the decision through the collective group and never just one individual.

This decentralization is the reason why DAOs promising, because it theoretically removes the potential of corruption or manipulation with a single entity. Smart contracts (and never people) execute the conditions and terms from the organization, which makes them incredibly efficient and resilient to alter.

So how exactly does a DAO work?

A DAO is an accumulation of smart contracts living around the Ethereum blockchain. These contracts communicate with one another to create the business. They’re written in a way that anybody on the planet may use them.

The code for any DAO is public, and anybody can observe it to see results for yourself. This transparency is among the key options that come with a DAO. When compared with traditional organizations, DAOs tend to be more effective because there’s no requirement for an intermediary or central authority.

Another key feature of the DAO is it is autonomous, meaning that it may operate without human intervention. This really is thanks to using smart contracts, which could instantly execute tasks based on the programmed rules.

DAOs are self-governing and self-sustaining, meaning they could exist and operate whether or not the original creators aren’t involved. This really is an additional advantage of utilizing smart contracts. They make sure the DAO is constantly on the follow its original rules whether or not the people running it changes.

Probably the most well-known DAO tokens and platforms are Uniswap (UNI), Aave (AAVE), Compound (COMP), Maker (MKR) and Curve DAO.

Steps to boost money from VCs after incorporating a DAO

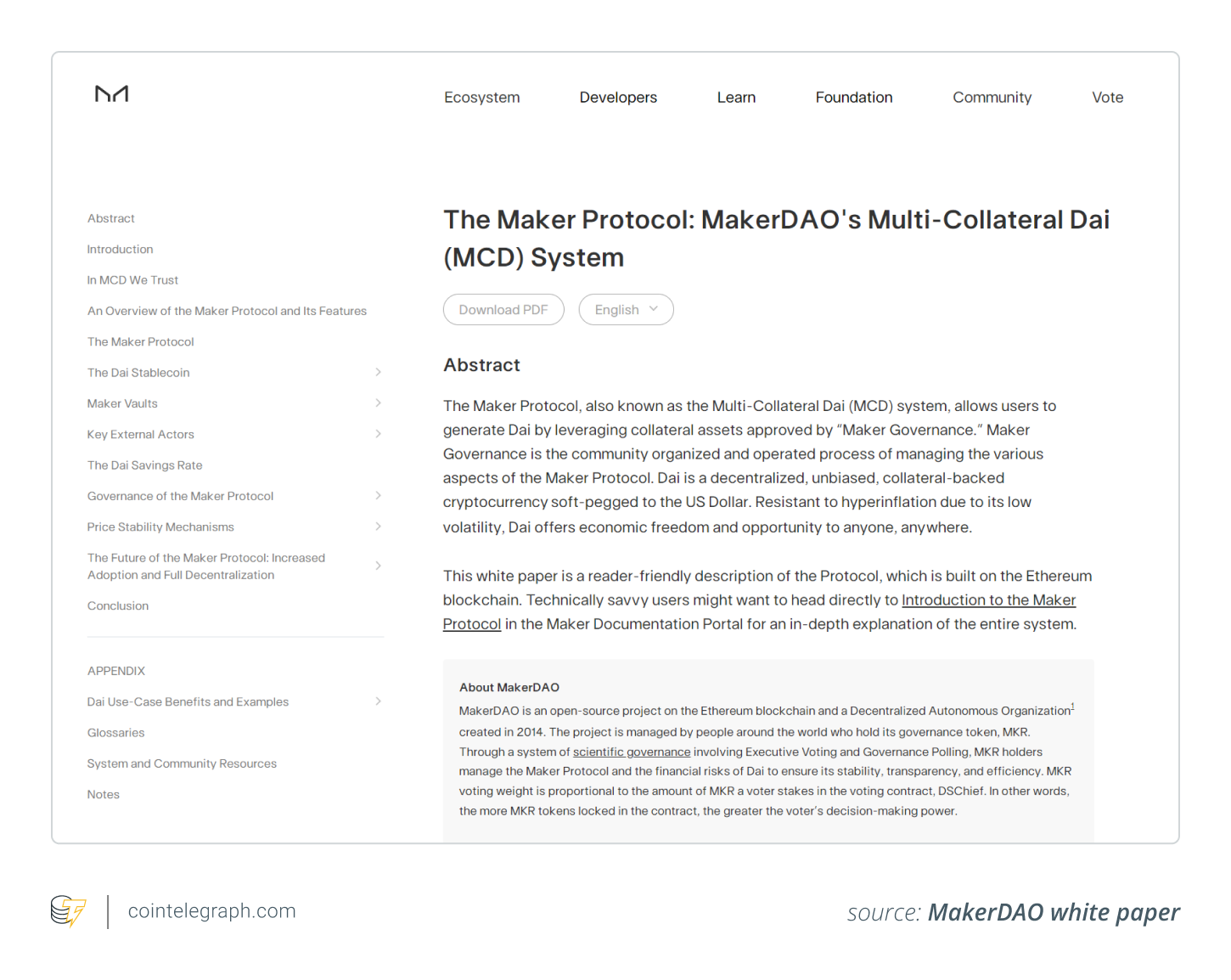

Write a white-colored paper

After incorporating your DAO, you will have to write a white-colored paper. A white-colored paper is a vital document that explains what your DAO is, what it really does and how it operates. It ought to be obvious, concise and clear to see.

Your white-colored paper will be employed to convince potential investors to aid your DAO, so it’s vital that you ensure it’s well-written and persuasive. To obtain began on writing your DAO’s white-colored paper, take a look at our detailed guide here.

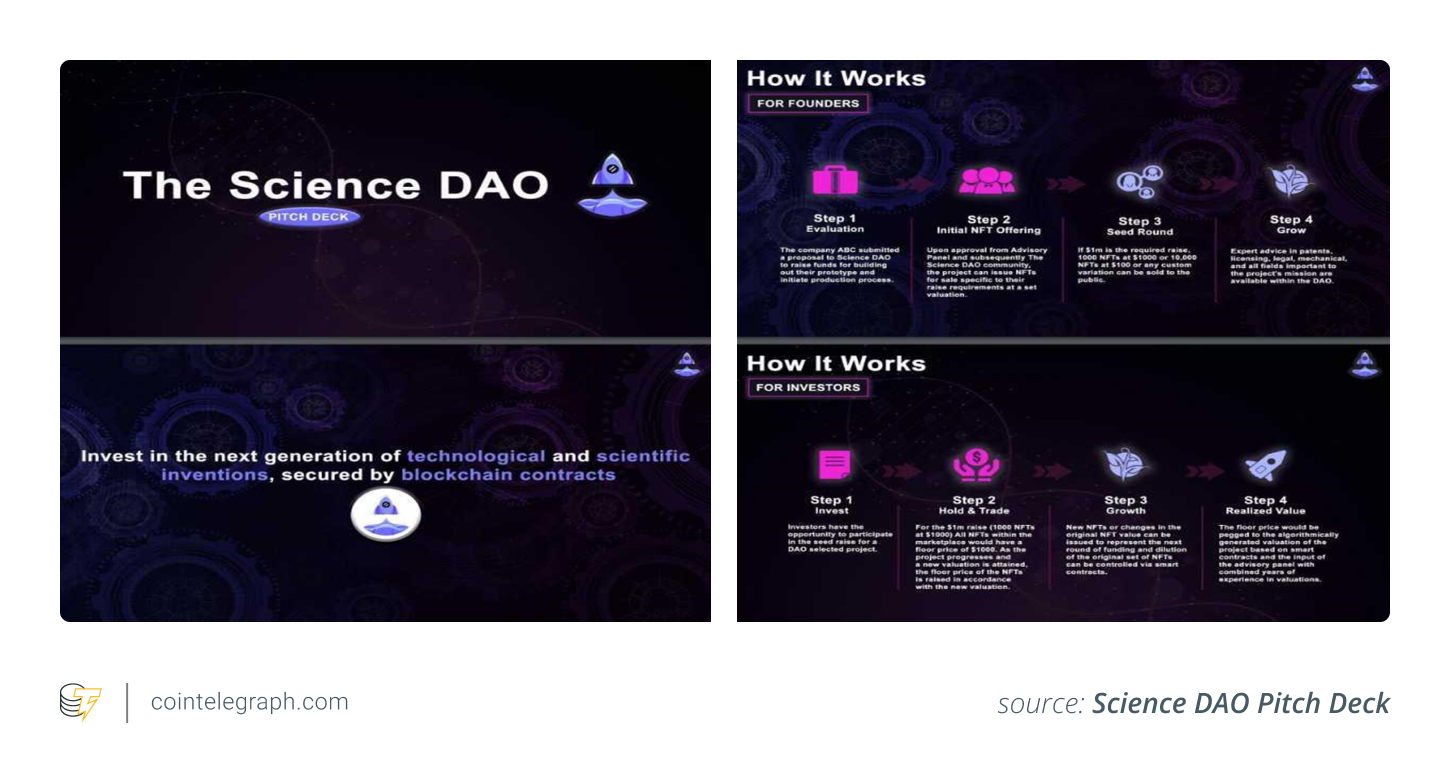

Produce a pitch deck

Additionally to some white-colored paper, you must also produce a pitch deck. A pitch deck is really a short presentation that provides an introduction to your DAO and it is purpose.

Your pitch deck ought to be obvious, visually appealing and simple to follow. It ought to likewise incorporate details about your team, how well you’re progressing up to now as well as your plans for future years.

Make a website

The next phase in raising money for the DAO is to produce a website. Your site ought to be professional and informative. It ought to incorporate your white-colored paper in addition to every other relevant details about your DAO.

It ought to in addition have a method for potential investors to make contact with you. This may be via a contact page, their email or perhaps a social networking account.

Achieve to VCs

After you have produced a white-colored paper, pitch deck and website, you can begin contacting vc’s, or VCs. When contacting VCs, it’s vital that you be obvious regarding your objectives and what you’re searching for.

Some VCs may want to consider purchasing your DAO when they have confidence in its mission. Others might be interested in the financial return that purchasing your DAO will give them.

Related: Investment capital financing: A beginner’s help guide to VC funding within the crypto space

It is also remember this that VCs are busy people. They receive countless pitches each week, so you have to make sure that your pitch sticks out.

Negotiate terms

After you have found a VC thinking about purchasing your DAO, you will have to negotiate the the investment. Including how much money the VC invested, and also the equity stake they’ll receive in exchange.

It’s remember this that you’re in a strong position when negotiating with VCs. In the end, those are the ones who are curious about purchasing your DAO. As a result, you need to strive for terms favorable to both you and your team. Including obtaining a large equity stake along with a high valuation for the DAO.

Close the offer

Closing the offer is a vital part of raising money for the DAO. After you have negotiated the the investment, you will have to close the offer. This requires signing an agreement using the VC, in addition to finding the decided amount of cash. It’s smart to possess a lawyer evaluate the contract prior to signing it.

Make use of the funds

After you have closed the offer and received an investment, you will have to make use of the money wisely. What this means is spending it in a manner that can help your DAO achieve its objectives. A few of the things you could utilize the cash for include hiring employees, marketing your DAO and developing additional features.

It is also remember this that you’ll want to report on their behavior towards the VCs about how you use the cash. Because of this, make sure that your expenses and progress are correctly tracked.

Repay the VCs

Eventually, you will have to repay the VCs. This may be via a purchase of the company, an dpo (IPO) or any other exit strategy. Having to pay back the VCs is a vital part of the existence cycle of the DAO. It’s also a great way to demonstrate to them you’re dedicated to your company and also have belief in the future.

Related: What’s an IPO? A beginner’s guide about how crypto firms will go public

Can DAOs replace VCs?

Are DAOs a practical substitute for vc’s? The reply is it depends. VCs typically purchase early-stage companies which help them grow with the provision of capital, mentorship and connections.

DAOs can offer a few of these same services, but they are not suitable to purchase early-stage companies. It is because DAOs are decentralized and can’t make fast and decisive decisions.

VCs, however, are centralized and may make quick decisions which help early-stage companies grow. So, while DAOs can offer a few of the same services as VCs, they are not really a perfect substitute. A VC is most likely a better option if you are searching for a corporation to purchase early-stage companies.

A hybrid way forward for DAOs and traditional VCs

DAOs really are a innovative and new method of organizing people and sources. When they can’t exactly replace traditional VCs, they are able to potentially disrupt the.

We’ll likely visit a future where DAOs and traditional VCs interact to aid the development of early-stage companies. For instance, a DAO could supply the capital and sources while a VC offers the mentorship and connections.

This type of hybrid model allows early-stage companies for the greatest of all possible worlds: the main city and sources they have to grow, and also the mentorship and connections they have to succeed.

VC DAOs already exist, showing that this type of model can be done. To illustrate The LAO, a investment capital DAO. It concentrates on early-stage blockchain projects according to Ethereum (ETH) and it has funded over 30 projects to date. How it operates is the fact that governance remains the purpose from the blockchain while an exterior company takes proper care of the executive and legal procedures.

One other good example is MetaCartel Ventures, a personal VC DAO along with a spin-from the Ethereum ecosystem grant fund, MetaCartel. The VC DAO arm is managed with a board of “mages,” who conduct functions like presenting investment proposals, research and voting on proposals. They mainly fund early-stage decentralized applications and protocols right now.