When cryptocurrencies like Bitcoin (BTC) undergo bear phases such as the one we presently find inside us, the thought of earning passive earnings from one’s holdings becomes even more attractive for lengthy-term investors.

Related: Decentralized finance: A beginner’s help guide to earning passive earnings with DeFi

Different ways for example staking, lending, cloud mining, and yield farming have grown to be popular previously couple of many involve rewarding investors with money or tokens for that crypto tokens committed to the mechanism.

However, with hard forks or airdrops, users who are involved in the crypto ecosystem can forage for tokens or projects that provide additional tokens compared for their vested holdings in exchange for various reasons.

Since both of them are intended at growing the recognition from the project or included in a marketing campaign, hard forks and airdrops work differently and are available into existence through unique mechanisms.

Let’s explore what differentiates crypto airdrops from hard forks and ways to take advantage of them when committed to the crypto marketplace for the lengthy term.

Exactly what is a crypto airdrop and just how do you use it?

Regarded as like manna from paradise for crypto fans willing to test out different projects, crypto airdrops require minimum technical understanding and potentially lower risks.

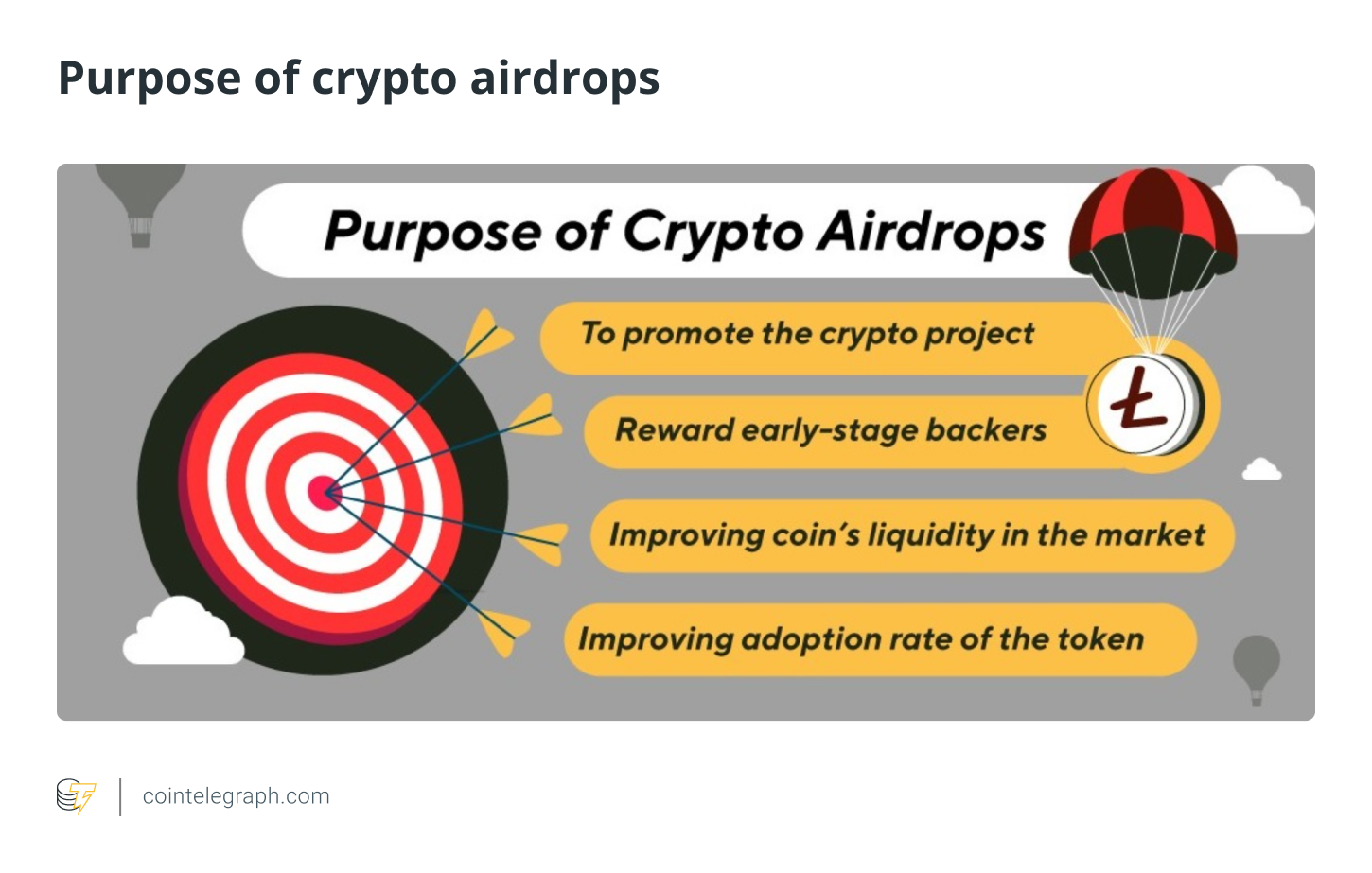

A crypto airdrop is really a gratuitous distribution of the cryptocurrency gold coin or token to existing token holders, also referred to as token giveaways in modern language. Usually connected using the launch of the new project or cryptocurrency, the intent of the airdrop would be to gain in user traction inside a market that’s flooded with a large number of crypto tokens and coins.

Purely marketing anyway, users don’t have control of when an airdrop might occur, which is usually made by developers or crypto entrepreneurs to reward existing token holders with a lot more tokens or coins free of charge.

The quantum of tokens awarded is dependant on the invested amount or contributions made toward a task and is comparable to how traditional brands offer freebies to popularize something new offering.

There’s two kinds of crypto airdrops: retroactive airdrops and takeover airdrops, with key variations backward and forward staying at which stage they’re on offer as well as their specific purpose.

A retroactive airdrop is usually announced when a current blockchain protocol is intending to unveil its native crypto token and rewards early users or individuals who’ve led to the work in front of you evening out.

It’s a extremely popular tool for creating hype round the soon-to-be-launched token. Meanwhile, additionally, it works as a liquidity creation mechanism helping with audience engagement by awarding tokens in return for retweets, feedback or perhaps growing supporters on social networking.

Takeover airdrops are utilized when decentralized finance (DeFi) protocols wish to snatch users from the competition or improve their likelihood of retaining them by providing greater rewards.

Even though it is a somewhat more aggressive type of an airdrop, takeover airdrops are directed at liquidity providers and users who’ve displayed greater engagement in activities for example staking in order to attract them from the competing DeFi protocol.

DeFi aggregator 1INCH conducted numerous airdrops using the specific aim of enticing rival Uniswap users to shift to the platform, rewarding specific user sets in a number of airdrops and serving as a vintage illustration of how free crypto airdrops are employed.

Pros and cons for crypto airdrops

They’ve lengthy been considered an unorthodox type of radical marketing within the crypto space, but crypto airdrops have grown to be more and more popular. Countless projects make use of this method to spur the adoption of the new crypto tokens.

Airdrops offer superlative benefits for crypto entrepreneurs and investors alike, which makes them the most popular advertising tool to produce initial hype and catalyze user traction — two factors that are crucial for a brand new coin’s success.

For crypto firms planning to launch a local token for his or her blockchain or DeFi protocol, crypto airdrops may be the easiest and many cost-effective mode of advertising within the crypto world today. Though it involves expending lots of tokens, which, too, free of charge, these form an extremely small area of the overall tokens to become introduced into circulation and therefore are a sure-shot method of generating excitement among other crypto token holders because they see users earn crypto in the free airdrops.

Around the switch side, airdrops may have a negative implication if a lot of tokens receive included in the airdrop, diluting the marketplace worth of the token and impacting the token’s cost along the way. Furthermore, the majority of the addresses that get the airdrop could sell the received tokens immediately once it’s listed, that will again exert downward pressure around the token’s cost. For users, it’s also vital that you conduct due research to get rid of dump airdrops or crypto scams which are getting good sophisticated as time passes.

When the token increases in recognition and demand, these airdropped tokens could possibly generate much more returns as the need for the token increases in sync. Simply by carrying out a project on its various social networking handles or by discussing news about this with buddies, crypto airdrops reward crypto users with free tokens that may be worth 100’s of dollars, with absolutely nsa.

Actually, for crypto wallet holders or individuals holding specific crypto tokens, airdrops are an easy way of creating good profits on which is essentially a zero investment and could be an effective way of generating passive earnings within the crypto markets. All one should do would be to stay tuned in to projects or firms that are slated to provide airdrops and make the most of them.

Thus, although you earn money from crypto airdrops by immediately selling the received tokens on the crypto exchange, you are able to choose to hold them for an extended duration and potentially increase the likelihood of generating much more returns.

What exactly are hard forks and just how will they work?

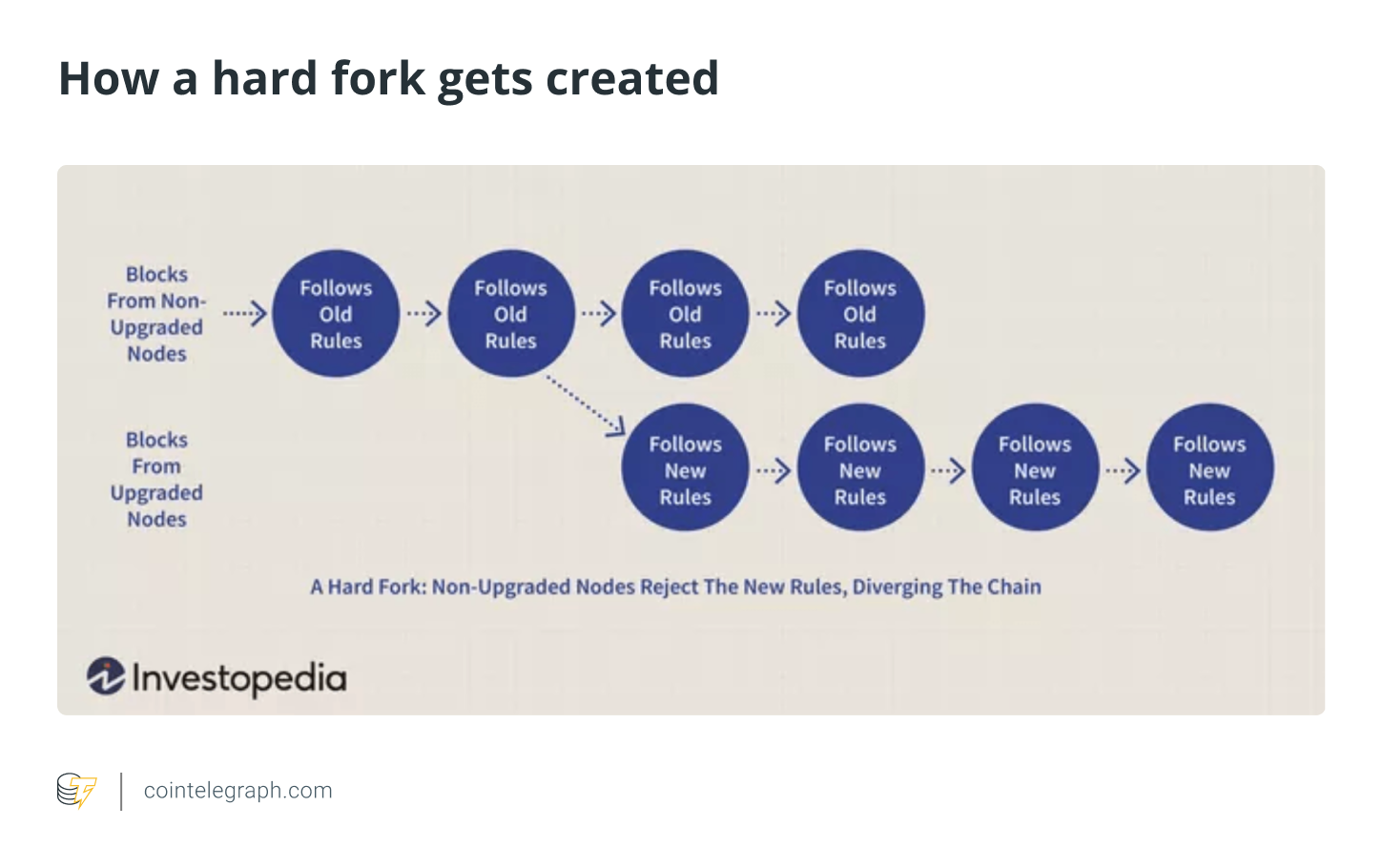

Generally, blockchain protocols undergo alterations to make a new blockchain that runs in parallel using the original but might differ with regards to the finish utility it purports to users and token holders.

Probably the most prominent types of this type of parallel blockchain may be the Bitcoin Cash (BCH) fork, developing a P2P cash system along the way from what’s basically a Bitcoin hard fork.

Related: Soft fork versus. hard fork: Variations described

There are more Bitcoin forks for example Bitcoin Gold, plus they demonstrate how hard forks are produced by altering the bottom protocol’s code to produce a parallel form of it that’s meant for another purpose.

Furthermore, because the recently produced blockchain needs a native token because of its users to transact with, a tough fork leads to the development of a brand new crypto token and helps to create value for individuals who have been committed to the initial gold coin.

A notable illustration of it was when each BTC holder received a similar quantity of BCH tokens in August 2017, generating sizable returns thinking about an inventory cost of $900 for Bitcoin Money on cryptocurrency exchanges.

By having an growing quantity of new blockchain protocols being produced and much more branching out through hard forks, you can easily observe how investors can usually benefit from hard forks without presuming high risks.

However, not every hard forks result from an intention to produce a new system, with a few to be the product of the crypto debacle. Consider for example the Ethereum hard fork, Ethereum Classic (ETC), which even supports another consensus mechanism and it has the native ETC token that may be exchanged on cryptocurrency exchanges freely.

Hived removed from the “official” Ethereum blockchain, it has been around since as a result of the attack on Ethereum’s noticably project, The DAO, and issued tokens to any or all existing ETH holders inside a 1:1 ratio.

Initially should have been a brand new decentralized business design for commercial and non-profit entities, The DAO was susceptible to a vulnerability attack which brought to some couple of users siphoning off one-third of their funds to some secondary account.

Once the Ethereum community dicated to hard-fork the initial blockchain to be able to restore the lost funds, it split the blockchain into two branches and also the unforked blockchain was renamed Ethereum Classic.

For discerning investors, there are lots of possibilities frequently available to purchase blockchain protocols before a tough fork and potentially make use of the additional new tokens available. However, you should conduct thorough research and invest only in individuals tokens which have seem fundamentals to make money from hard forks.

Benefits and drawbacks of hard forks

Hard forks provide developers using the chance to include new functionalities without getting to change the initial blockchain, particularly when it features a huge users list that will nothing like any changes to make.

Additionally, it involves less computational power than having a soft fork and offers more privacy too.

In addition to this, token holders and investors are issued harder fork tokens, which may be immediately monetized or held to profit from lengthy-term appreciation, a predicament with a good venture when the hard fork succeeds in the objective and gains prominence within the crypto space.

However, this might not necessarily function as the situation, as shown by BCH, that is buying and selling near all-time lows since its issuance in 2017.

In addition to the likelihood of cost erosion, people that use the hard fork face a greater chance of losing their token holdings within the light of the attack. Just because a hard fork occurs because of the actual blockchain being split, it’s frequently regarded as harmful towards the security from the network, which makes them more susceptible to malicious attacks.

This is also true when the split occurs between your nodes and miners, because it exposes the blockchain and it is fork to bad actors who can use their computing capacity to overcome the network to steal funds.

Regardless of the kind of attack, the intention is with the idea to undermine the network’s status, which can lead to cost erosion for that native token, in order to steal funds in the network itself and divert these to accounts on another network.

This could lead to investors losing capital around the hard fork tokens along with the original token. Therefore, you should investigate the actual enhancements being produced in a tough fork and if the developers took the required safeguards to insulate the fork from the attack.

Investors can usually benefit from hard forks when they stay up with the most recent developments and place the best possibilities to create earnings by earning crypto through hard forks.