Regulators from Europe, the U . s . States and elsewhere are busily hammering out details regarding how to designate decentralized exchanges (DEXs) as “brokers,” transaction agents or similar entities affecting a transfer and cooperate with one another. The U.S. known as for multinational cooperation in its executive order on responsible digital asset development, as did the Eu using its recent Financial Stability and Integration Review. And that’s just what’s openly accessible.

Behind the curtain, the whisper of regulation gets louder. Did anybody observe that all of the Know Your Customer (KYC) needs happen to be laid on smaller sized centralized exchanges in exotic locations in the last two several weeks? Which was the canary within the coal mine. Using the aforementioned designation and cooperation, DEXs will begin to feel regulator heat soon.

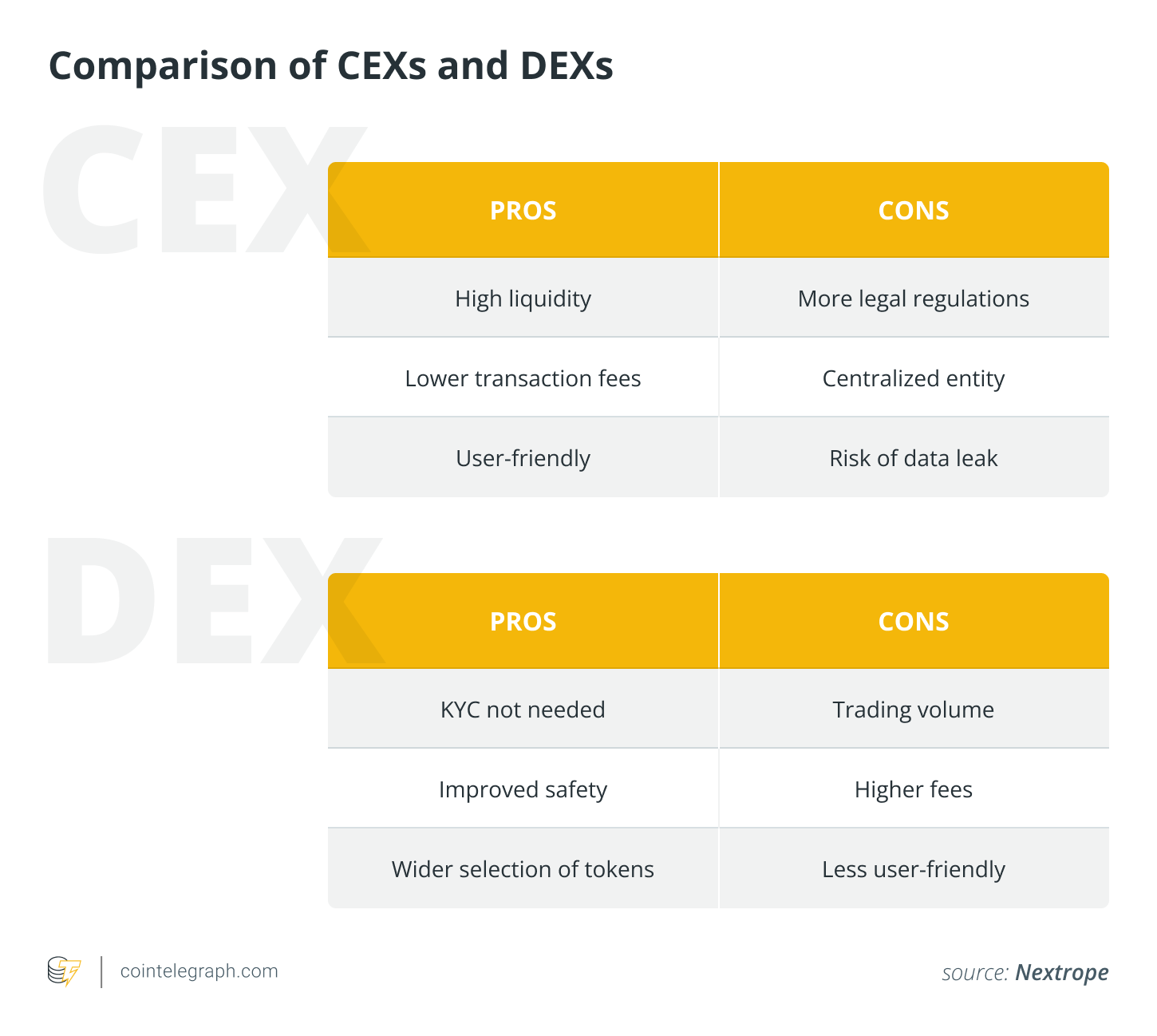

Yes, rules are coming, and also the primary reason DEXs will hardly survive the approaching storm is the announced inabiility to recognize you using and adding to liquidity pools. In conventional financial circles, rendering services without correct KYC procedures is a huge no-no. Not tracking identity permitted Russian oligarchs to make use of the Hawala payment plan to anonymously move huge amount of money prior to world war 2 in Ukraine, so regulators are justifiably worried about DEXs. For many DEX enthusiasts, KYC sounds somewhat insult, or at best, something which a DEX is essentially not capable of doing. Is the fact that truly the situation, though?

Related: Crypto’s effect on sanctions: Are regulators’ concerns justified?

DEXs are really pretty central

We begin using the anatomy of the DEX, and we’ll discover that they aren’t even while decentralized as you might think. Yes, DEXs operate on smart contracts, however the team or person who uploads the code on-chain usually will get special admin-level rights and permissions. Furthermore, a known, centralized team typically takes proper care of the leading finish. For instance, Uniswap Labs lately added the opportunity to scrub known hacker wallets, removing tokens using their menu. While DEXs tell you they are pure code, the truth is, there’s still a far more-or-less centralized developer team behind this ethereal entity. This team also consumes any profits to make.

In addition, an in-depth consider the way users talk to permissionless chains reveals more centralized choke points. For instance, recently, MetaMask was unavailable inside a couple of regions. Why? Because Infura, a centralized company the on-chain wallet depends on to have an Ethereum API, made the decision so. Having a DEX, things can invariably engage in similarly.

Many people state that DEXs tend to be more decentralized due to being free, meaning any community is free of charge to fork the code and make their very own DEX. Sure, you could have as numerous DEXs as you would like, but now you ask , about which of them have the ability to bring more liquidity towards the table, where users really visit trade their tokens. That’s, in the end, what exchanges are suitable for to begin with.

Related: DEXs and KYC: A match produced in hell or possible?

From the regulatory perspective, a business facilitating such trades is visible like a “broker” or perhaps a “transfer agent” whether or not it’s free or otherwise. That’s where most rules are heading. Once recognized as such, DEXs will require major fire unless of course they are able to adhere to several needs. These would come with obtaining a license, verifying user identities and reporting transactions, including suspicious ones. Within the U.S., they’d also need to adhere to the financial institution Secrecy Act and freeze accounts upon request in the government bodies. Without all that, DEXs will probably go below.

The identity-and-KYC issue

Since DEXs claim they’re decentralized, additionally they claim that they’re technologically not capable of applying any identity verification or KYC controls. However in truth, KYC and pseudonymity aren’t mutually exclusive from the technological perspective. This kind of attitude reveals, at the best, idleness or perhaps an unhinged push for lower costs, and also at worst, a wish to learn from dirty money being moved around.

Arguments that the DEX is not able to complete KYC without developing a honeypot of private information lack technical merit and imagination. Multiple teams happen to be building identity solutions according to zero-understanding proofs, a cryptographic way in which enables one party to demonstrate it’s certain data without revealing that information. For instance, evidence of identity may include a eco-friendly checkmark the person has transpired the KYC, but doesn’t reveal your personal data. Users can share this ID having a DEX for verification purposes without resorting to a centralized repository of knowledge.

Since their users do not have to pass through a KYC, DEXs end up part of the puzzle with regards to ransomware: Online hackers rely on them like a major hub for moving bounty. Because of the insufficient ID verification, DEX teams are not able to describe the “source of funds,” meaning they’re not able to prove the cash doesn’t originate from a sanctioned territory or from money washing. Without it proof, banks won’t ever issue a financial institution take into account DEXs. Banks require info on the origins of funds so that they don’t get fined or their very own license revoked. When DeFi may be easily employed for criminal activity, it can make a poor reputation for crypto and pushes it farther away from mainstream adaptation.

DEXs in addition have a unique and single-purpose suite of software, Automated Market Making or AMM, which enables liquidity providers to complement with consumers, and get or determine a cost for any given asset. This isn’t general-purpose software that may be leveraged for multiple use cases, out of the box the situation with BitTorrent’s P2P protocol, which moves bits rapidly and efficiently for Twitter, Facebook, Microsoft and video pirates. An AMM includes a single purpose and creates a profit for teams.

Verifying user identities and checking that cash and tokens aren’t illegal ensures some degree of defense against cybercrime. It can make DeFi safer for users and much more achievable for regulators and policymakers. To outlive, DEXs will need to eventually admit this and adopt an amount of identity verification and protection against money washing.

By applying a few of these solutions, DEXs can continue to deliver around the commitment of DeFi. They are able to remain open for users to lead liquidity, earn charges, and steer clear of counting on banks or any other centralized entities while remaining pseudonymous.

Related: Wish to get rid of ransomware? Regulate crypto exchanges

If DEXs decide to disregard the regulatory pressure, it may finish in 1 of 2 ways. Either more legitimate platforms could adjust to growing government scrutiny and rising demand in crypto from more mainstream investors, who are required usability and security, therefore departing persistent DEXs to die, or else, unadaptable DEXs will transfer to the grey market of far-flung jurisdictions, tax havens and unregulated cash-like economies.

We’ve every need to believe the previous is really a much likelier scenario. It’s here we are at DEXs to develop track of average folks or risk being controlled to dying combined with the shadier ghosts of crypto’s past.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Bob Reid may be the current Chief executive officer and co-founding father of Everest, a fintech company that leverages blockchain technologies for any safer and inclusive multi-currency account, digital/biometric identity, payment platform and eMoney platform. Like a licensed and registered lender, Everest supplies finish-to-finish financial solutions, facilitating eKYC/AML, digital identity and regulatory compliance connected with money movement. He was an consultant to Kai Labs, the overall manager of licensing at BitTorrent, and v . p . of strategy and business development at Neulion and DivX.