Illicit cryptocurrency activity in 2021 and also the first quarter of 2022 has declined like a number of overall crypto activity, based on blockchain forensics firm CipherTrace.

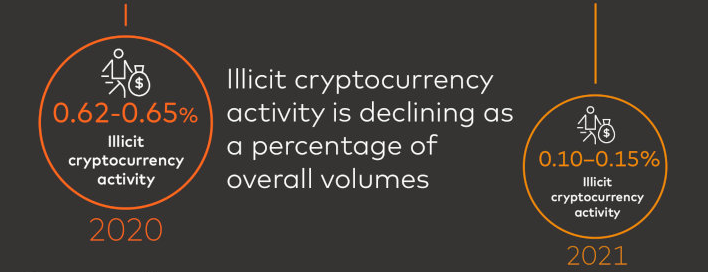

The cryptocurrency industry has lengthy held a status in certain jurisdictions like a haven for criminal activity. However, CipherTrace estimates that illicit activity was between .62% and .65% of overall cryptocurrency activity in 2020. The firm reported it has fallen to between .10% and .15% of overall activity in 2021.

In the “Cryptocurrency Crime and Anti-Money Laundering” report released Monday, CipherTrace outlined the top decentralized finance (DeFi) hacks in 2021 and Q1 2022 netted attackers $2.4 billion.

Over 1 / 2 of that figure originated from just two occasions, the biggest to be the late March 2022 Ronin Network exploit worth about $650 million and also the $610 million August 2021 hack from the Poly Network, many of which was came back through the anonymous hacker.

Inside a similar period of time, Anti-Money Washing (AML) related fines within the banking sector elevated dramatically, with 80 institutions fined in 2021, up from just 24 in 2020, according to Kyckr.

As the total amount of money from the fines fell from 2020, this past year saw banks pay $2.7 billion price of fines for AML or Know Your Customer (KYC) related violations, the biggest single fine totaling around $700 million.

While significant sums happen to be exploited in crypto, CipherTrace detailed the quickly expanding crypto ecosystem, noting the total crypto market activity for 2020 was around $4.3 trillion, which increased to roughly $16 trillion of activity just within the first 1 / 2 of 2021.

CipherTrace states the development of the crypto market also brings by using it elevated scrutiny in the world’s regulators, who’re “starting to consider decisive action to make sure that the area isn’t only a modern-day wild west.”

Related: A existence after crime: What goes on to crypto grabbed in criminal investigations?

Probably the most significant regulatory occasions reported within the report range from the U . s . States President Biden’s crypto executive order in March to review blockchain technology, Dubai creating a virtual assets regulator and the ecu Union’s suggested Anti-Money Washing laws and regulations.

CipherTrace added organizations will have a “very real incentive to shape up” or face “heavy losses as a result of the federal government,” adding it expects the threats existing in crypto would be the focus of future regulatory efforts.