Interlay, a London-based blockchain firm, launched a Bitcoin (BTC)-based mix-chain bridge on Polkadot (Us dot). Named interBTC (iBTC), the bridge enables using Bitcoin on non-native blockchains for decentralized finance (DeFi), mix-chain transfers and nonfungible tokens (NFTs), amongst others.

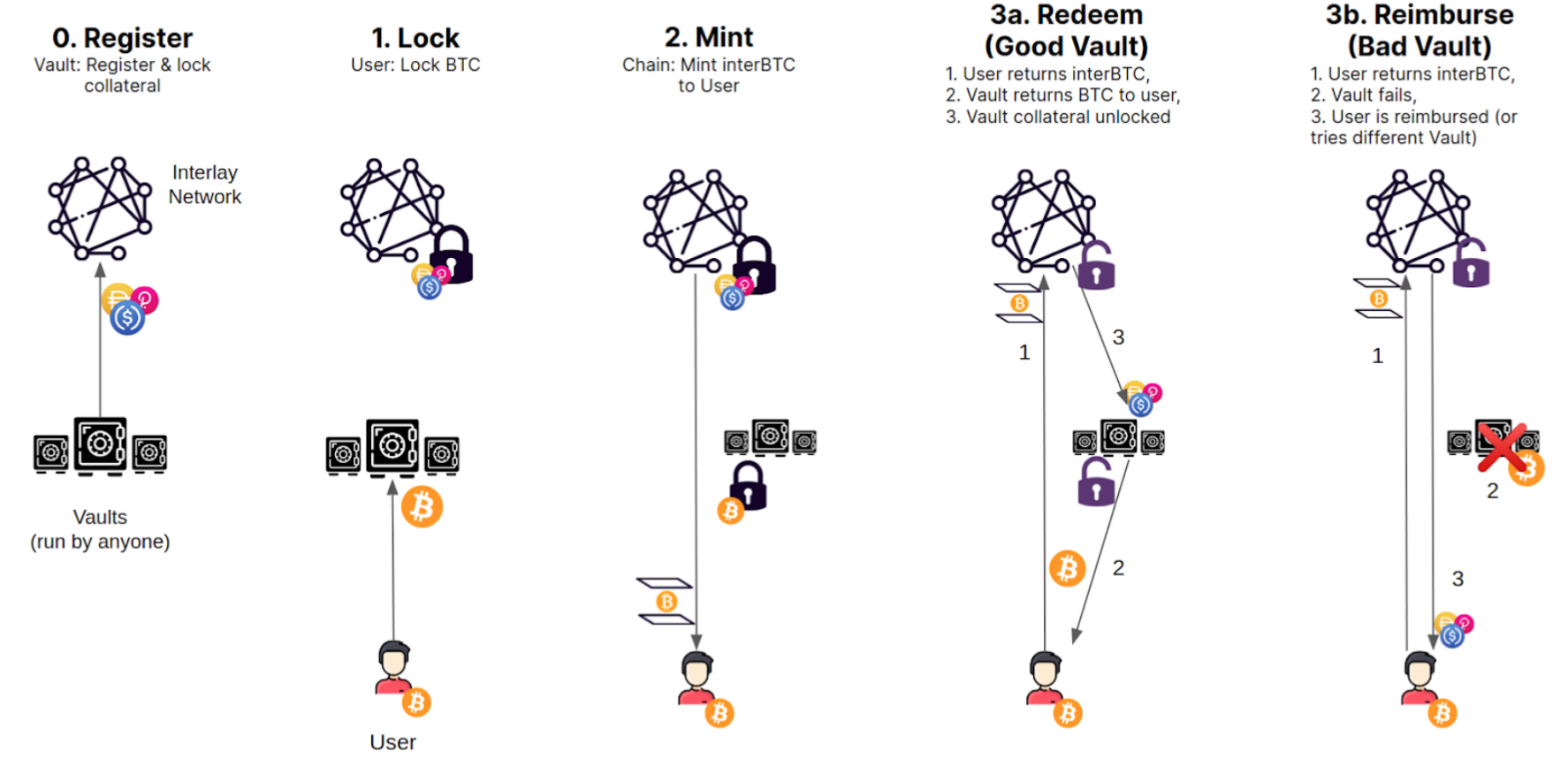

interBTC operates like a BTC-backed stablecoin, guaranteed with a decentralized network of overcollateralized vaults, which based on Interlay, resembles MakerDAO’s DAI token, a stablecoin around the Ethereum blockchain.

The iBTC vaults use mixed-asset collateral to insure BTC reserves, making iBTC redeemable 1:1 with BTC within the Bitcoin blockchain. Like a safety measure during unforeseen vault failure, the collateral is developed to get slashed and compensate the BTC depositors. Discussing the idea process behind the initiative, Interlay co-founder and Chief executive officer Alexei Zamyatin mentioned:

“Bitcoin may be the driving pressure behind global crypto adoption, while Polkadot, Ethereum & co. is how technology is going on. With interBTC, we combine the very best of all possible worlds while preserving the trustless nature of Bitcoin.”

Interlay’s announcement also highlighted Ethereum co-founder and Polkadot inventor Gavin Wood’s vision of making a completely decentralized Bitcoin bridge on Polkadot, that was thanks to interBTC. Acala and Moonbeam would be the first DeFi hubs for hosting iBTC’s debut, which is based on a $a million liquidity program provided by the Interlay network treasury and partner projects.

The roadmap for iBTC involves being offered on other major DeFi systems, including Ethereum, Cosmos, Solana, and Avalanche.

Related: DeFi market has room for development in Korea: 1inch co-founder — KBW 2022

Echoing Interlay’s curiosity about serving the DeFi along with other crypto markets, DeFi aggregator 1inch Network eyes geographical expansion in newer jurisdictions. Speaking to Cointelegraph, DeFi aggregator 1inch Network co-founder Sergej Kunz revealed intends to expand its achieve in Asia.

Kunz disclosed that 1inch is positively searching to work with Asia-based Web3 companies regardless of the small DeFi market in Korea and Asia, adding that:

“Here, there are plenty of people that like gaming and lots of such things as that, and so i think the DeFi market can grow a great deal in Columbia.”

1inch’s primary use situation like a decentralized exchange (DEX) aggregator involves identifying pools using the largest liquidity, cheapest slippage and least expensive cryptocurrency forex rates.