The cost of Terra (LUNA) has tanked around 70% because the re-launch from the Terra ecosystem via Terra 2. on May 28.

Under the revival plan of Terraform Labs founder Do Kwon, new LUNA tokens, also called LUNA 2, are now being airdropped to investors that formerly held Luna Classic (LUNC), TerraUSD Classic (USTC) and Anchor Protocol UST (aUST).

The only real need to buy $LUNA 2. would be to entitled to the next airdrop of $LUNA 3. after it is going to zero like $LUNA 1.

— Luke Martin (@VentureCoinist) May 29, 2022

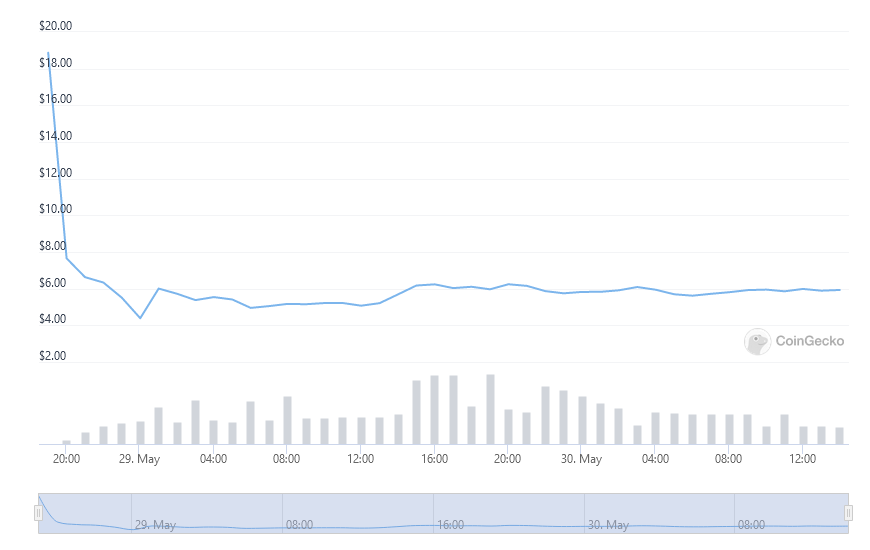

Based on data from CoinGecko, LUNA has dropped roughly 69% since its opening of $18.87 on Saturday to sit down around $5.71 during the time of writing.

At this time, the sharp plummet appears to point out a family member insufficient belief in Do Kwon’s update continuing to move forward, with lots of investors indicating on Twitter that they’re rather searching to recuperate a little part of their formerly lost capital and wipe their hands clean from the project.

Offered my available LUNA 2. airdrop → ETH @ $1,790.

I do not use whatever fundamental here & I see whatever I recieve as bonus since i have already authored everything off like a loss & $.

Otherwise the other medication is vesting, I’ll sell ‘em all.

— (@0xWolff) May 28, 2022

Binance is placed to start a multi-year distribution of LUNA to qualified users beginning from May 31, together with listing the token for buying and selling via its Innovation Zone, a passionate buying and selling zone for volatile and-risk assets.

Many people locally who’ve outlined intends to eventually purchase LUNA when the carnage has ended for example “lurkaroundfind” have predicted further bloodshed when the Binance drop goes live.

Related: Bitcoin cost stuck below $29K as Terra returns in the dead

They noticed that Binance has “15.7MM liquid LUNA, which is open to users on Tuesday,” and recommended that investors who mainly used the Anchor Protocol will appear to spend as other product real curiosity about the Terra ecosystem.

5/8 Binance offered an Anchor UST staking service. https://t.co/TuacL1JXSK

Many users had UST on Anchor via Binance at pre-attack snapshot. A number of these users never owned old LUNA and do not worry about new LUNA.

Yeah, they are gonna dump.

— Terra Watcher (@lurkaroundfind) May 29, 2022

Popular influencers within the space for example Lark Davis also have noted such, telling his 988,000 Twitter follows yesterday that:

“Zero intends to buy $luna 2., however i will dump any airdrop basically go on Binance.”