The crypto winter has feelings running high. Kraken Chief executive officer Jesse Powell received fire for his defense of listing the brand new LUNA, also referred to as LUNA 2., which seeks to create the initial LUNA — now referred to as Luna Classic (LUNC) — and TerraUSD — now referred to as TerraUSD Classic (USTC) — away from the dead.

Respected names within the crypto industry for example Nic Carter of Castle Ventures spoke out from the decision, during another tweet thread, Powell lashed out at short-seller Jim Chanos, who’d built a sizable short against Coinbase, Kraken’s greatest competitor.

Carter simply tweeted “why” towards the official Kraken Twitter account that announced your opportunity from the new LUNA.

Client demand. There is a weird dynamic with exchanges. Switching price is low and individuals have a tendency to wish to accomplish everything on this page for capital efficiency/synergies/convenience. Not supporting 1 gold coin people demand might cost the entire account. Listing isn’t an endorsement

— Jesse Powell (@jespow) May 30, 2022

The world’s 4th-largest crypto exchange, Kraken lists over 160 cryptocurrencies. Their email list grows each month, from Bitcoin (BTC) to Filecoin (FIL) towards the second iteration of LUNA, which presently sits 164th on its cost index.

The very first Terra collapse easily wiped out circa $50 billion, causing suicide hotlines to become pinned towards the Terra subreddit, while legal documents reveal Terraform Labs founder Do Kwon liquidated two branches as well as an entire company days before the disaster happened.

Related: Exchanges back ‘Terra 2. revival plan’ via airdrops, listing, buyback and burning

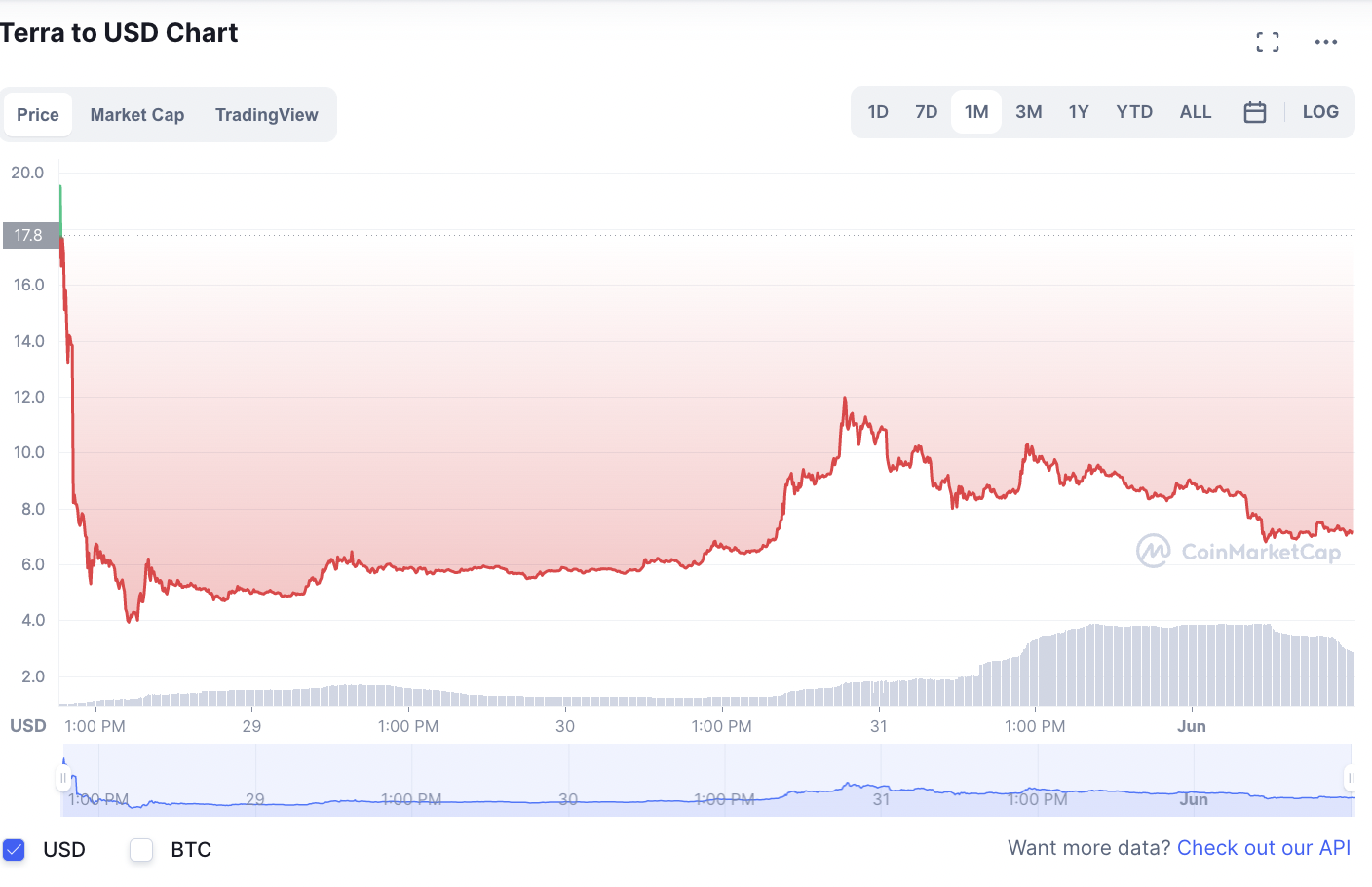

The work ended up being hard-forked and relaunched with virtually no recompense for impoverished investors. An airdrop, for instance, didn’t go the way the developers intended, as tokens were unevenly distributed. The brand new LUNA has since slid from highs of just about $20 to under $8, despite a 90% spike in cost driven by a Binance airdrop.

Powell cites that “client demand” motivated your opportunity of LUNA. Rohan Gray, a helper professor of law at Willamette College, known as Powell out on the go, quarrelling that eBay doesn’t allow fraudsters to stay around the e-commerce platform, why should crypto exchanges allow Terra a seat while dining? The comment would be a quip to Powell’s claim about Kraken:

“We’re a marketplace, like eBay. BTC<>BTC traders don’t settle the bills.”

Powell has formerly proven a decisive side to his operations, lately closing Kraken’s global headquarters because “San Francisco isn’t safe.” However, with regards to money and Kraken, “We play the role of as asset-agnostic as you possibly can,” he tweeted.

“Fiat and many stocks are garbage but where’s the outrage? Revenue from all of these other coins pays for the security, pro-BTC lobbying and marketing.”

Inside a separate Twitter thread, Kraken defended the way forward for crypto exchanges. Inside a Crypto Critics Corner podcast, Chanos — a united states investment manager — detailed rapid he’d built facing Coinbase, America’s largest crypto exchange. For Powell, you will see a “paradigm shift within the next ten years,” and crypto exchanges can come out as winners.

Legacy “charges” remain, hidden or moved. Crypto brokerage is simply one service that’s operated by a huge stack of infrastructure that replaces like 20 other middlemen and ancillary companies. Revenue diversity will grow with adoption, paradigm shift over next ten years.

— Jesse Powell (@jespow) June 1, 2022

Infighting and Twitter spats aside, for individuals seeking signal one of the war of words, Powell shared his investment preferences for choosing Bitcoin, purchasing exchanges, or both:

Personally, I’d wish to own both. Exchanges are kind of a bet overall space growing.

— Jesse Powell (@jespow) June 1, 2022

Kraken didn’t immediately react to Cointelegraph’s request comment.