Nonfungible tokens (NFTs) will be in the headlines within the last couple of years. While swaths of people have attempted to have their mind around why NFTs exist, demand from customers has soared, institutions happen to be built, and also the lingo has joined our collective awareness.

There’s an elephant within the room, though: NFTs take time and effort to make use of and most options are digital snake oil. However these problems produce the chance to supply solutions. The ease of access and authenticity of NFTs are generally ripe for change. As funding flows in to the space, the marketplace is beginning to mature, which change is gaining momentum. We’re entering a brand new era of NFTs — NFT 2. — in which the technology could be more readily available through the mainstream, and also the underlying value proposition from the NFTs could be more transparent and reliable.

Reflecting increasing of NFTs

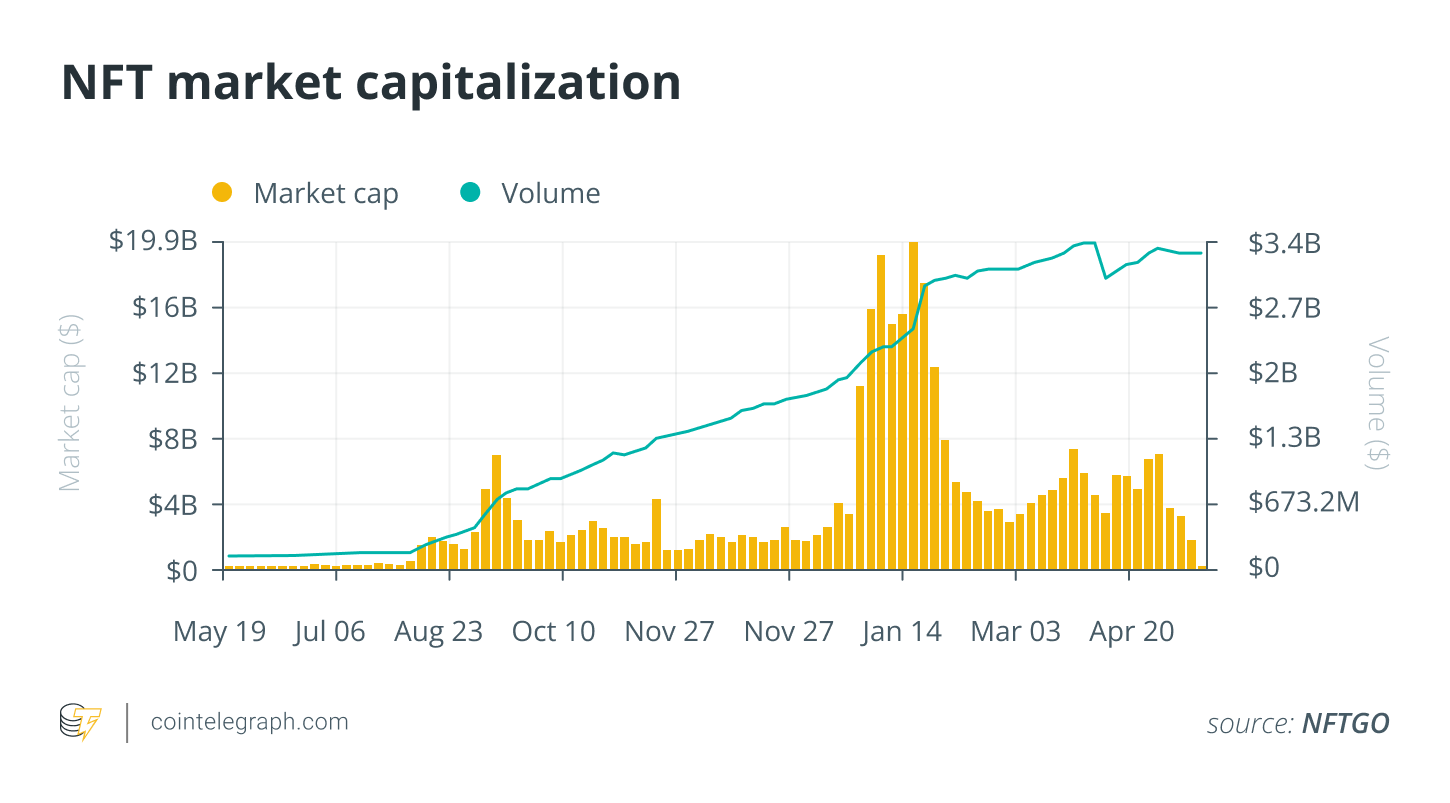

Within their short existence, NFTs have exploded to the crypto scene, topping $17 billion in buying and selling volume in 2021. The dpi is expected to balloon to $147 billion by 2026. Much more impressive is always that this volume is owned by less than 400,000 holders, which totals an astonishing $47,000 transaction volume per user.

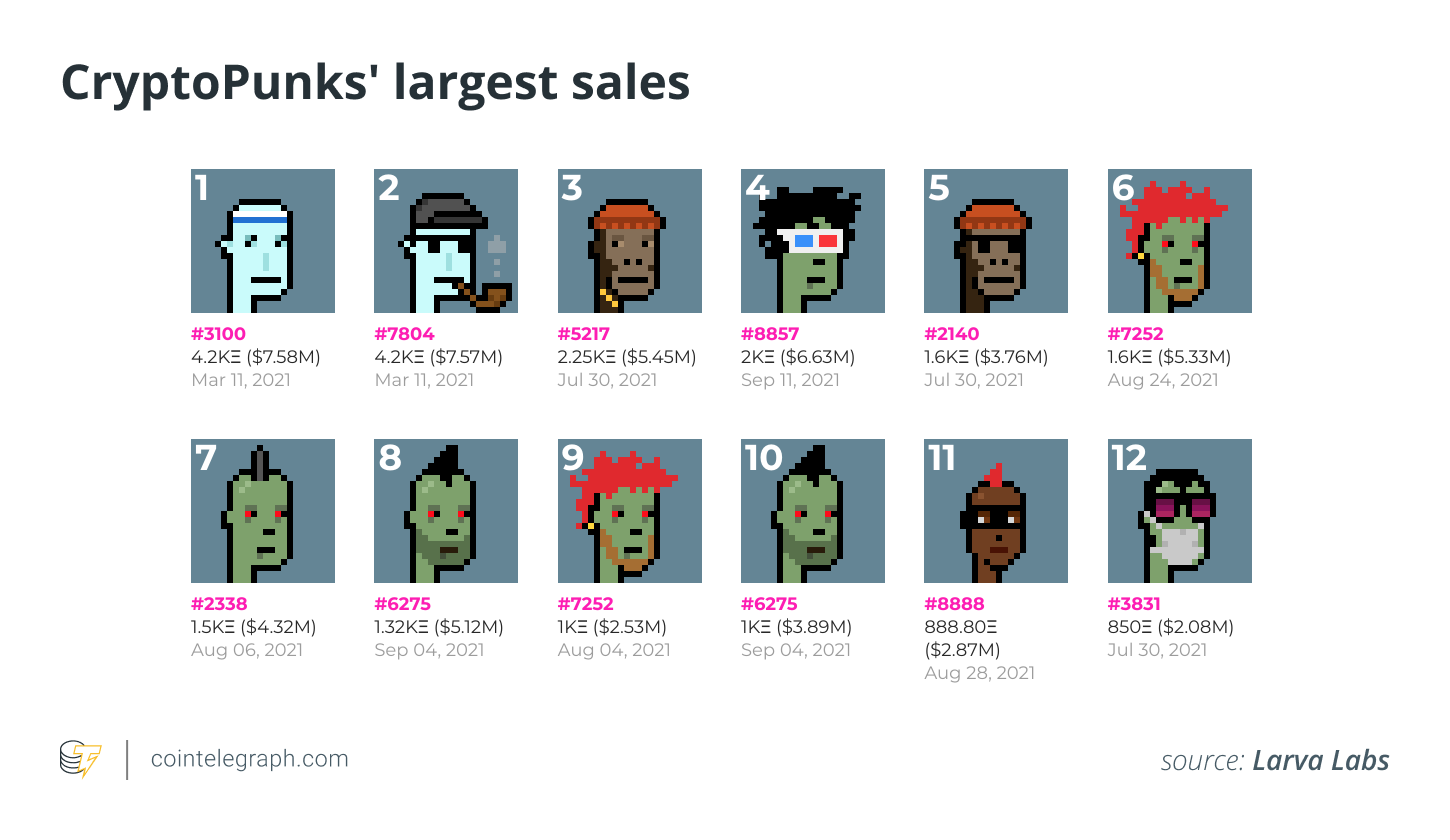

Plus the industry’s meteoric rise, NFTs themselves have undergone enormous changes since their beginning. For instance, CryptoPunks, which minted free of charge in 2017, rose to blue-nick status, peaking by having an $11.8-million purchase at Sotheby’s this past year. A couple of years later, Larva Labs, the organization accountable for allowing the Punks, was acquired through the Bored Ape Yacht Club’s parent company, Yuga Labs, to have an undisclosed amount.

The evolution of NFTs

Ignored like a fad in early stages, NFTs have proven a significant quantity of remaining power, attracting the interest of major celebrities and types as well as being featured in Super Bowl commercials. Companies for example Budweiser, McDonald’s and Adidas have dropped their very own collections, while Nike has joined the area by obtaining RTFKT Studios.

Related: How come major global brands tinkering with NFTs within the metaverse?

While organizations determine their NFT strategy, the general space has mirrored yesteryear several decades of technology, just below a considerably faster timeline. As the iPhone required about ten years to achieve its current version, NFTs have moved from 8-bit pixelated images and Pong-like blockchain games to high-fidelity 3D animations and sophisticated play-to-earn game mechanics with massive multi-player encounters in just a few years.

As the actual NFTs evolve, the ecosystem of pick-and-shovel solutions can also be quickly evolving. The onslaught of NFT minting platforms and toolings has dramatically reduced the barrier to entry, that has produced deep saturation on the market. By March 2022, there have been more NFTs than there have been public websites, creating a lot of noise that lots of have discovered hard to cut through.

1/ Nowadays there are more NFTs on OpenSea than there have been websites on the web this year.

Soon, NFTs will outnumber websites, possibly even webpages. This growth has major implications for the way we ought to index NFTs…

— Alex Atallah (@xanderatallah) March 9, 2022

The remaining power the asset class and also the gargantuan transaction volumes have shifted the methods that creators approach the area. Many have rushed their Web3 strategy or treated their fans as an origin of liquidity, departing chaos of missteps, rug pulls and abandoned projects. Quite simply, a lot of companies and creators aren’t prepared to enter Web3, plus they want more hands-holding and white-colored-glove services compared to what they do tools.

Much like email

Ultimately, NFTs seem to be heading exactly the same way as email. At one time within the 1990s when companies required to hire specialists to code emails on their behalf. Early adopters founded lucrative agencies that could service Fortune 500 companies and execute early digital strategies. The data gap gave these agencies tremendous leverage until technological advancement (and education) managed to get simpler for brands to get it done themselves.

Related: We haven’t even started to take advantage of the potential of NFTs

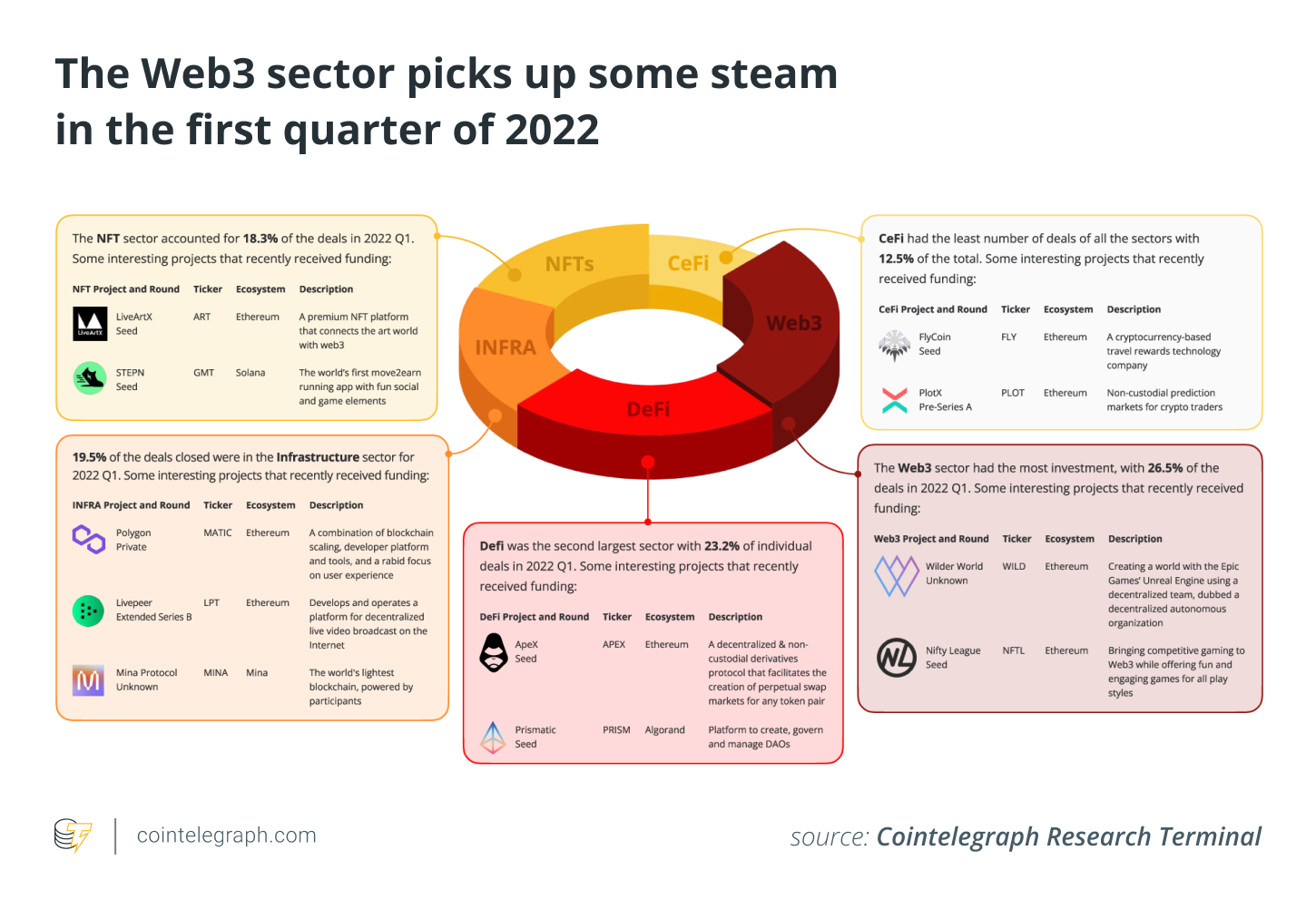

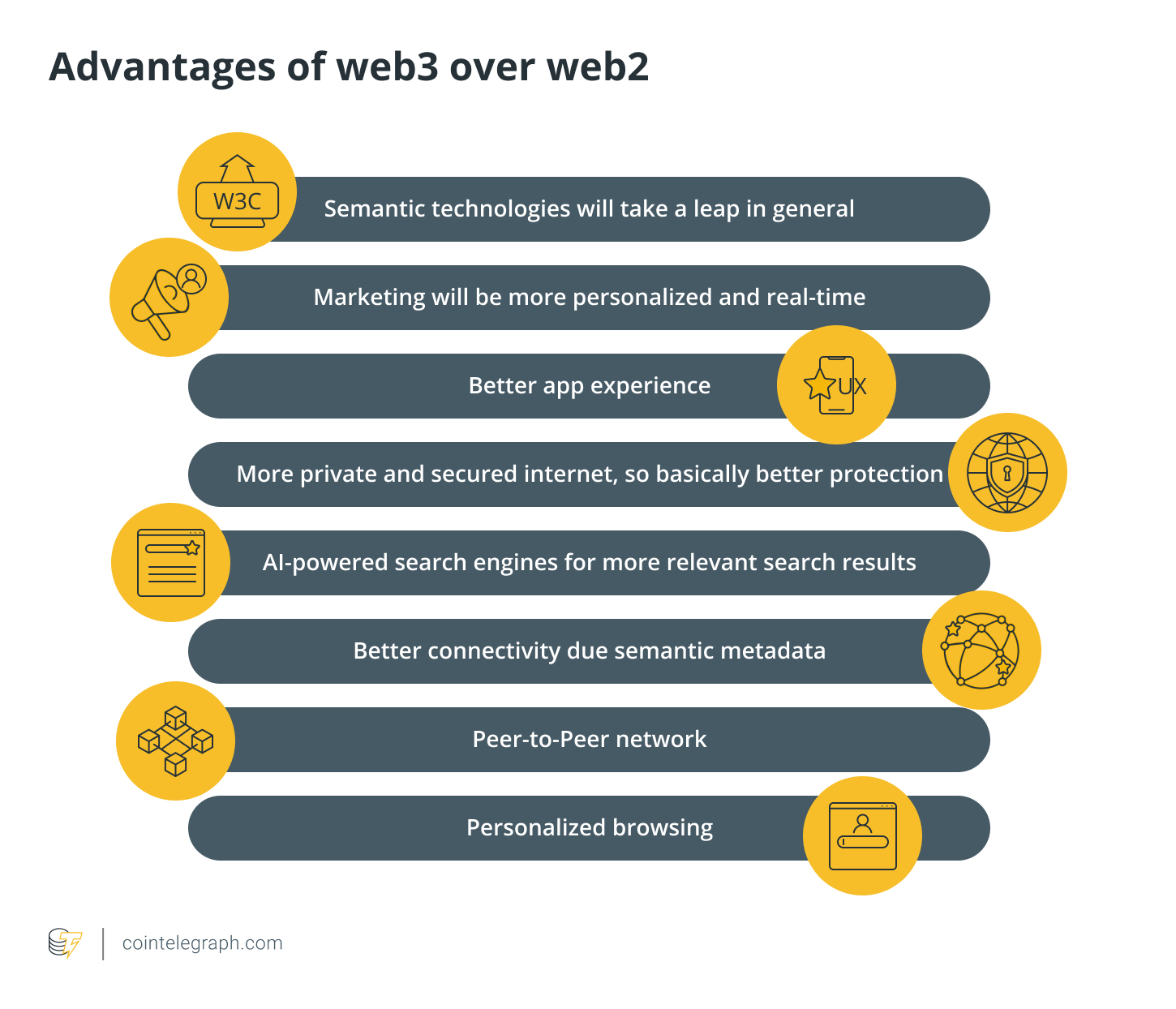

Similarly, we’re presently within the era where brands are searching to experts to teach and make preparations them for any Web3 future, which is only dependent on time before they fully disintermediate and manage their Web3 strategy fully in-house. Onboarding for NFTs, and crypto in particular, is a reasonably complex procedure that many just can’t handle. Some companies, however, have found methods to abstract the greater difficult facets of crypto and creating avenues for much deeper engagement using their fans.

Designed for the mainstream: NFT 2.

The present iteration of NFTs isn’t created for mainstream consumption. The onboarding system isn’t smooth for consumers the volatility is unhealthy for true fans also it skews the artist-fan relationship. There’s an excessive amount of dissonance between your sticker cost of the NFT and also the value with the ability to provide consumers, and lots of collections are seeing rough demand shocks because they neglect to execute on their own road maps.

The main NFT buyer has become savvier to rug pulls and scams, which ensures they are less inclined to mint new collections. Despite the fact that it’s very easy to check out declining volumes and find out disaster, in fact NFTs require a sizable washout to be able to get rid of individuals searching to obtain wealthy rapidly and much more correctly incentivize true builders within the space. Because the vaporware will get easily wiped out throughout a bear cycle, the antifragile firms that can weather the storm when shifting from Web2 to Web3 will thrive. Agencies and platforms, if timed incorrectly, is going to be easily wiped out, but individuals ready for an e-mail-esque shift will maximize high-margin, high-touch projects while recording lengthy-tail revenue streams.

It has important implications whether you’re building within the space, a possible user or perhaps an investor. This space will develop fast and evolve rapidly. Don’t blink or you will miss it.

This short article was co-created by Mark Peter Davis and Sterling Campbell.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Mark Peter Davis is really a venture capitalist, serial entrepreneur, author and community organizer. He’s the managing partner of Interplay, a high-performing investment capital firm located in New You are able to City. He’s also an energetic podcaster, the writer of The Fundraiser Rules and also the founding father of both Columbia Venture Community and also the Duke Venture Community.

Sterling Campbell may be the Chief executive officer of Minotaur, Web3 company servicing top-tier creators and types because they develop NFT projects, decentralized autonomous organiations and tokens. He’s spent nearly all his career concentrating on consumer-focused tech for Blockchain Capital, Lerer Hippeau, Grishin Robotics and William Morris Endeavor, where also, he developed talent. Sterling earned his bs in music business and business in the College of Los Angeles and the mba course from Columbia Business School.