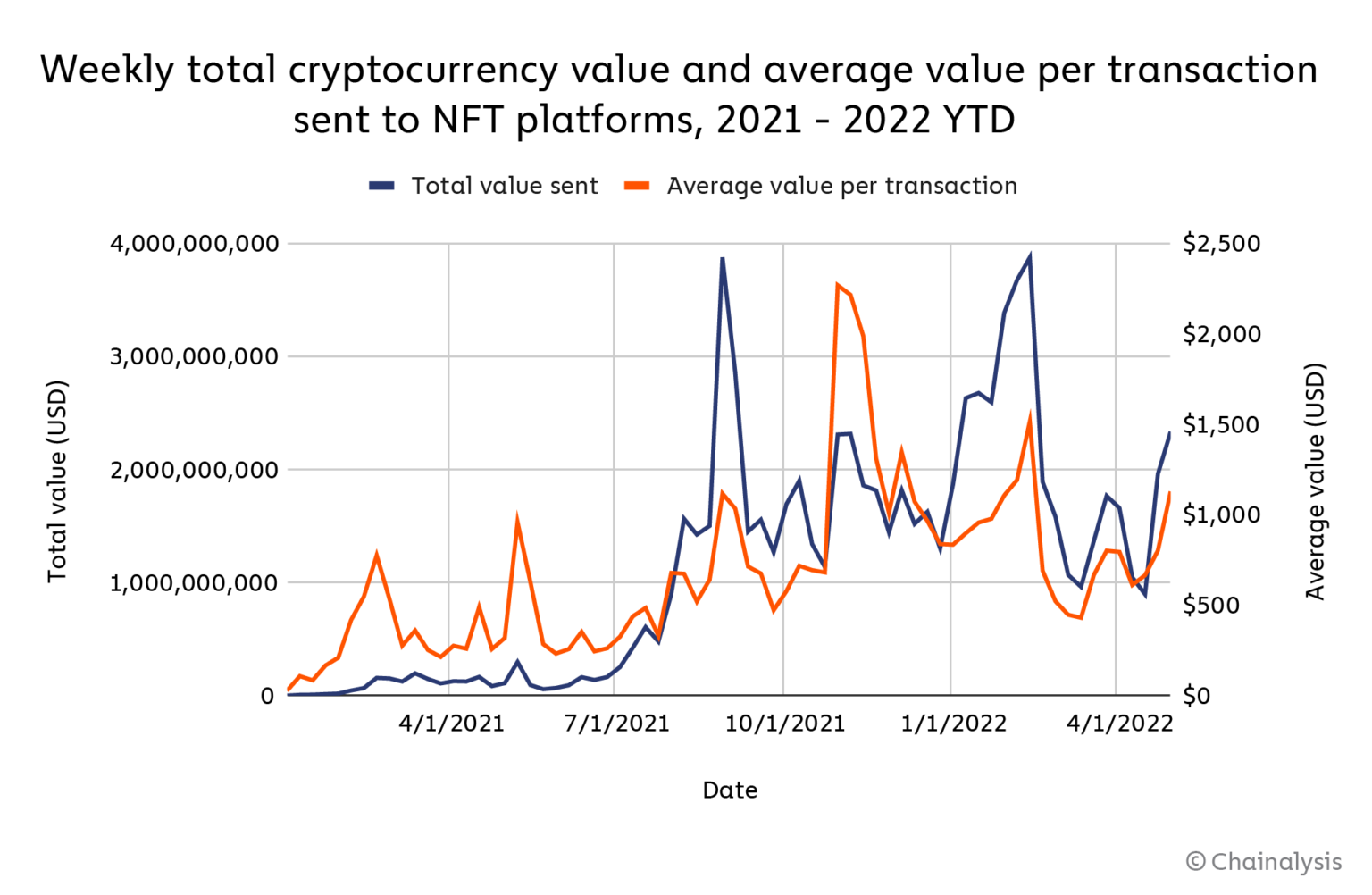

Collectors of nonfungible tokens (NFTs) have previously sent greater than $37 billion in value to NFT marketplaces this season by Sunday, an amount that just about exceeds the quantity throughout 2021.

According to some report from Chainalysis, investors sent $40 billion price of cryptocurrency to smart contracts connected with NFT collections and marketplaces throughout 2021.

Forever of this past year, NFT transaction volume is continuing to grow significantly, however the overall growth of the profession continues to be sporadic.

The report outlines that NFT transaction volume occurs sporadically and has been around a downturn since mid-Feb. The NFT market has since designed a brief recovery by mid-April — probably because of the recent hype around Moonbirds and also the Bored Ape Yacht Club’s metaverse project Otherside.

Regardless of the short-term fluctuations in NFT transaction volume, the amount of people all over the world exchanging NFTs remains strong, with 950,000 unique addresses selling or buying NFTs in Q1 2022.

By Sunday, Q2 2022, 491,000 unique addresses have transacted with NFTs, putting the marketplace on the right track to carry on its growth trend in the amount of participants.

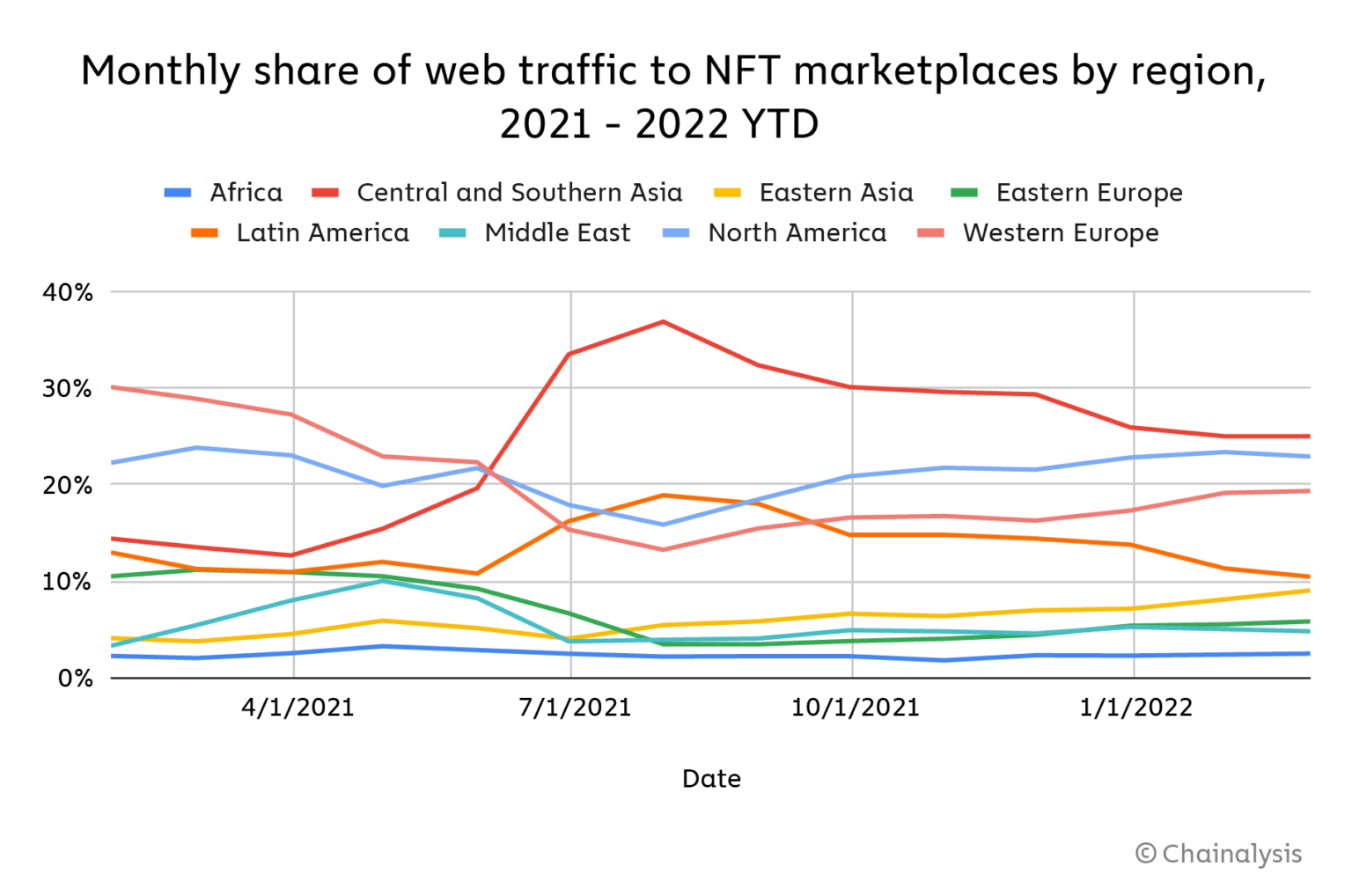

By analyzing the net traffic from the major NFT marketplaces, Chainalysis determined that NFTs attract users all corners from the globe, with Central and Southern Asia leading the charge, adopted carefully by The United States and The European Union.

Related: The NFT sector is forecasted to maneuver $800 billion over next 24 months: Report

The report contradicts the final outcome of the recent article printed through the Wall Street Journal, which claimed that NFT sales were flatlining. The content mentioned that “The NFT marketplace is collapsing,” yet, within the same week, the very best five NFT collections alone accounted in excess of $1 billion in secondary and primary sales.

Chainalysis’ report also comes the next day Coinbases’ launch of their in-house NFT marketplace unsuccessful to create any major interest. On-chain data demonstrated that the mere 150 transactions happened on Wednesday — the very first day of buying and selling — with only $75,000 in volume moving with the platform.