The funny factor about most of the absolutely insane things happening these days is the fact that from the certain perspective, they really make sense. Go ahead and take well known brands buying metaverse property, for instance. Initially glance, it is not sensible whatsoever. At second glance, presuming the consumer lower particular projects grows with time, it’s like buying an advertisement banner online, just in a greater markup. Thinking about the number of headlines you receive around the purchase, the acquisition becomes quite sensible even though you may nothing together with your plot of virtual land.

It’s fairly simple to help make the same situation for nonfungible token (NFT) art, another major trend within the blockchain space, a minimum of in just how much buzz it’s generated. Only a couple of several weeks ago, Paris Hilton and Jimmy Fallon checked how deep the cringe abyss continues live TV because they showcased their Bored Apes. And that’s only a couple of from the mainstream celebs who’ve became a member of the NFT art hype train lately, with a number of of these managed through the same entity, U . s . Talent Agency. And can you accept is as true, UTA also represents Yuga Labs Bored Ape Yacht Club’s makers.

Thanks for visiting the club, @guyoseary ! ☠️⛵️ https://t.co/PcUtD67zIF

— Bored Ape Yacht Club (@BoredApeYC) October 12, 2021

This might hint in an interesting nexus between your entertainment elites and also the poster kids from the NFT scene. BAYC a minimum of has greater than pictures to provide, though, which isn’t always the situation for NFTs we have seen appearing at leading auction houses Christie’s and Sotheby’s. Because these two worlds move nearer to one another, their similarities come in the spotlight — and reveal some pretty funky facts across the means by the way we see both art and cost.

Related: Planet from the Bored Apes: BAYC’s success morphs into ecosystem

Value is incorporated in the eye from the appraiser

Traditional art is very effective like a store of worth it may generate some returns with time and it is pretty convenient meaning that the $100-million painting takes less space compared to same amount in cash. However, if the worth of fiat originates from the financial strength from the issuing nation, with art, situations are 100 occasions murkier.

What’s art? Virtually anything, you might think following a walk-through an arbitrary modern gallery. Actually, probably the most famous and modern artists, from Andy Warhol to Shaun Koons, try to deconstruct our knowledge of what art is and just what could be art. Contrary, we live at a time whenever a blueberry recorded to some wall could be displayed within an gallery, worth $120,000. Someone ate it and known as the deed an action of artistic expression, but have no fear — the fruit was soon replaced, and business returned to as always.

Out of this blueberry switcheroo, we are able to deduce the fruit was technically fungible because this piece went. Quite simply, the need for the skill piece didn’t originate from just one blueberry, but from the blueberry being locked in place by, presumably, a similarly fungible bit of duct tape. So, just what designed for the $120,000 cost tag? The artist’s brand, the prestige from the gallery, along with a couple of other quite ethereal factors.

Related: Plain discuss NFTs: What they’ve been and what they’re becoming

Things get even funnier whenever we attempt to apply exactly the same logic with other valuable works of art. The Black Square, probably the most famous works of art by Kazimir Malevich, altered hands for $60 million in 2008. The painting displays exactly what you will think — a literal black square — and, as a result, includes a questionable value when it comes to pure appearance. In addition, to determine the painting for authenticity, we’d have to depend on nothing more than an in-depth analysis of their components, paint and canvas to determine if they’re of sufficient age and typical enough for Malevich’s era and locality. But when someone would at random munch about this artwork, there’s no means by hell we’d have the ability to change it with another black square, although the aesthetic value could be pretty much exactly the same. The need for this piece originates from the hands that came it, and anybody who’s not Malevich won’t do.

This isn’t to state that art valuation is entirely subjective (Malevich is Malevich, in the end), but collective subjectivity occurring itself in altering fashions and trends underpins it to begin being virtually unavoidable. Enhance nature money many people are prepared to hand out of these quasi-ephemeral goods, toss in some centralization and insiderism, and you receive a brew that will most likely be unimaginable in almost any other industry.

The shady underbelly

Even though many would most likely wish to have confidence in Cinderella-style tales of the depriving artist whose star eventually will take off, the truth is different. Fundamentally from the art world, like a massive study revealed in 2018, is really a network of approximately 400 venues, mostly found in the U . s . States and Europe. If you continue show in a single of individuals, pat your self on the rear and provide your muse a higher-five. Otherwise, though, things might be bleak-ant. Success, including as measured through the valuations of the works, is dependent on drawing the eye from the right dealers, critics, publicists and curators — a large, but nonetheless relatively limited crowd.

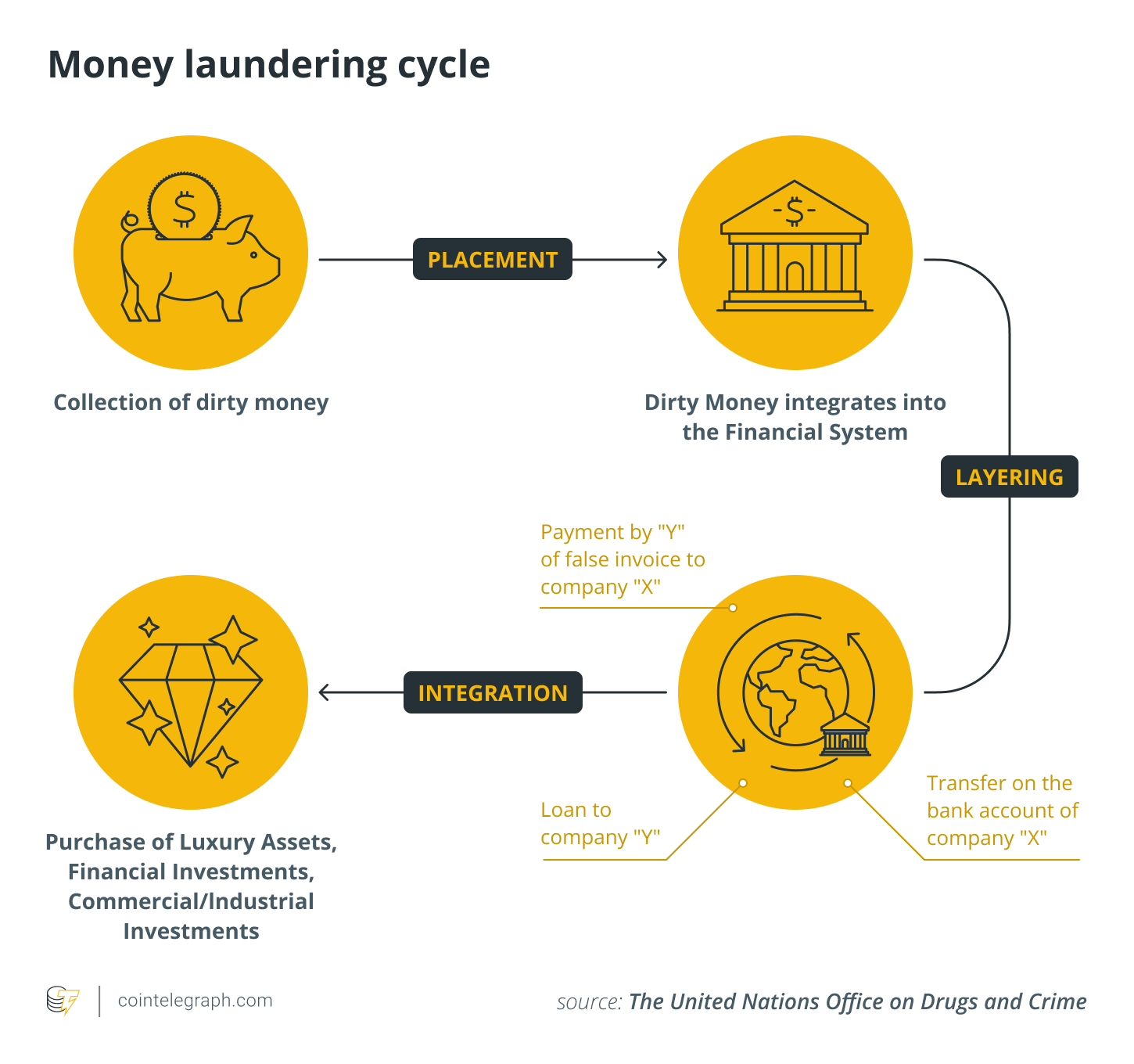

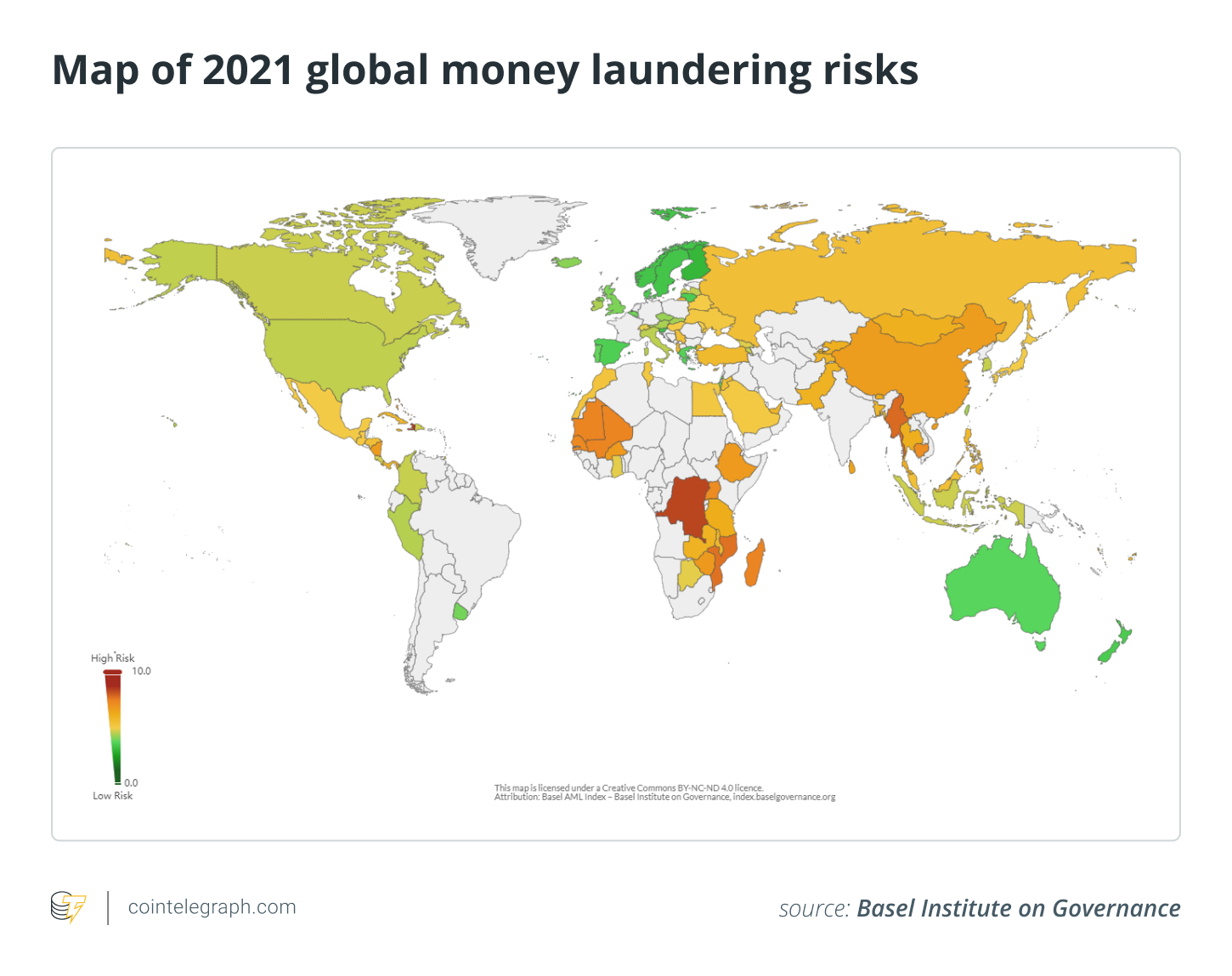

Around the switch side of the gold coin may be the wild number of financial trickery a wealthy individual can perform with the art market, particularly if they are fully aware the best people. Because of its openness to anonymity and intermediaries and interest in big piles of money, art is a terrific way to launder dirty money. While major auction houses do conduct research checks, they are oftentimes voluntary, and also the complex possession structures increase the obscurity, enabling criminal money to circulate in to the market.

Art also works miracles for individuals in the industry of bribery without raising a lot of warning flags. Make a businessman on the search for any tender approaches the official responsible for the stated tender having a request to place that very awesome porcelain vase up for auction. In the auction, the vase would choose a great deal, excess of its initial valuation. Who got it, and who’d obtain the tender? You stated it, not I.

Besides everything, art creates a neat financial instrument for stuff that aren’t even illegal. Tax write-offs through art donations are extremely much a factor: Snatch a couple of works of the soon-to-be star for $1,000, invest $500,000 in to the network to amp up their valuation to $ten million, generously donate these to a museum, and there you have it — no taxes with that your main earnings. This really is still an oversimplification — things could possibly get much more interesting.

Related: Washing via digital pictures? A brand new twist within the regulatory discussion around NFTs

Monkeying around

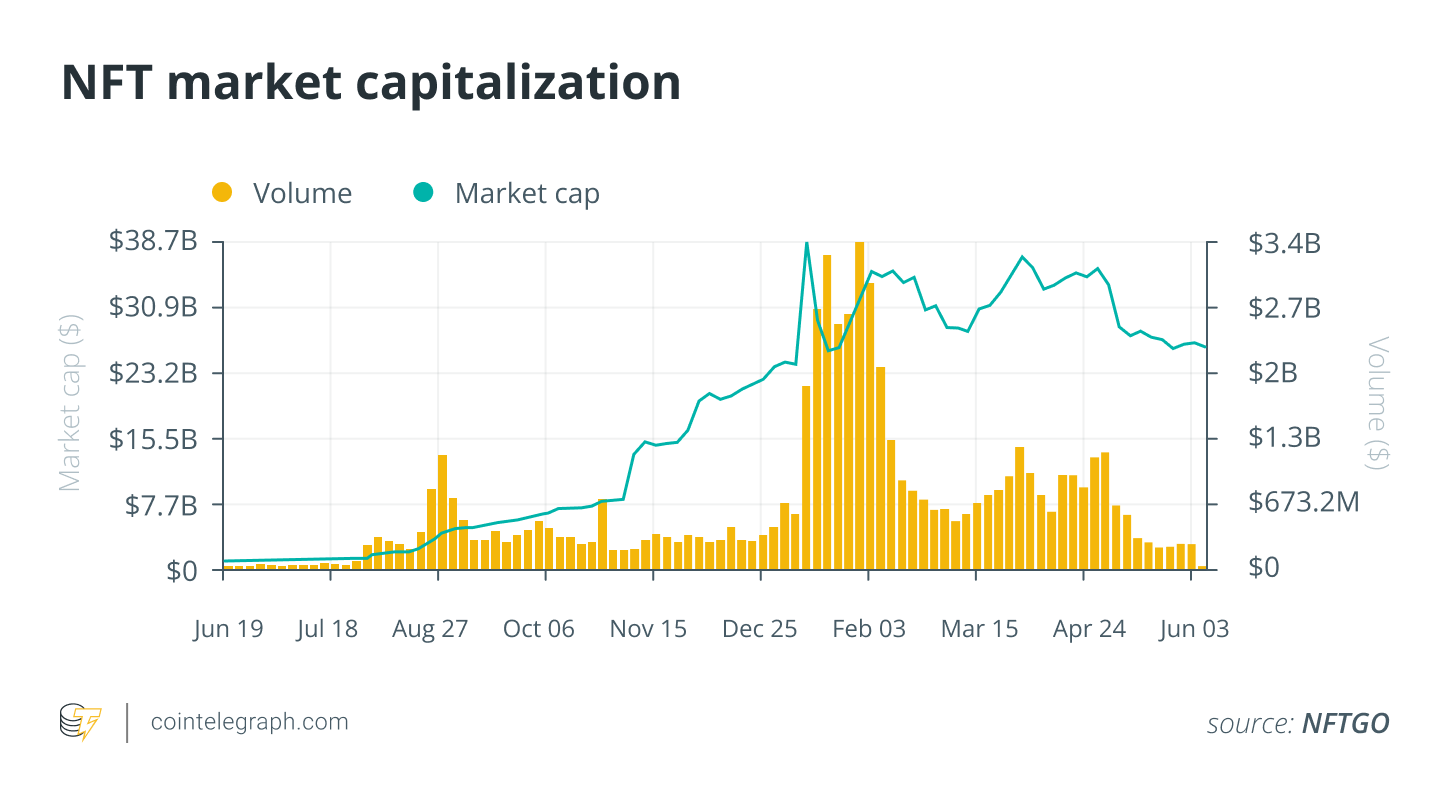

High-value art represents a comparatively small area of the overall industry: Just beneath 20% of art sales in 2020 saw cost tags over $50,000. An identical breakdown has become happening within the NFT art market, where top collections generate millions in resales around the secondary market, but many trades are really pretty small. Indeed, such figures add credit towards the view the entire marketplace is essentially produced by several 1000 investors flowing millions into what’s basically irrational investing.

By creating artificial scarcity, NFT art seeks to duplicate the mechanism behind our prime-finish traditional art. A much better real question is if they’d like to work in addition to a store of worth, and that’s a difficult someone to answer, because of the intrinsic subjectivity of artistic value as a result. Yes, an NFT is really a token having a connect to an image in the metadata. But does which means that anything inside a world in which a fungible blueberry may cost $120,000?

You could argue it really still takes care of, searching in the fate from the NFT for Jack Dorsey’s first tweet, once auctioned off for $2.9 million after which received an offer just for $280. In a year, the token’s value within the eyes from the market plummeted by 99% — an expression from the altering trends and perceptions within the crypto community and also the current condition from the crypto market, which naturally affects NFTs’ capacity to keep value.

Still, the genesis tweet NFT could have altered hands at $50 million were built with a single collector with sufficient Ether (ETH) for everyone made the decision the token is definitely worth this type of cost. Bored Apes continue to be buying and selling by having an average cost counting in thousands and thousands of U.S. dollars. You will find signs the marketplace is in decline. Why shouldn’t it’s, because of the entire crypto marketplace is lower?

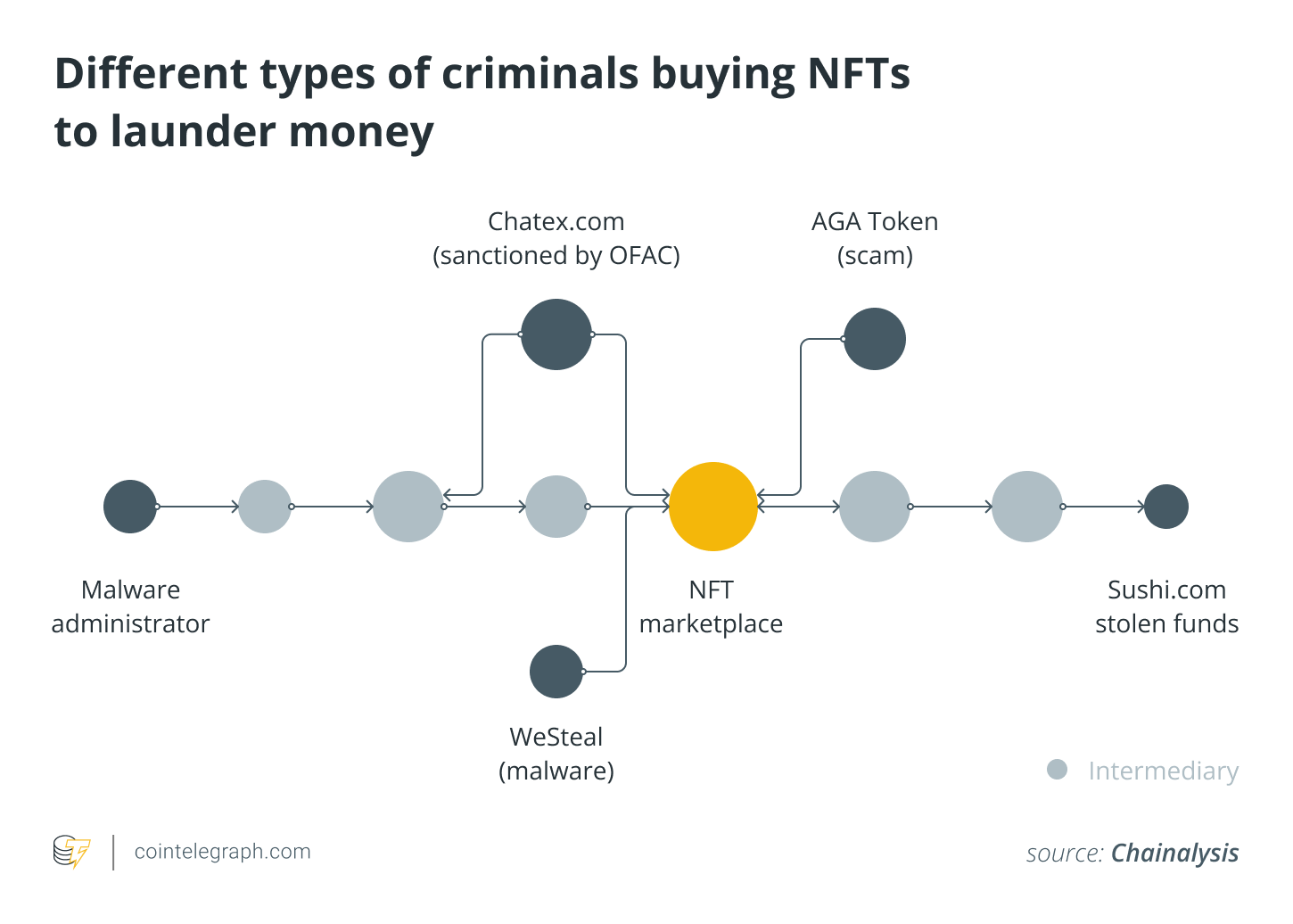

So, among the key features making high-finish art handy for shadowy business — the frequently arbitrary nature of their valuation — seems in have fun with NFTs too. What may do or die NFTs’ future like a new rendition of high-finish art is thus if they’d like to offer exactly the same legal and financial versatility that commodified traditional art has.

A Chainalysis report highlights that money washing makes up about a little share of NFT buying and selling activity, even despite a current spike. Within this situation, though, money washing particularly describes using crypto connected with hacks and scams to purchase NFTs, that is a bit too small when we can remember the backstage stuff happening within the traditional art market. Rather, what matters is whether or not and just how the NFT scene develops its engine that imbues art with value, exactly the same way as museums, galleries and auction houses do. Contrary, the standard art institutions moving much deeper into this space could participate it, and thus can these star-spangled shenanigans.

Related: Chainalysis report finds most NFT wash traders unprofitable

Alternatively finish of the equation are, well, the finish-users, for insufficient a much better word, and every one of the off-chain legal intricacies. Let’s take taxes again, for instance. When selling a skill piece out of your collection, you spend the main city gains tax. You have to selling an NFT.

With traditional art, though, you are able to avoid having to pay this tax having a neat trick. You can preserve your treasures inside a high-security warehouse within the world’s many freeports, also it can wallow in it for many years, altering hands, although not its location. As lengthy because the art sits there, there’s you don’t need to bother the esteemed inland revenue concerning the transactions.

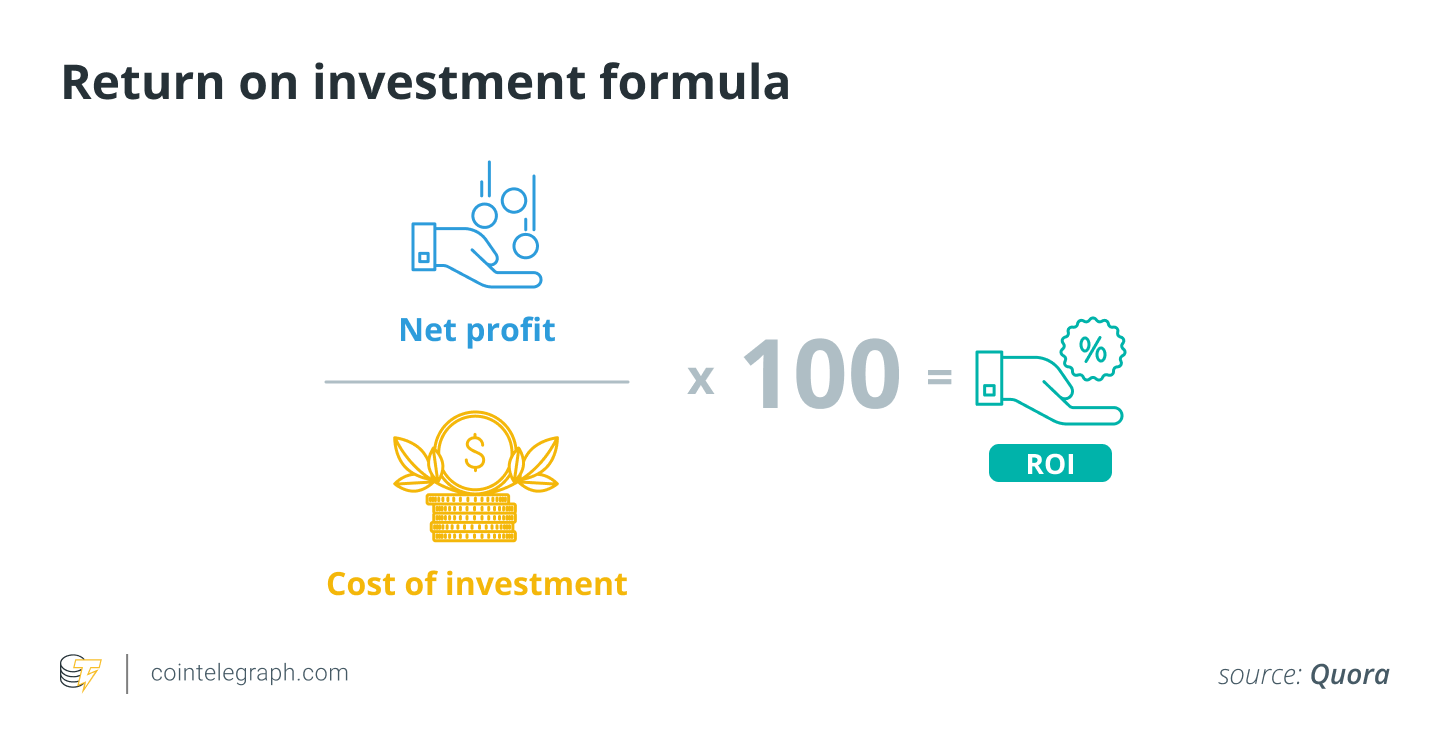

NFTs survive-chain, and then any transaction moving its possession to a new wallet is going to be open for anybody to examine — such as the U.S. Irs. Hypothetically speaking, even with regards to freeports, there may be a couple of methods to test. If you have a chilly wallet with a lot of costly NFTs, and also you keep these questions freeport, although the tokens continue to be on-chain. And when you choose it’s time for you to sell them, you sell the unit itself, without any on-chain transactions. Wouldn’t it seem sensible? This relies around the exact roi everybody involved will get.

This leads us for an ironic conclusion: Inside a world where art is really a speculative asset, the way forward for NFT art depends this is not on its artistic value but on its qualities like a financial instrument. Can you receive a tax cut by purchasing a cheapo NFT, amping up its value via a couple of wash trades (quite simply, buying and selling it involving the own wallets) and donating it to some museum or perhaps a charitable organization? What about staking, or temporarily locking your NFT right into a digital protocol? Are you able to stake it right into a museum’s wallet, possibly, to obtain some tax relief? Are you able to fake an NFT thievery, simply bouncing it for your other wallet, to create off some tax on capital loss? Wouldn’t it be preferable to purchase an NFT in the official responsible for that juicy, juicy tender, or possibly that awesome vase on their own table works more effectively?

All of these are good questions, and when you get enough to pay for people particularly for working out the best way to avoid taxation, your lawyers are most likely already searching into that. For everybody else, the NFT art marketplace is at the best another venue for supporting their most favorite creators, quite different motivation-wise from getting wealthy rapidly. In this way, it’s a bit more to provide than the usual corporate jungle for locating the following big factor, and knowing through the awesome-off and also the dominance from the top collections, the following big factor may originate from — as well as for — the large boy club.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Denis Khoronenko is really a publicist, fiction author and content editor at ReBlode PR agency.