Blockchain analytics service Nansen has printed its NFT Indexes Report for that second quarter of 2022, showing the marketplace dynamics and quantitative performance of nonfungible tokens (NFTs) during the last three several weeks.

The report identifies and determines important aspects adding towards the well-documented NFT bear market, including Ethereum-based volume and transactional metrics, in addition to market capital, amongst others.

Commencing by having an analysis of NFT volume statistics on Ethereum measured each week across a regular monthly time period, the report discovered that June recorded the cheapest figure from the twelve months.

Calculated across six marketplaces — OpenSea, LooksRare, Mints, X2Y2, 0x, and CryptoPunks — the NFT space, a minimum of with an economic level, possessed a considerable depreciation throughout June to shut to roughly 600,000 Ether (ETH) in buying and selling each week.

In stark comparison, the prior month of May recorded around 1.3 million in weekly ETH volume, circa 900,000 which happened on OpenSea alone.

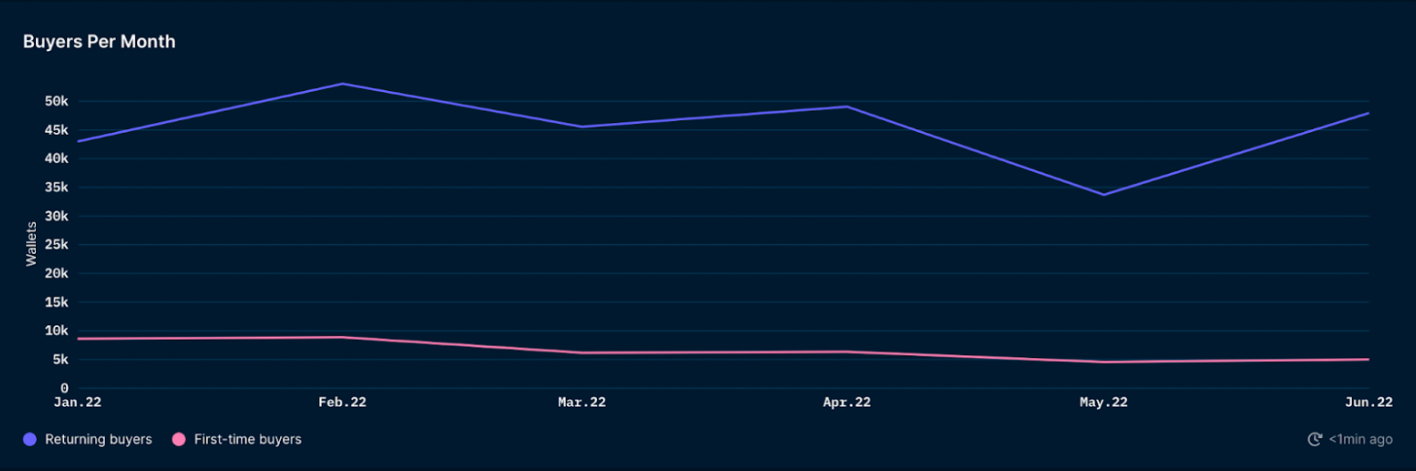

Regardless of this short-mid term deflationary atmosphere, beacons of lengthy-term optimism and assurances regarding the lengthy-term need for the area flicker when searching in the charts of coming back monthly users, and first-time buyers.

Related: NFT markets slump as weekly product sales dives 30%

The previous has experienced significant fluctuations because the turn of the season, from 55,000 coming back monthly users in Feb to 35,000 in May, before rising once more close to 48,000 in June.

First-time buyers however have continued to be relatively consistent in the 5,000 user mark since March this season, suggesting the appetite for NFTs on Ethereum like a speculative mechanism, and medium of entertainment, has sustained a modest appeal.

This lengthy-term bullish thesis is corroborated through the monthly user count, which remains in the 650,000 level although a little decrease from last month’s 700,000.

Related: Ethereum analytics firm Nansen acquires DeFi tracker Ape Board

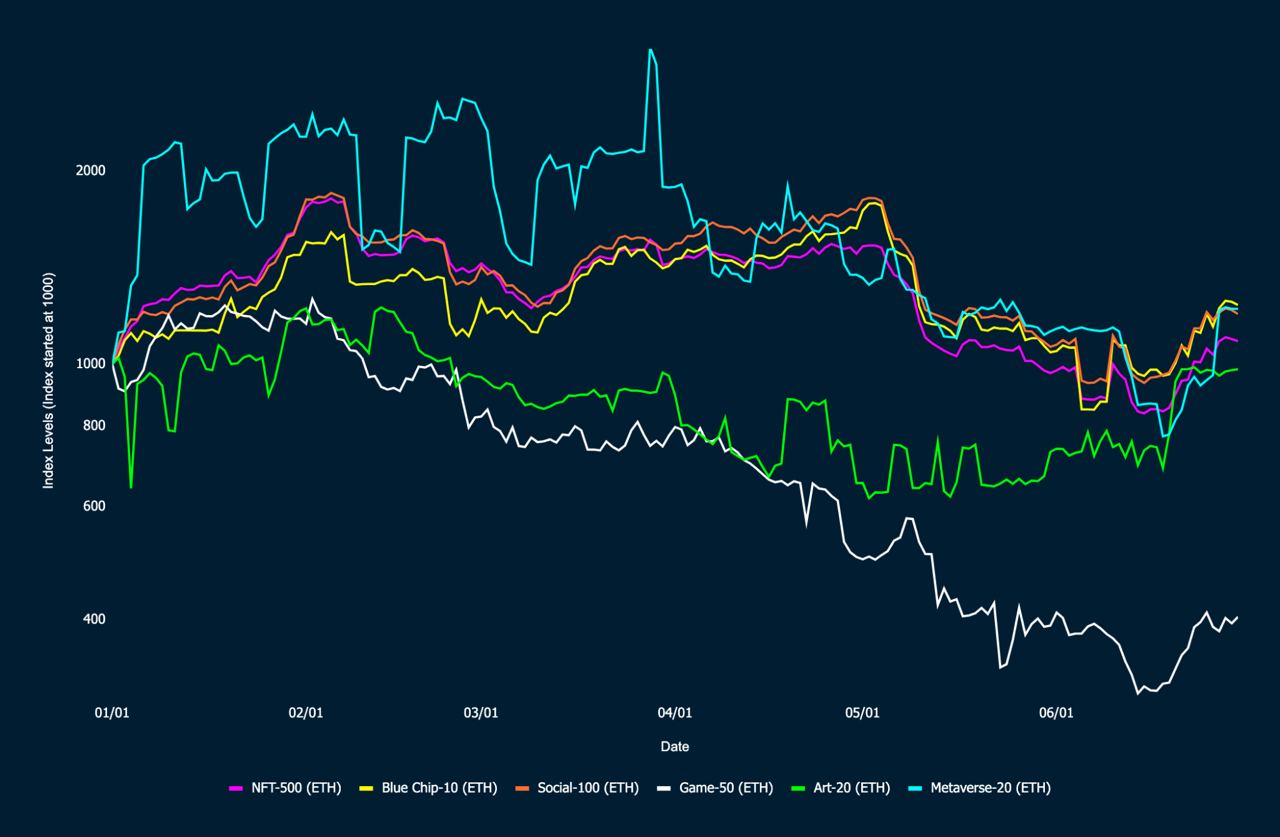

Assessing indexes over the breadth from the NFT space, the report mentioned that “recorded a bounce in June (when measured in ETH), aside from Gaming NFTs in the finish of Q2 2022.”

Blue Nick-10, Social-100, and Metaverse-20 were the greatest performance NFT ETH indexes over the month of June, using the latter building success out notable strides to achieve more than 1,000 around the index scoring system.

Upon witnessing this slight uptick in index performance across June, Nansen mentioned, “NFTs’ trend reversal began sooner than the broad cryptocurrency market,” before noting that the “risk-off sentiment continues to be highly apparent within the NFT market and also the limited liquidity […] hints this upward trend may not sustain.”