Solana released its first-ever, “Validator Health Report” which revealed info on its network operators. Based on the report the network has over 1,900 block-producing nodes with nearly 1,688 (88.14%) of individuals operated by independent entities.

Solana states the strength and health of their validators is crucial towards the lengthy-term health from the ecosystem. Formerly, the network has faced backlash for too little decentralization and costly validator hardware.

Though this latest report highlights the three,400 validators across six different continents.

9/ Distribution across geographies is essential. Resilient blockchains continue operating through all kinds of global occasions.

Here is how stake is shipped over the @Solana network, having a snapshot of Ethereum miner distribution for benchmarking. https://t.co/1jsylk9J3J pic.twitter.com/faepZ4RvYm

— Solana Foundation (@SolanaFndn) August 10, 2022

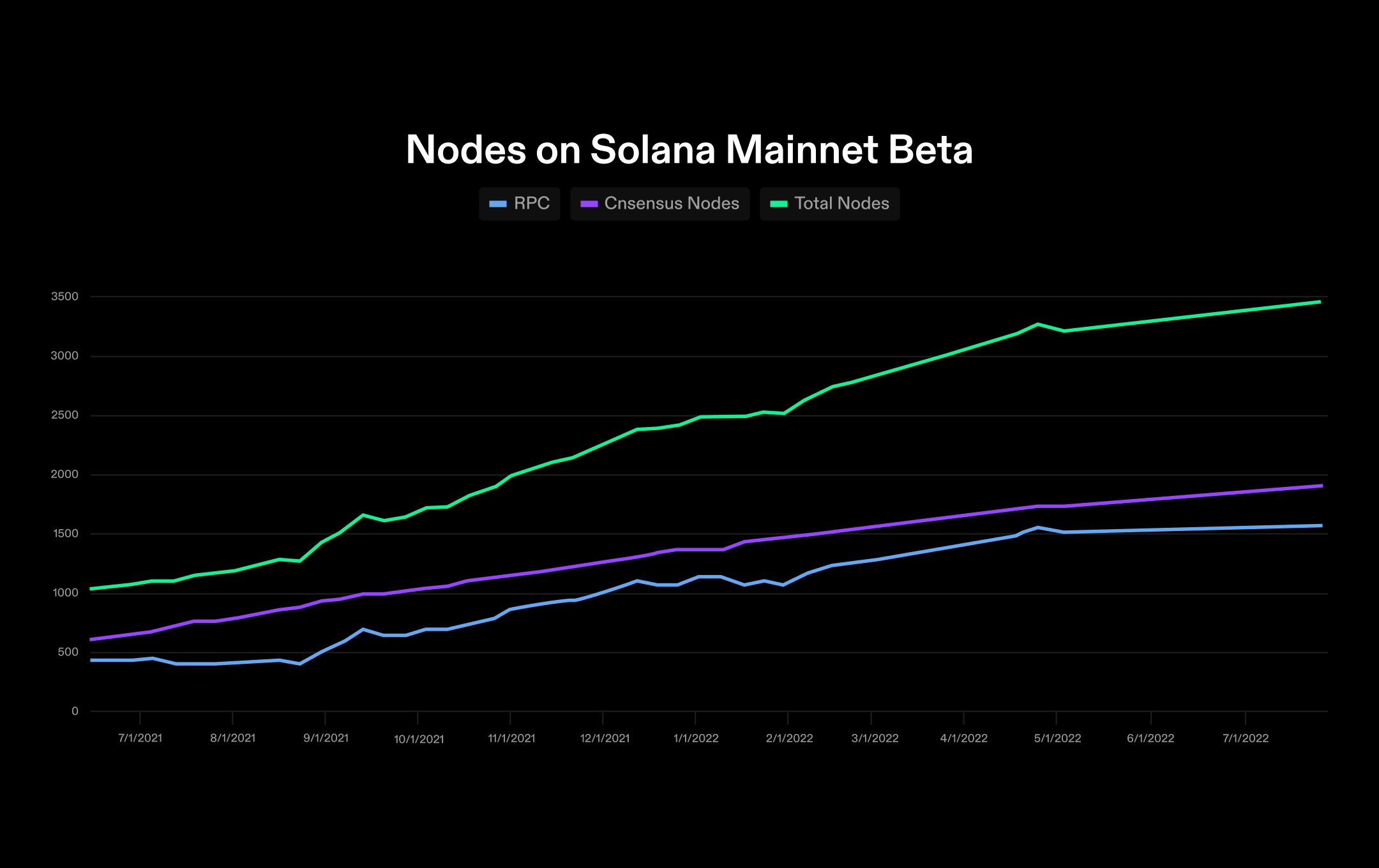

Furthermore, the report shows how activity around the network has risen within the this past year. Typically the network has witnessed 95 new consensus nodes and 99 RPC nodes join each month since June of this past year.

Additionally, it stressed the Nakamoto Coefficient on Solana, also known as the quantity of validator collusion required to censor the network, is 31 — and growing. A chart printed within the report demonstrated Solana using the greatest Nakmoto Coefficient when compared with other systems for example Avalanche, Binance and Polygon.

Nevertheless, this report comes as a direct consequence of last week’s hack. Around $5.two million in Solana (SOL) was hacked from 8,000 wallets including Phantom, Slope and Trust.

This news shook the and users were advised to abandon their hot wallets for cold storage wallets for added security, while being vigilant against scams.

Related: Is the SOL safe? What we should know of the Solana hack The Marketplace Report

Investigations in to the hack are presently ongoing. Some experts indicate the Slope wallet as accountable for the compromise. Slope is really a Web3 provider of the hot wallet for that Solana layer-1 (L1) blockchain. Research indicates the compromised wallets were at some point, “created, imported or used” within the mobile application for Slope.

Before the wallet hack, experts speculated a 40% cost hike in SOL regardless of the bear market conditions. Soon after this news broke from the hack the cryptocurrency were built with a cost drop of nearly 8%, adopted with a rebound of $40 per gold coin.

During the time of writing, SOL hovers around $44 USD per gold coin.