Cryptocurrency markets happen to be maturing during the last couple of years, making interest in crypto insurance solutions bigger as increasing numbers of advanced players dip their toes in to the nascent ecosystem.

Investopedia reports that cryptocurrency insurance is viewed as a “big chance,” having a spokesman from among the world’s largest insurers, Allianz, stating that the organization has explored product and coverage options within the cryptocurrency space because it becomes “more relevant, important and prevalent around the real economy.”

The cryptocurrency ecosystem continues to be viewed as harmful and volatile, where funds aren’t completely secure even on leading cryptocurrency exchanges. Although some platforms, including Coinbase, have revealed they have hot wallet coverage via specific insurers, most don’t openly promote whether assets deposited you will find insured.

The poses specific challenges for insurers. For just one, premiums are frequently defined by using historic data, which within the cryptocurrency market is slim at the best and absent in newer areas including nonfungible tokens (NFTs).

Interest in insurance within the space is nonetheless present, as crypto exchange Crypto.com has expanded its insurance program to pay for $750 million in 2021, and decentralized solutions according to decentralized autonomous organizations (DAOs) like Nexus Mutual happen to be produced.

Talking with Cointelegraph, Tony Lees, chief product officer at digital payment platform Wirex, stated among the key blockers for “true mainstream adoption during the last couple of years” continues to be the idea the cryptocurrency space is “untrustworthy and insecure.”

To Lees, most users believe that their are unsafe which a good investment in crypto assets is riskier than a good investment within the traditional stock exchange. Industry-standard compliance along with other rules, Lees added, have helped platforms showcase how users’ money is safe. Lees stated:

“Corporate-level insurance policy with custodial platforms for example Fireblocks has allowed the likes of Wirex to show that robust systems and controls have established yourself to be able to provide the user reassurance.”

Michael Vogel, Chief executive officer of Coinstream and founding father of Canadian crypto exchange Netcoins, echoed Lees’ ideas, telling Cointelegraph that crypto represents a “very different risk paradigm” than investors are utilized to, as no consumers ever worry “about their shares in Tesla going missing from your online brokerage account.”

Many users, Vogel stated, aren’t confident with down to handling the safety of the coins themselves. Consequently, the marketplace continues to be developing “custody-type solutions, in which a reliable company functions as a kind of crypto bank.”

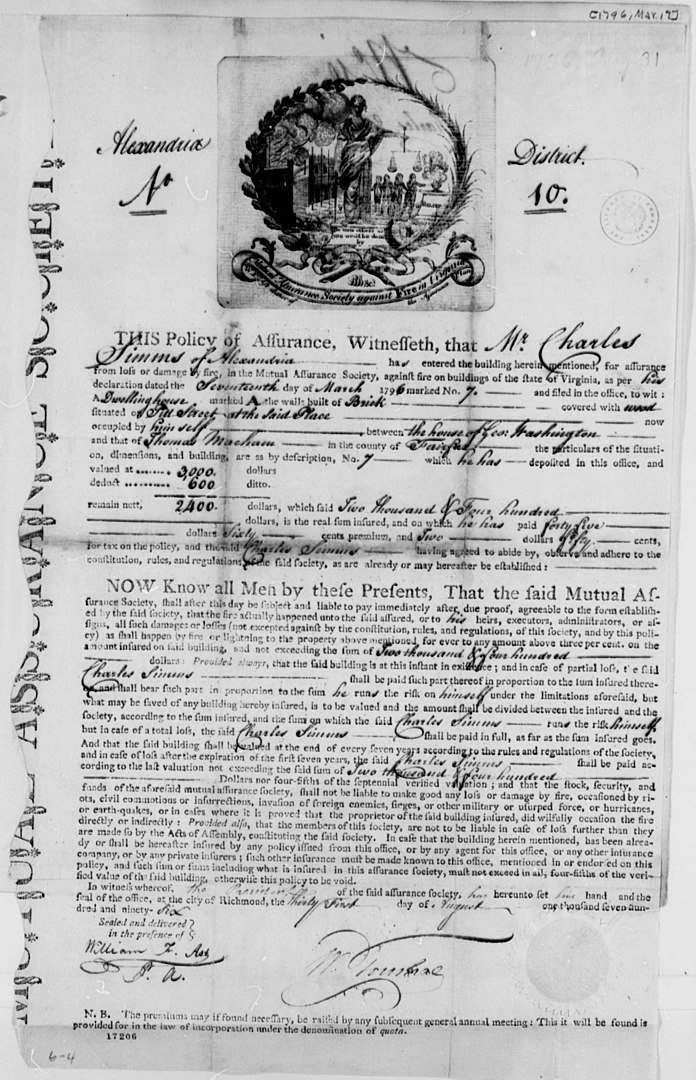

Insurers could provide obvious guidelines that custodians have to follow to be eligible for a insurance here, he stated. The move could provide familiarity to investors within the space. As Lees stated, most understand the Financial Services Compensation Plan as high as $104,000, or 85,000 Great British pounds within the Uk, or even the Federal Deposit Insurance Corporation’s coverage as high as $100,000 within the U . s . States.

These schemes, Lees stated, help investors feel at ease departing their in banks. Crypto insurance covering users’ holdings inside a centralized platform provides “that familiar, traditional coverage against hacks or cyber-attacks.”

Centralized entities like Allianz entering the area would only further offer the perception of familiarity. Johnny Lyu, Chief executive officer of cryptocurrency exchange KuCoin, told Cointelegraph that although the crypto ecosystem needs insurance, in the initial phase of development most participation can come from centralized institutions.

Because the industry develops, Lyu stated that decentralized alternatives are progressively improving. Whether these platforms could be truly decentralized, he stated, will “depend around the development and improvement from the crypto atmosphere in particular.” For the time being, both centralized and decentralized entities have challenges to beat.

Confidence to function with crypto

Overcoming these challenges could give more investors the arrogance to purchase cryptocurrencies and gain contact with the nascent asset class.

Based on Vogel, fraud is really a major challenge for insurers within the cryptocurrency space. Using house insurance for example, Vogel noted the “tangible help to insurance is your house could be reconstructed whether it burns lower.” The internet result, he stated, is the fact that in the finish during the day, individuals will have a home.

However, obfuscation around the blockchain can lead to specific kinds of fraud. Vogel added:

“A crypto-insurance fraudster could double dip, hide or obfuscate their coins along with an insurance payout.”

To Lees, the greatest challenge the cryptocurrency industry has faced to date is “providing traditional services to a different unknown sector, especially concerning the technology.” Lees echoed Vogel’s sentiment, stating that funds being difficult to trace around the blockchain have “created a nervousness for insurance agencies.”

Recent: Mixing reality using the Metaverse: Fashion icon Phillip Plein goes crypto

Recently, he added, robust Know Your Customer (KYC) checks happen to be “paramount to crypto providers,” whose use blockchain forensics firms like Chainalysis and Elliptic has meant “that transactions made between crypto addresses happen to be much simpler to trace.”

Lees now expects the general risks inside the industry to help be reduced, making certain “it is a lot simpler for insurers to know and underwrite.” Ultimately, he stated, insurers will “play a huge role in realising a completely digital economy later on, by providing both consumers and companies the arrogance to function within the space.”

This kind of confidence would, initially, originate from centralized players within the insurance space, as decentralized solutions aren’t still prevalent and might have to improve further prior to going mainstream.

Smart contract risks

Decentralized insurance solutions happen to be active during the last couple of several weeks. Popular decentralized insurance carrier Nexus Mutual, for instance, presently covers over $400 million in Ether (ETH) across numerous projects, while rival protocol InsurAce states have covered over $340 million.

Talking with Cointelegraph, Lior Lamesh, Chief executive officer and co-founding father of blockchain security firm GK8, stated the crypto ecosystem needs insurance for decentralized protocols and finish-users. Wile Lamesh noted that “automatic, decentralized insurance tools could indeed prove useful,” he recommended they themselves may need insurance.

As decentralized insurance tools are members of the protocol layer and depend on smart contracts, that could fail over human error, they might have “vulnerabilities open for online hackers to take advantage of.”

Lamesh recommended a possible flaw might be within the protocol covering its very own failure after it causes losses for users, “making for any lucrative feature for potential users.” He added:

“Hypothetically, we’re able to still finish in a loop of smart contracts insuring other smart contracts, however i would expect that centralized insurers may likely become involved sooner or later.”

Consequently, the crypto Chief executive officer expects more centralized insurers to go in the marketplace because they better grasp blockchain technology and turn into within the lead “while decentralized insurance solutions will probably take a moment to evolve and determine the very best methods for the.

He added that, presently, hacks within the decentralized finance (DeFi) space occur “every week, otherwise every day” and, as a result, it’s challenging for decentralized insurance protocols to function, because these protocols themselves may become lucrative targets for online hackers.

When the industry matures, he stated, decentralized insurance “will remove.”

An increasing industry

The cryptocurrency insurance industry continues to be growing with time. To Lamesh, its current challenge is perfect for experts to “wrap their heads round the technology involved,” as blockchain “can be rather puzzling enough because of its own men and women without levels in information technology.”

Recent: Wanting to work: Bitcoin change to proof-of-stake remains unlikely

Crypto insurance handles DeFi protocols, which require “a large amount of specialist understanding.” Lamesh noted, however, the crypto insurance industry could have a vibrant future ahead, saying:

“The future might be stunning, obviously, with blockchain entering mainstream insurance, and decentralized protocols tapping AI-driven data oracles to provide us tailored insurance coverage and packages for anything we want.”

Lees noted the crypto insurance industry has “become competent during the last 12-18 several weeks,” with traditional firms entering the area and offering coverage on “certain digital assets depending on how they’re stored and also the compliance amounts of wallet providers.”

Because the overall crypto industry grows, he stated, Lees can “only begin to see the crypto-insurance industry following suit, because of the sheer amount of new crypto wallets being opened up each month.” To Lees, the factors crypto firms meet have a “traditional feel, giving insurers reassurance that they’ll underwrite holdings.”

The difficulties crypto insurers face might be a significant income for that insurance industry, as centralized providers may relocate with items that exclude specific kinds of common risks within the space for example hacks or smart contract failures.

While these risks are most likely what most users want, the reassurance of the centralized platform providing them insurance they are able to depend on might be enough to influence them into entering the crypto market.