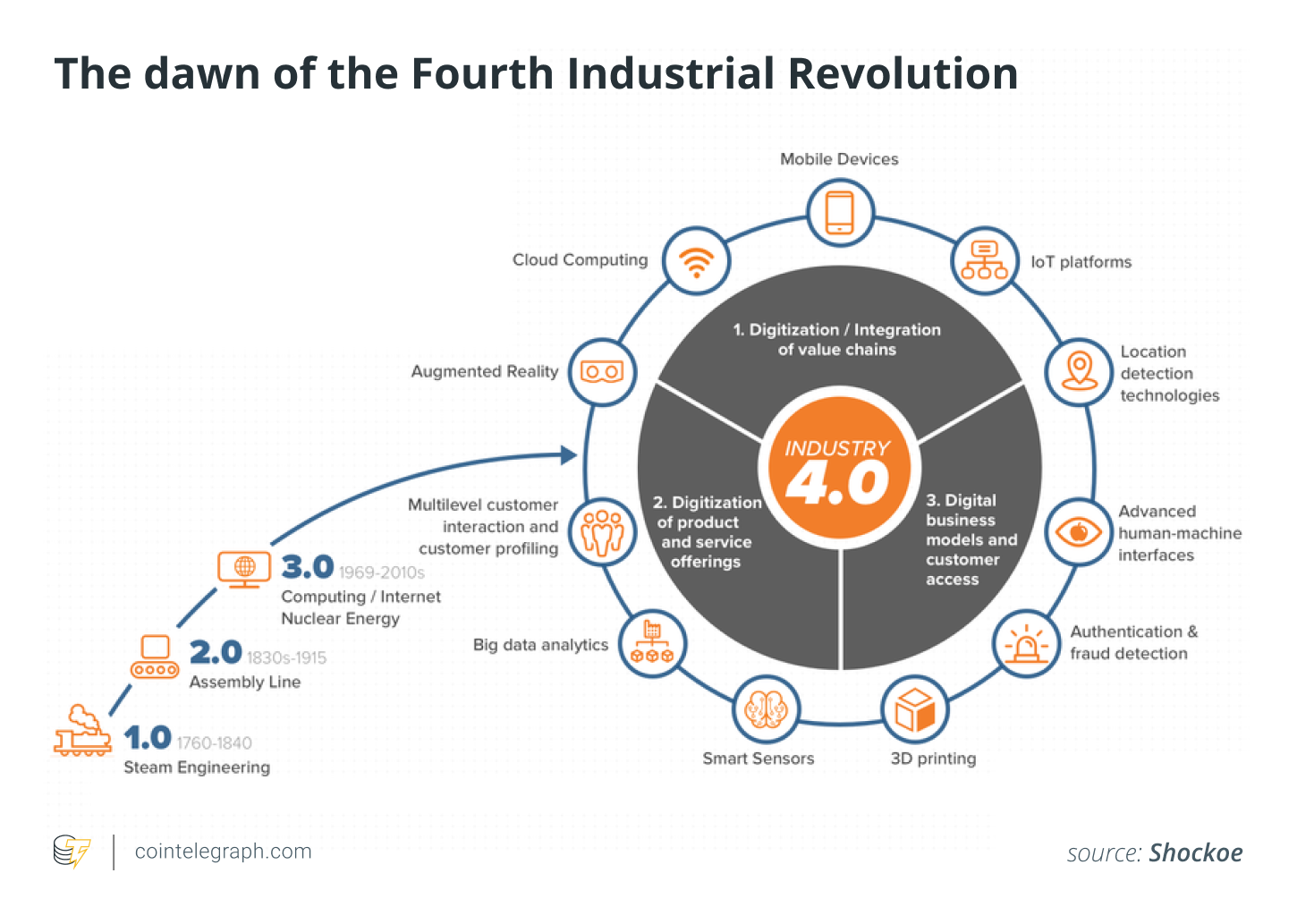

Mass adoption of technologies from the 4th Industrial Revolution (4IR) potentially might trigger a level bigger than forecasted transition to a different taxonomy of regulation concerning various fields of human existence, including those of finance and also the market itself. Technology are enabling new concepts, systems and frameworks, for example driverless cars, drone postal deliveries and central bank digital currencies (CBDC). In the future, the function of technology in today’s world could be exceeding the limitations of the elementary subsystem, where its regulation could be designated towards the stakeholders or even the market itself.

A persistent theme of the short submission may be the presently altering methods to the regulating technological risks carrying out a rapid transition towards the wholesale level leveraging and mass adoption of technologies. I am inclined to think that effective regulatory the perception of technology accepted through the presently ongoing 4th Industrial Revolution should, to begin with, be considerate of prerequisites as set through the notions of dominant product design, public thought of technological risk and social benefits versus technological risks.

Avoiding a voluntary and fragmented usage of technologies and much more toward their mass adoption on the wholesale level, public perception toward the technologies’ risks, role and effect on society is ongoing to evolve, subsequently leading to altering methods to regulation. This really is better highlighted by a good example of systems with organized complexity for example markets where technologies and computerization were of interest predominantly for that market itself. As compared to the past industrial revolutions, that have not were built with a direct effect on the banking and financial sector, the presently unfolding 4IR includes a direct influence and impact overall sector of worldwide finance, which, currently, has already been probably the most digitized sectors from the global economy.

Related: Crypto, like railways, is probably the world’s top innovations from the millennium

Markets were initially modeled as straight line systems. Nowadays, however, they’re more and more global with no anchorman of control, unpredictable by way of nonlinear feedback effects as a result of inter-activities among market participants and have a tendency toward self-organized behavior. Comprising organized complexity or hierarchy in markets could be better referred to as arising from investor demand. It might also subsequently appear in a very interconnected system of subsystems present around the factor market — an industry for financial assets — where delayed regulatory initiatives, to begin with, could be related to the qualities of their parts that originally look easy and the laws and regulations of the interpretation as not allowing to infer the qualities from the whole. As Herbert Simon famously noted, justifying frequency that complexity takes the type of hierarchy:

“In most systems anyway, it’s somewhat arbitrary regarding where we leave from the partitioning, and just what subsystems we take as elementary.”

He ongoing: “Physics makes much utilisation of the idea of ‘elementary particle’ although particles possess a disturbing inclination to not remain elementary very lengthy. Only a few generations ago, the atoms themselves were elementary particles today, towards the nuclear physicist they’re complex systems…[J]ust why a researcher includes a to treat as elementary a subsystem that is actually exceedingly complex is among the questions.”

In the future, the function of technology in human lives could be exceeding the limitations of the elementary subsystem, where its regulation could be designated towards the sector as postal services for drones, financial rules for robo-advisors companies or perhaps a particular market itself.

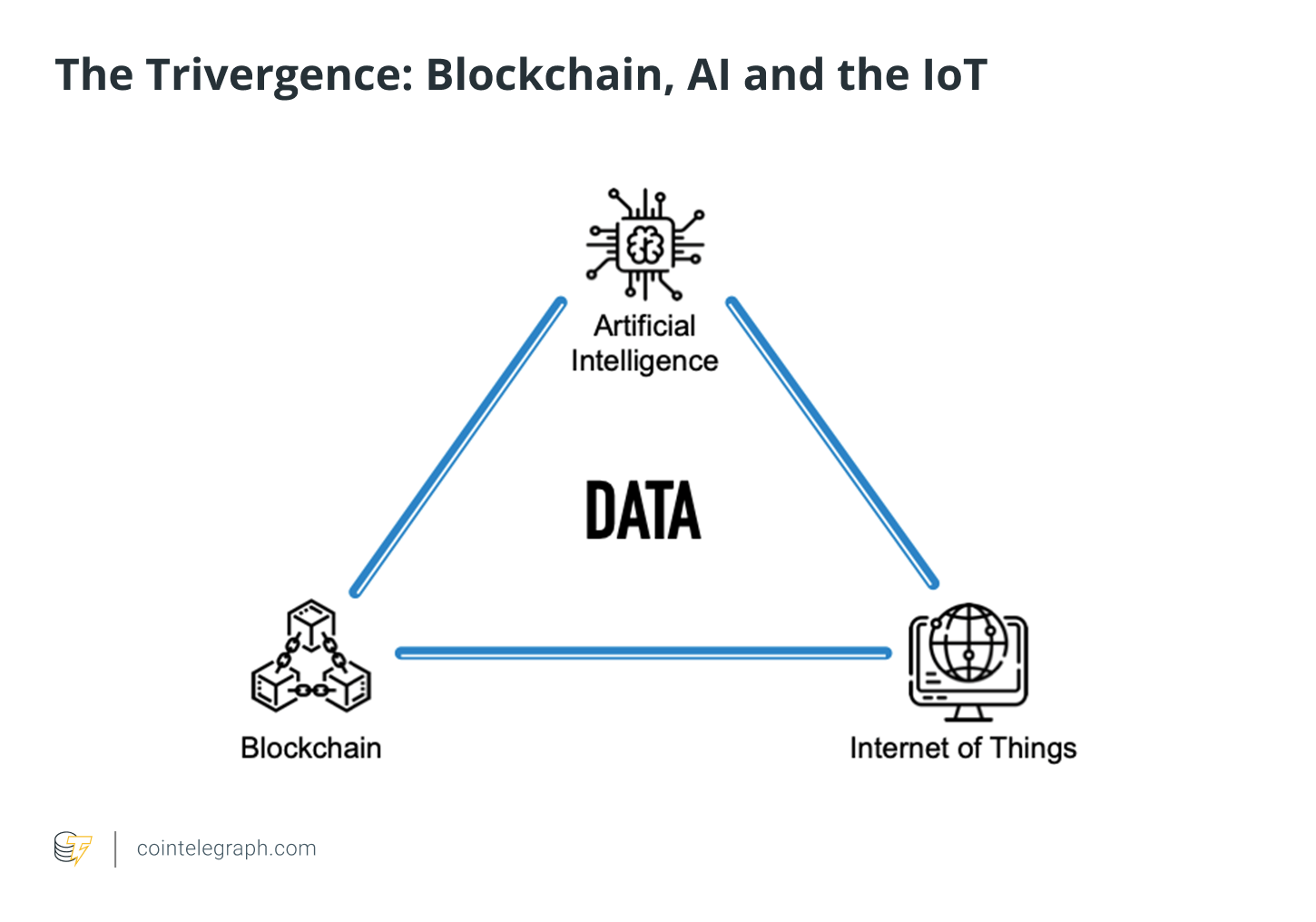

In the application, blockchains along with other mix-cutting enabling technologies, generally dubbed because the ABCD framework: artificial intelligence, blockchain, cloud and knowledge (Big Data), in addition to machine learning and Biometrics generally accepted through the 4IR wouldn’t be mandatory restricted to enabling start up business possibilities fostering transparency and price- and time-effective organization from the complex systems. It’s fair to calculate that future simplification and transformation of regulatory practices is within its achieve.

The innovation lifecycle

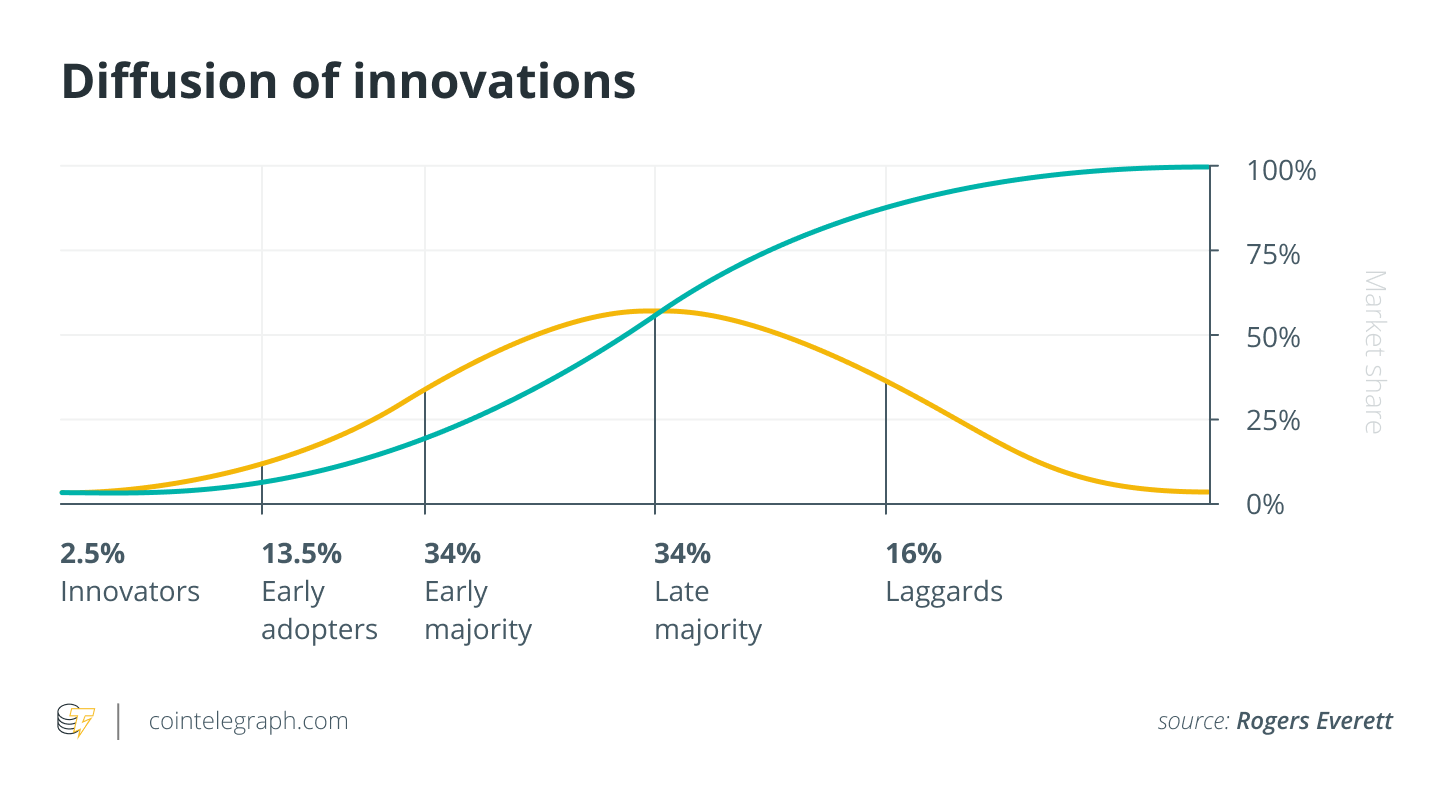

The innovation lifecycle for technologies from the 4IR has progressed from fluid toward a far more transitional phase. The speed of product innovation within an industry or product class is greatest during its childhood, the so-known as the fluid phase, where inside the wealthy combination of experimentation and competition, some center of gravity eventually forms the same shape as a dominant product design.

A dominant design because the landmark event to have an industry (as hypothesized) has got the aftereffect of enforcing or encouraging standardization to ensure that production or any other complementary economies could be searched for and perfected. Simultaneously, it might not meet the requirements of the particular class to quite exactly the same extent as would a personalized design, neither is it a dominant design always the one which embodies probably the most extreme technical performance. For instance, the IBM PC, such as the Model 5, offered the marketplace little when it comes to breakthrough technology, however it introduced together familiar factors that had proven their value to users: a TV monitor, standard disk drive, Texting keyboard, the Apple 8088 nick, open architecture and MS-DOS operating-system.

Related: Presenting the Trivergence: Transformation driven by blockchain, AI and also the IoT

Because the ABCD framework of enabling technologies utilized by fintechs, techfins and regtechs is presently approaching the dominant design stage, their product design model is primarily determined by regulation, a design which has similarities to the majority of the controlled industries, such as the sector of finance.

New significance and rationale behind the regulating technologies have finally emerged, embracing the acceleration of recent types of conducting business available on the market, a pattern that is increasingly more generally noticed in many countries. It appears the perception of Global Technology Risks (GTRs), which formerly is not a problem en vogue, is going to be gaining increasingly more pace, mandating changes to make to regulatory approaches implemented worldwide. The reason behind this really is simple: Everyone, which usually has a tendency to underestimate the potential risks stemming from voluntary activities, as the effective use of technologies have progressed from being purely voluntary for example transferring Bitcoin (BTC) using blockchain more toward the wholesale degree of tech utilization (e.g. CBDC), has become more concerned from the approaching risks requiring appropriate regulatory and supervisory response by regulators.

What appears vital that you highlight would be that the extent that these responses ought to be according to technological advances for example embedded supervision ultimately depends upon if the industry itself will readily accept these advances for regulation or otherwise.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Pavel Kulikov is really a partner at PLL Legal & CBP in Zürich, Europe, counseling startups and large firms on financial market regulatory matters, compliance and equity. His academic research creates New Taxonomy for Technology Regulation around the Markets DLT Regulation reforms and fintech are frequently reported on sides from the Atlantic. Pavel can also be a writer and a number of a well known LegalTask program on Swiss TV.