Stock and crypto investment platform Robinhood has apparently scored a 58% cut on its $170 million offer to purchase crypto exchange Ziglu because of adverse market conditions.

The first offer from Robinhood arrived April, however based on various reports online around August.17, the organization revised its offer to $72.5 million after citing adverse market conditions. Ziglu Chief executive officer Mark Hipperson apparently recognized the sale on August. 18.

Robinhood is stated to possess highlighted a number of factors such as the bear market, the implosion of countless major centralized crypto lenders BlockFi, Celsius, and Voyager, along with other macroeconomic factors like the Russian invasion of Ukraine.

The entire crypto market cap has fallen by nearly 40% since April according to CoinGecko, adding significant pressure to Robinhood to re-think the quantity it had been prepared to invest in United kingdom-based Ziglu.

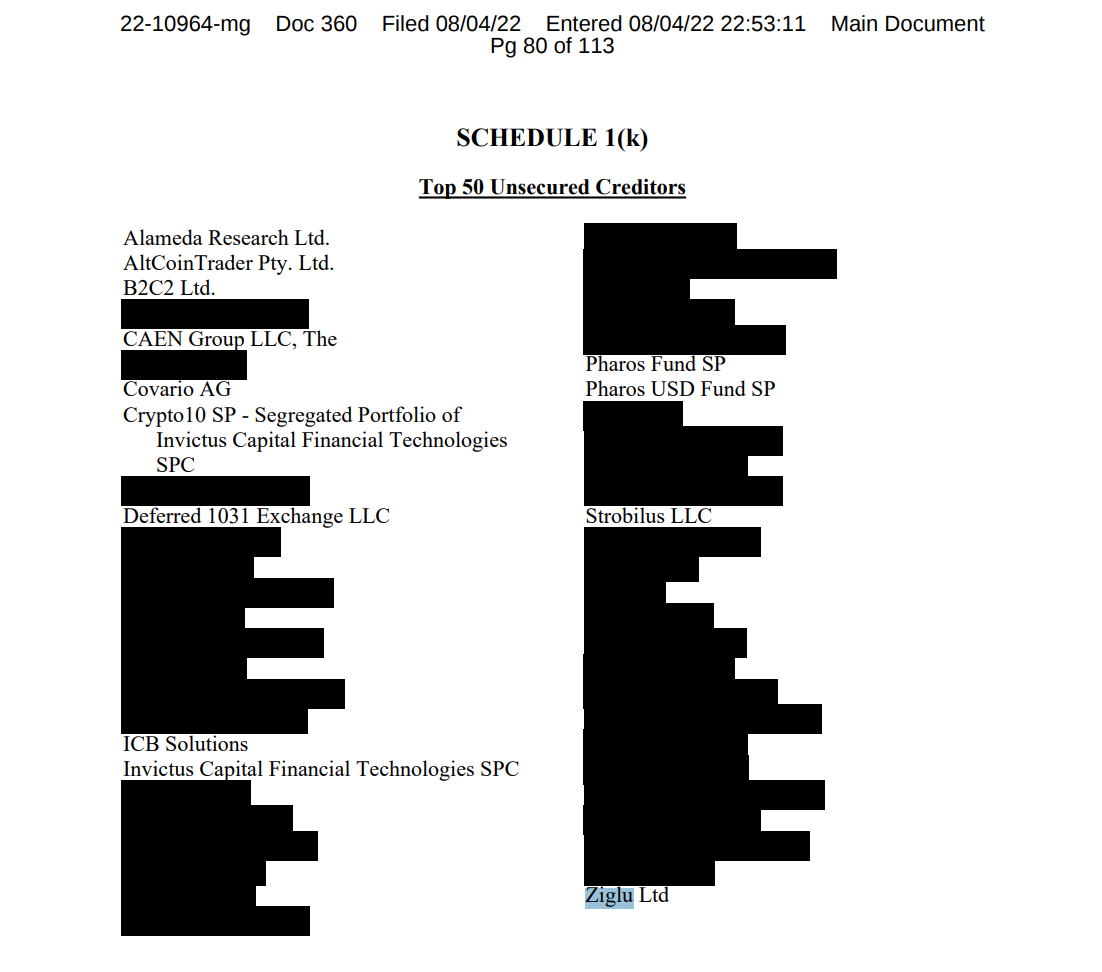

Ziglu can also be listed among the top 50 unsecured creditors to bankrupt crypto loan provider Celsius. Ziglu’s funds on Celsius might be locked indefinitely because the loan provider is rapidly not having enough money and it has been operating in a multi-big deficit although it experiences personal bankruptcy proceedings.

Robinhood’s purchase of Ziglu belongs to the business’s plans to create a headway within the United kingdom market, however the Robinhood team brought by Chief executive officer Vlad Tenev might have to return to enter board if Ziglu refuses the brand new offer.

Related: Robinhood to manage class action lawsuit suit from meme stock debacle: Report

However, the brand new terms appear to possess left Ziglu from a rock along with a hard place. Founder Mark Hipperson mentioned inside a letter to investors when the first $170 million deal may be canceled, his company could be left within an “extremely challenging market, and undercapitalized for that period ahead.”

An agent from Ziglu didn’t immediately react to a request comment. Hipperson told fintech news outlet Altfi that “we believe the revised proposal…is the greatest and just reasonable path forward for that company” despite expressing concerns from the revised figure.

Ziglu’s last round of funding was closed last November and bumped share prices in the organization as much as $58.12. The brand new deal drops the proportion cost to $34.04.

Should you committed to Ziglu via Seedrs, I bet you are pretty pissed off at this time.

— Mr Omneo (@mr_omneo) August 15, 2022