Terra continued to be the main focus of nearly all headlines throughout May because of its spiral collapse resulting in a loss of revenue well over $40 billion in investors’ money. Despite some early resistance in the community and high backlash from the kind of Binance Chief executive officer Changpeng “CZ” Zhao, Terra co-founder Do Kwon were able to relaunch the collapsed network with a brand new chain known as Terra 2. (Phoenix-1).

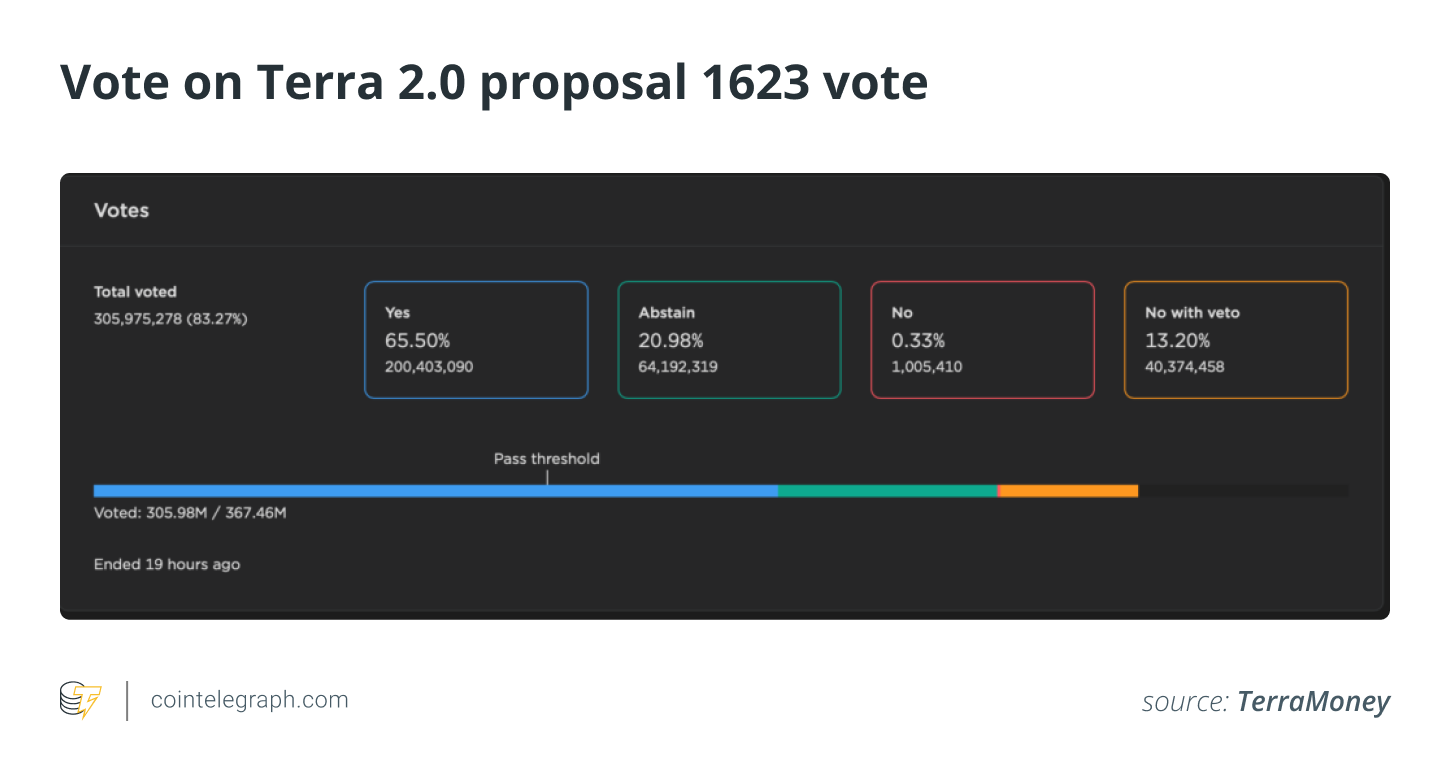

The amended proposal for that relaunch from the network by growing the genesis liquidity, which introduces a brand new liquidity profile for pre-attack Luna Classic (LUNC) holders and reduces the distribution to publish-attack TerraUSD Classic (USTC) holders, was authorized by the community having a 65% election for.

The brand new blockchain went survive May 28 following a hard fork. The brand new token stays Terra (LUNA) and also the old one was rebranded to Luna Classic. Using the new network launch, the holders of LUNC, USTC and Anchor Protocol UST (aUST) were qualified to get the brand new tokens.

Despite industry-wide outrage against Do Kwon — the co-founder and also the parent company Terraform Labs are facing lawsuits and investigations in Columbia — major crypto exchanges including Binance, Kucoin, FTX, Bitfinex and many others announced support for that Terra 2. chain.

Cointelegraph arrived at to Binance to ask about the reasoning behind its report on the LUNC on its platform, particularly when the marketplace continues to be dealing with the after-results of the $40 billion collapse. A Binance spokesperson told Cointelegraph:

“Binance listed LUNA around the Innovation Zone, that is a dedicated buying and selling zone where users can trade new tokens that could have elevated volatility and pose a greater risk than other tokens. Before having the ability to trade around the Innovation Zone, every user needs to go to the web form of the Innovation Zone buying and selling page and finish a questionnaire after studying the Binance Relation to Use.”

Binance claimed that the objective of the Terra 2. ended up being to compensate individuals who’d lost a lot of funds throughout the crash from the primary network. Like a platform, “Binance made the decision to allow people trade the airdropped tokens to understand their assets.”

CZ has additionally stated that he’s not so positive about the way forward for the Terra 2. ecosystem which the choice to list the brand new token took it’s origin from helping investors recover a few of their losses. Talking with Cointelegraph, Zhao stated:

“We still need ensure continuity of people’s use of liquidity. We must offer the revival plan wishing that it could work.”

Kraken Chief executive officer Jesse Powell also defended listing LUNA, saying it’s the community’s demand. However, he did point out that an inventory doesn’t always equal an endorsement for that questionable token.

Related: Kraken Chief executive officer defends listing LUNA 2.: ‘Bitcoin traders do not pay the bills’

Client satisfaction appears to become a common concern for that ongoing listing fo the asset. Bitrue crypto exchange research analyst Whitney Setiawan told Cointelegraph:

“As an exchange, Bitrue’s primary priority is client satisfaction, as it’s only right that people give our Bitruers the liberty to purchase assets of the choice. We’re still carefully monitoring developments in the Luna Foundation Guard analysis and would act right away if the situation worsen.”

Terra 2. sees heavy volatility

The launch from the new network was nothing under a craze. To start with, many investors claimed that they are not appropriately paid for the brand new airdrop. The Terra 2. team acknowledged the problem and stated they’re trying to resolve the problem soon.

Many users also joked about how exactly the brand new airdrop is really a mockery, considering that individuals have lost thousands and thousands of dollars and received about $50 price of new tokens in exchange:

Lost $300k in $LUNA

Got an airdrop of $59

Thanks do kwon and team

— Ash WSB (@ashwsbreal) May 29, 2022

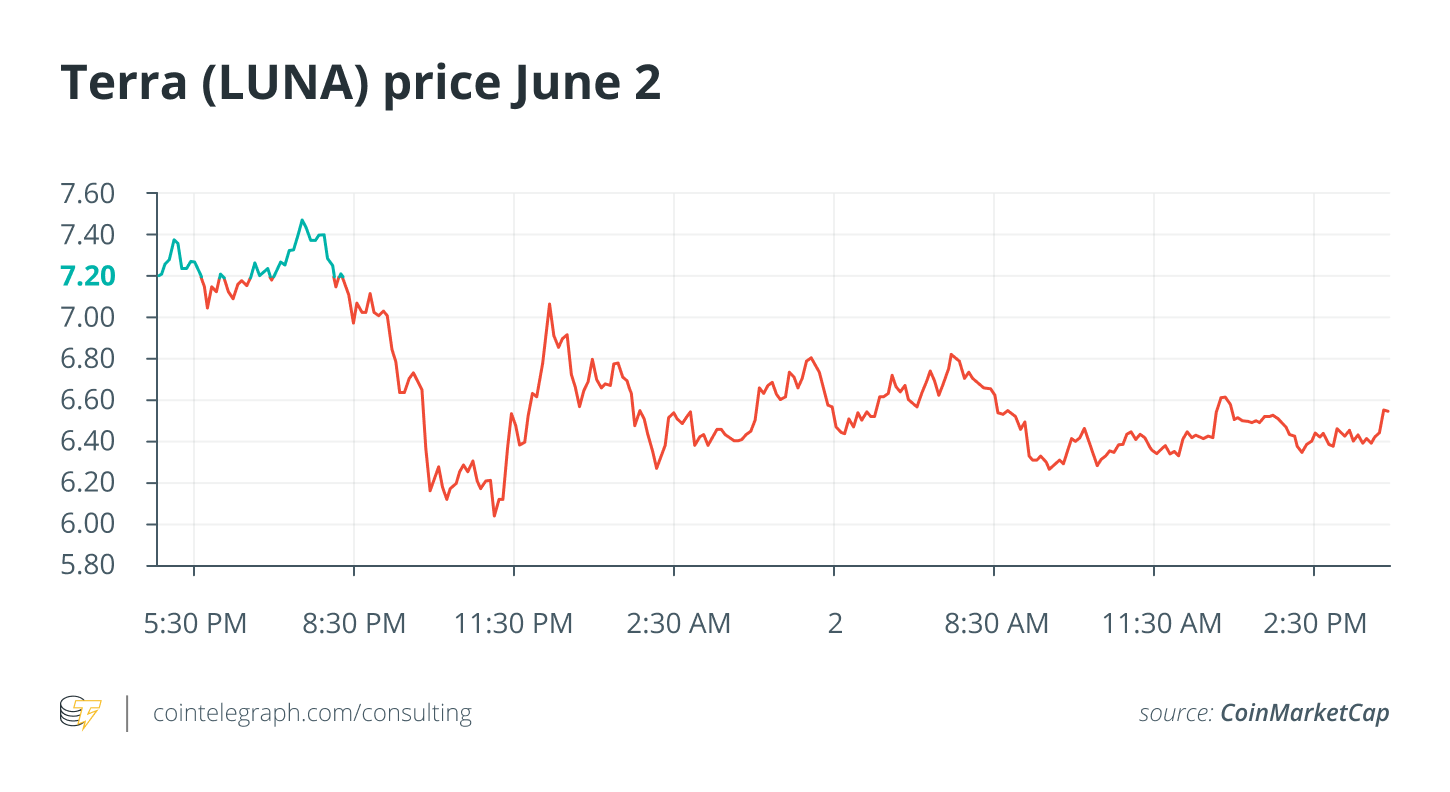

The brand new airdropped token began buying and selling across multiple crypto exchanges on May 28. However, as cautioned by many people, the brand new token demonstrated high cost volatility on day one from the relaunch, shedding by over 70%. Many investors who received the brand new LUNA began selling every time they received it, showing too little confidence within the new ecosystem.

LUNA was listed for $18.85 around the relaunch day but subsequently plummeted to $5.71 before recovering 1 / 2 of its losses each day prior to the Binance listing. The token is presently buying and selling at $6.44, based on Cointelegraph data, nearly one-third of their listing cost.

Justin Hartzman, Chief executive officer of crypto buying and selling platform Coinsmart, told Cointelegraph, “Precaution is definitely much better than cure. Why list a task with a few very noticeable flaws, noted by many people well-known folks on Twitter, after which ignore them? Exchanges must make their listing process safer and rigid. Money and a lot of life is on the line here.”

A person who apparently lost a lot of money purchasing LUNC authored:

“I don’t use whatever fundamentals here & I see whatever I recieve like a bonus since i have already authored everything off like a loss & $. Otherwise the other medication is vesting, I’ll sell ‘em all.”

Do Kwon includes a history of unsuccessful projects

There’s a famous meme on offer on Crypto Twitter that blogs about the fate of two fund managers, who each lost investors vast amounts of dollars. The first is Bernie Madoff, the well known financier who had been sentenced to 150 years imprisonment after managing a $60 billion Ponzi plan — the world’s largest — and Do Kwon, who were able to relaunch a brand new network just two days after losing vast amounts of dollars.

In ’09, Bernie Madoff lost investors $60 billion. He was sentenced to 150 years imprisonment.

In 2022, Do Kwon lost investors $60 billion after Luna collapsed to $. Then he produced Luna 2.. pic.twitter.com/CkCC8AKPVR

— Fintwit (@fintwit_news) May 29, 2022

The meme highlights the possible lack of regulatory oversight within the crypto space, where multi-billion-dollar mistakes and scams have virtually no checks or balances.

Terra’s algorithmic stablecoin collapse wasn’t the very first time Kwon has launched a unsuccessful experimental project. In the peak from the Terra collapse saga, it had been says Do Kwon seemed to be behind another unsuccessful stablecoin project known as Basis Cash (BAC).

Most professionals also think that despite the fact that exchanges are liable to hear the city and list the brand new token, the next project brought by Do Kwon could be difficult to accept. Zachary Greene, who runs crypto-investing and finance website the Greenery Financial, told Cointelegraph:

“I believe Do Kwon heading operations holds Terra 2. from being recognized and seen as an legitimate reboot. Whether he was accountable for the mismanagement from the reserves or otherwise, he appears to become blamed through the community and crypto space for that disaster which was the collapse of LUNC and USTC. For me, assembling your shed with him because the lead, a minimum of for the following couple of years, is going to be dogged on through the crypto community.”

The Terra and Terra 2. story continues to be unfolding. Whether anything malicious happened using the stablecoin or maybe it had been only a unsuccessful experiment, can be.

Even just in traditional markets, however, you’ve seen again and again how unsuccessful executives hop in one executive position to a different. It isn’t shocking to determine Do Kwon in the helm of Terra 2., however it should certainly make investors stop and think hard before investing.

Why is the situation against Kwon is his desire not to anticipate the issues and act accordingly. Many happen to be warning against USTC’s peg being supported by volatile assets and Terra using community funds to purchase Bitcoin (BTC), but many from it went undetected among tall promises in the project’s management.

The Terra co-founder many the workers at Terraform Labs is presently under analysis on various charges including tax evasion, market manipulation and much more. As the community can’t be blamed for approving the relaunch plan given that they wished to recuperate a few of their funds using the airdrop, Kwon’s leading the charge once more can be problematic for that community within the lengthy term.