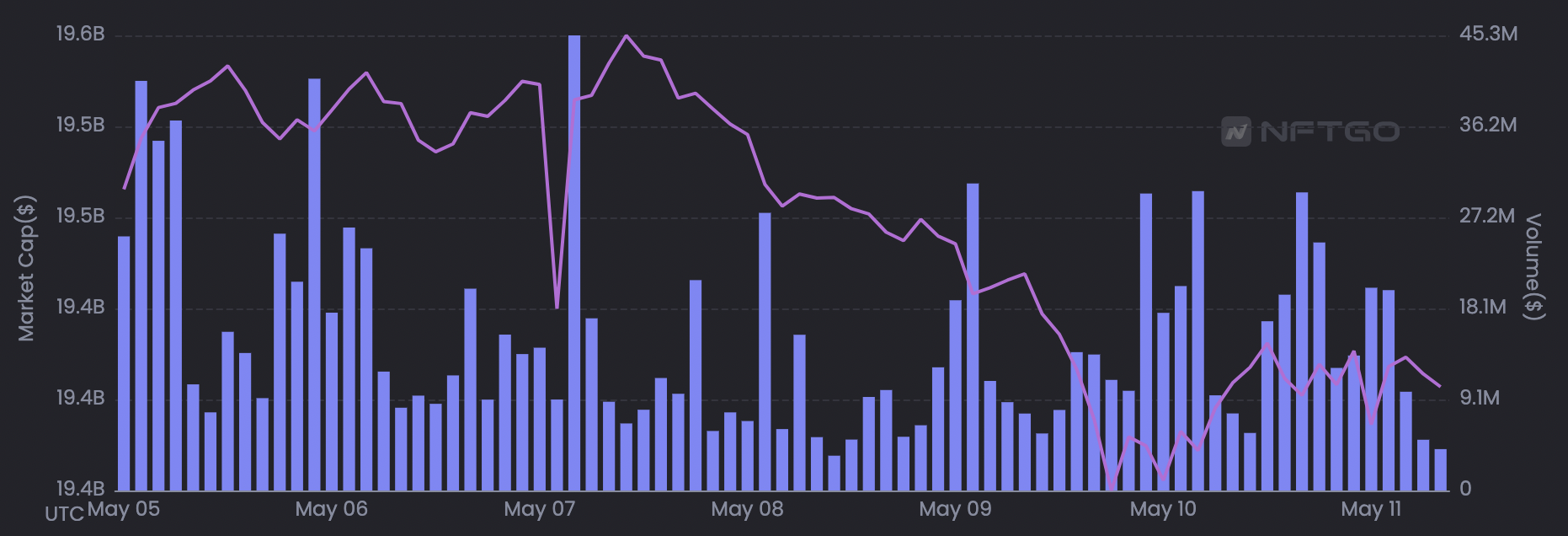

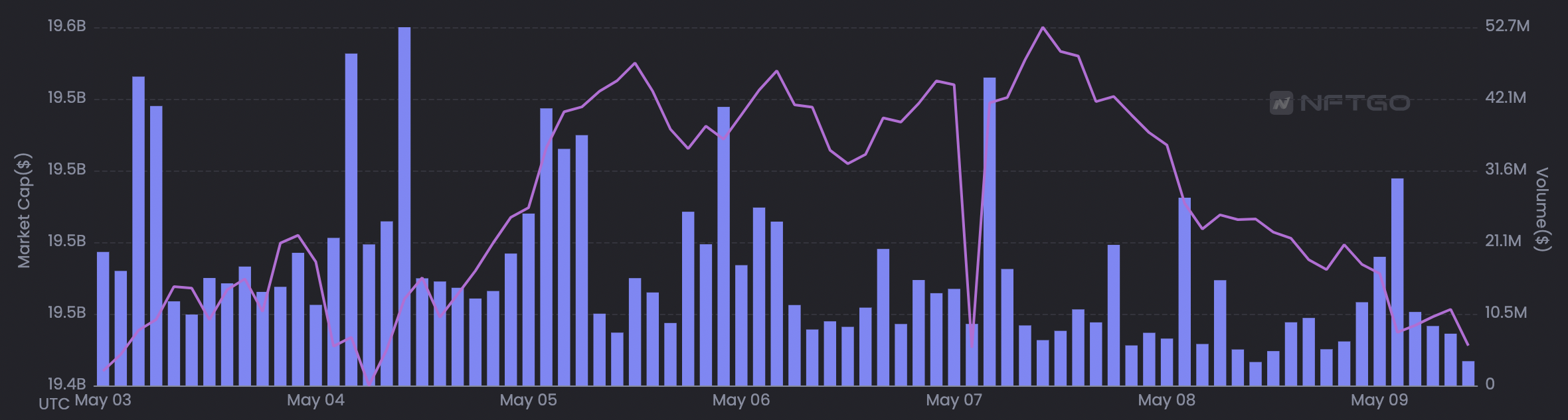

It is going undoubtedly that there’s been an increase of excited investors piling into Web3 which is regardless of the reduction in total volume sales within the last 7 days. Since the beginning of May, the entire market capital for nonfungible tokens (NFTs) rose to in excess of $19.4 billion using the total volume exceeding $1.2 billion within the last 7 days.

Although volumes are less than usual, spectators are quick to question if the projects launching are delivering workable products given the quantity of liquidity that pumps into them. Even though this is not necessarily the situation, NFT investors are earning their assessments according to roadmaps, bulletins and projections the team shares. However, because of the speed where the nascent NFT sector is moving, detours and roadblocks should be expected when purchasing NFTs.

Notable projects and blue-nick status NFTs like Awesome Cats’ Awesome Pets, Axie Infinity as well as Bored Ape Yacht Club (BAYC) have slightly deviated using their intended plans, slightly curbing its users’ enthusiasm. Although this clearly labored out well for BAYC, it is crucial that investors realize that investing capital around the commitment of a guide could ultimately result in disappointment.

The unpredictability of accelerating pains

It’s exciting to come across a task that seems to become blue-nick caliber. The work might tick all of the boxes and also the team has shown to possess formerly created a working product, the skill resonates with diverse categories of people. When the community is powerful and rallies around their conviction toward the work and it is supported by an appealing roadmap, then investors feel believing that they’ve happened on the champion.

Obviously, all this isn’t any guarantee of success.

For example take, Awesome Pets, which launched on Jan. 31 and meant to unveil its play-to-earn (P2E) game, Cooltopia. A couple of technical setbacks delayed the unveil and led to many NFT traders losing belief within the project. Contributing to this, on April 29, Chris Hassett, the previous Chief executive officer of Awesome Cats NFT, walked lower from his role and the organization has become looking for a substitute.

We’re around the search for any new Chief executive officer!!

Chris Hassett has walked lower as Chief executive officer. We thank him and need him the very best continuing to move forward. We’re using a top tier firm to assist look for a world-class Chief executive officer. Within the interim, the founders may lead and concentrate on the vision and direction of CC— Awesome Cats (@coolcatsnft) April 29, 2022

Frequently, the greatest deterrent to some projects’ success are unforeseeable occasions that could create logistical problems but it’s worth noting the main difference between “good” and “bad” problems. For instance, the acceleration of growth can make stress inside a project’s capability to securely scale, but frequently puts a target onto it.

Axie Infinity wasn’t safe from a socially engineered hack producing a $625 million hack that is representative of among the largest cryptocurrency exploits ever.

Because it stands, the Ronin bridge that transfers funds towards the Ethereum mainnet, is closed. Meaning, users’ capital is presently locked around the Ronin network until a complete audit is finished. This unforeseeable event leaves investors using their capital locked, as well as their in-game tokens on the steep downtrend. Considering this, the city morale has witnessed a number of its hardest days with investors voicing their opinions regarding how to proceed.

Market cycles could affect morale

The acceleration of growth can’t only convey a target on the project, but it may also result in a lot of chefs in the kitchen area tinkering with new ideas. Frequently, whenever a project’s user-base grows, so the amount of opinions on which is the best for the long run and sustainability from the community and also the project. Here’s where speculation starts to brew and expectations start to form.

Yuga Labs’ The Otherdeed digital-land NFTs went lower because the most anticipated mint for 2022 so far, with speculated value propositions upward of $110,880. Many of these values were related to rare Koda NFTs, that have been at random spread on Otherdeed lands.

Because the mint was initially priced in ApeCoin, secondary marketplace, OpenSea supported APE as a kind of payment for future listings. The Otherdeeds offered to have an average cost of $25,629 pre-veal but plummeted to $15,510 publish-reveal, plus the loss of cost of APE.

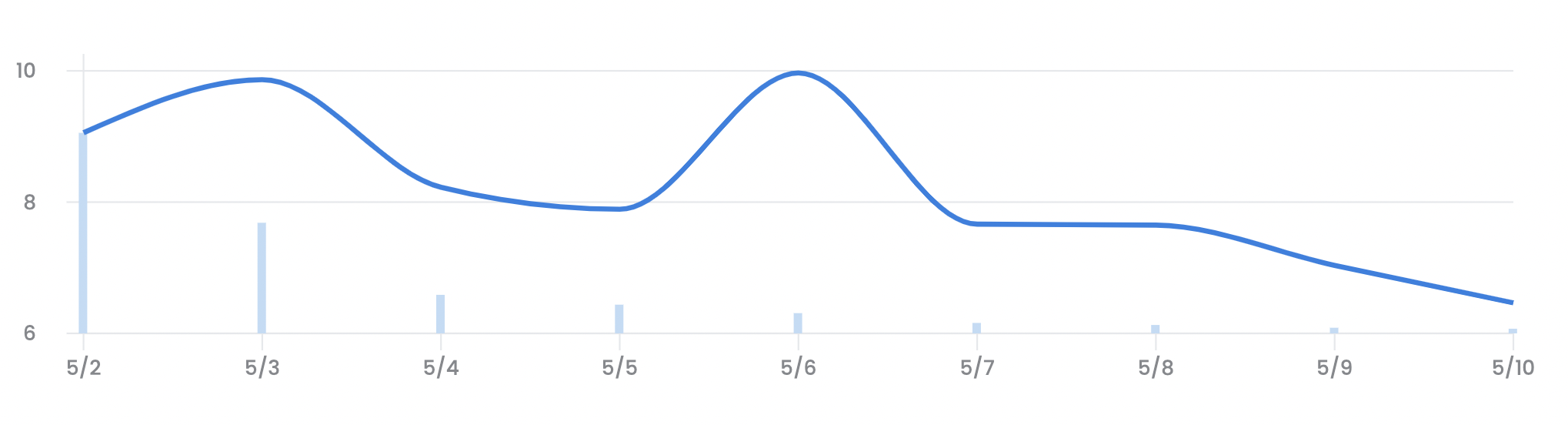

Although a lot of Web3 investors expected this mint to blow others through the wayside, they didn’t expect the general crypto and NFT markets to mind right into a volitile manner. Within the last 7 days, Ethereum has came by 15% with most NFTs being Ethereum-based, the prices also have taken a success. Solana (SOL)-based NFTs are also greatly impacted with SOL trending nearly 40% downward within the last 7 days.

NFT traders also long awaited the mint would raise the NFT market with liquidity. While liquidity was injected into certain collections, the general total sell volume for NFTs has came by 40% within the last 7 days. These figures claim that the marketplace might be entering a cooling period.

With a lot of the marketplace appearing in red, NFT investors have found themselves in tough predicaments. Some investors extended leverage way over they might cover and therefore are getting to pressure sell their assets baffled to pay for margin calls and liquidations. Other medication is rationalizing the negative slope to retail investors panicking due to rate of interest hikes within the U . s . States.

The WAGMI “we’re all gonna make it” mantra that increased well-liked by NFT investors has been tested and traders are getting to grapple with market cycles that aren’t decorated in most-time highs and monumental volume. An optimistic is the fact that oftentimes over these lulls, builders are born. More knowledgeable investors make use of the anticipated market dips as occasions to “stack and survive,” with the addition of for their portfolios and riding the present lows to new all-time highs.