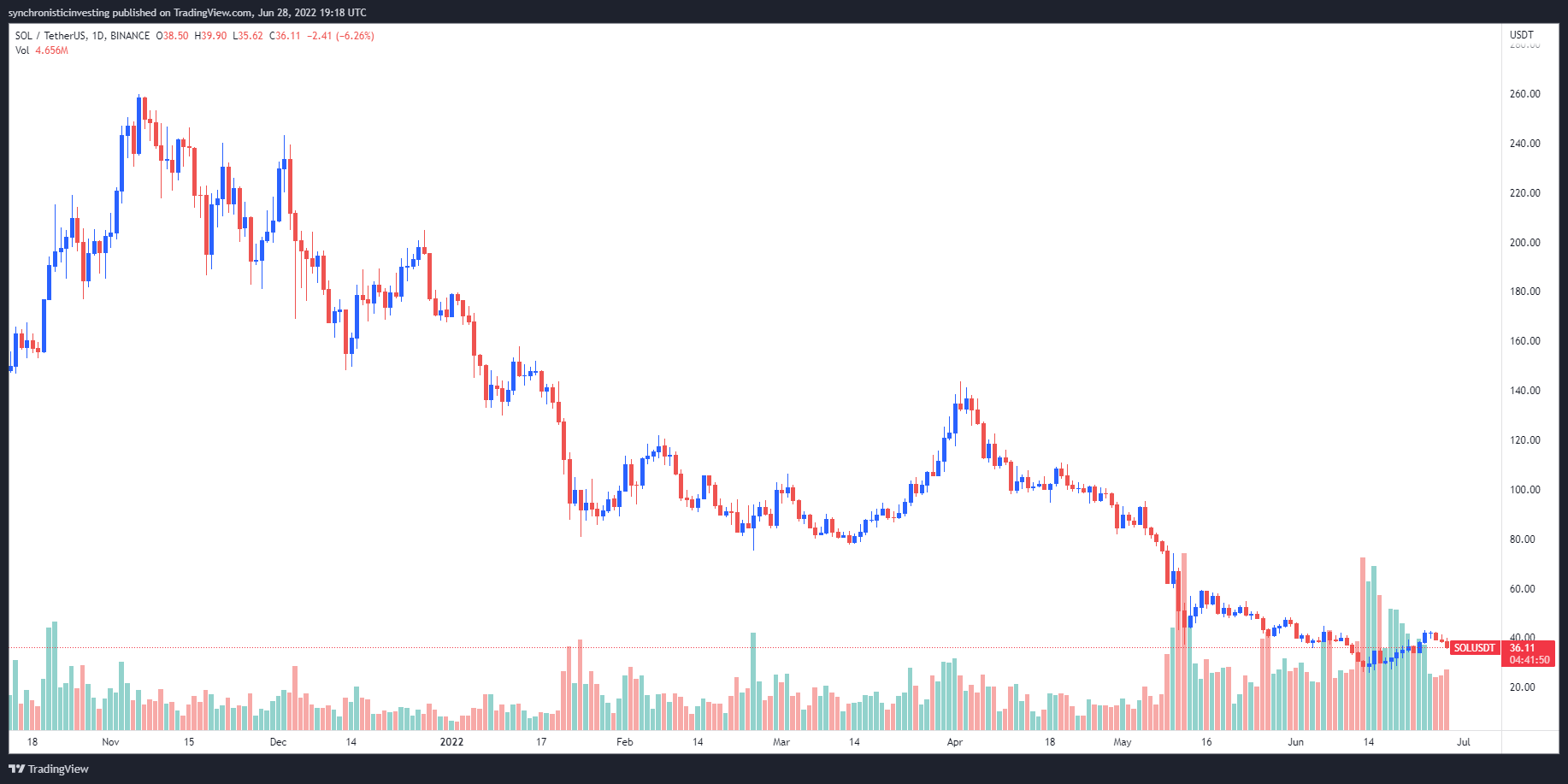

The crypto sector is caught inside a deep correction and up to date reporting shows that the majority of altcoins tend to be more than 70% lower using their 2021 highs. Solana is with that list and investors are undecided about if the token has sufficiently strong fundamentals to warrant buying Solana (SOL) at its current value.

Data from Cointelegraph Markets Pro and TradingView shows SOL is lower 87.5% from the all-time high and because of the current condition from the market, most cost breakouts neglect to notch a regular greater high.

Despite, the dismal outlook, there’s a couple of potential positives that may make Solana a task to look at when the wider market enters a consolidation phase.

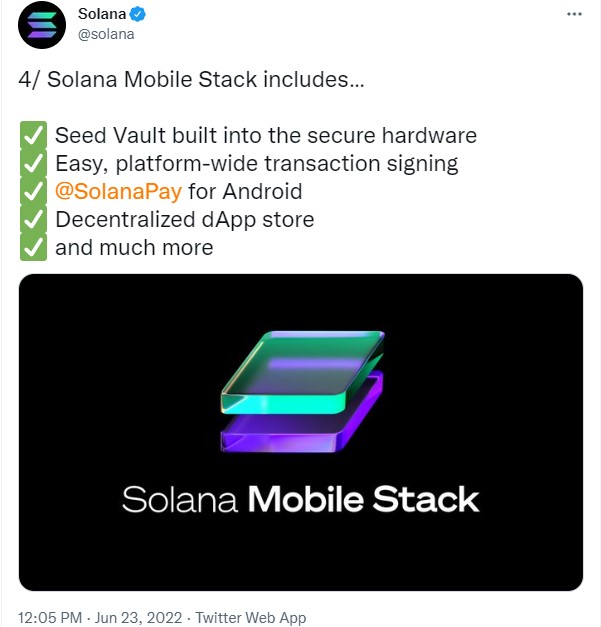

Solana Mobile

SOL cost received a fast boost late a week ago following a June 23 announcement the project would to produce Solana mobile stack, which helps native Android Web3 apps on Solana.

To go together with the brand new operating interface for smartphones, Solana also revealed that it’ll release its very own “Saga” Android phone through Solana Mobile in order to lead the way in which on Web3-enabled devices.

Web3 and also the Metaverse are two topics that came about from the 2021 bull market and indicate the way forward for where blockchain technologies are headed. This move by Solana implies that regardless of the short-term struggles, it is constantly on the develop for future years and appears to play a role within the wider adoption of blockchain and cryptocurrency.

The reduced fee nature from the Solana blockchain causes it to be a perfect candidate for nonfungible token (NFT) projects and gaming DApps, and also the discharge of a tech stack for cell phones happens in creating wider use of these technologies.

When the developers can have the ability to solve the problems that still cause Solana network outages, the token has an opportunity of as being a top contender when the wider market turns bullish again.

It feels in my experience like $SOL goes through an identical trough of disillusionment as $ETH did in 2018. In bear markets prices are not just reflexive—sentiment is simply too. @solana includes a vibrant developer ecosystem and it is downtime issues are solvable. This is apparent looking back.

— spencernoon.eth (@spencernoon) June 27, 2022

Short-term discomfort is anticipated, but fundamentals improve

While it’s nice to appear ahead at exactly what the distant future may hold, in fact rapid-term outlook for Solana and also the wider crypto ecosystem is quite unappealing.

Understanding of the low cost suggests keep close track of was provided by crypto trader and pseudonymous Twitter user Crypto Tony, who published the next chart warning traders not to be seduced by the very first retest of the major support level.

Crypto Tony stated,

“First demand zone tested hence this reaction, but you want to a bottom already following the first test…”

In line with the chart provided, the notable ‘abnormal’ amounts of support for Solana can be found at $13.50 and $3.50.

Market analyst and pseudonymous Twitter user Crypto Patel also predicts further downside soon for SOL as a result of strong quantity of resistance available at the 200-day exponential moving average (EMA).

Crypto Patel stated,

“After breakout and retest of $40 zone, Supports converts into Resistance […] Facing resistance at 200EMA. Anytime can provide downside movement. Sell: $38.5, SL: $43.2, TP: $27.”

Related: SOL cost eyes 75% rally as Solana paints a bullish reversal pattern

Is SOL in early stages of the recovery?

A far more positive outlook for Solana was provided by pseudonymous Twitter user Trader McGavin, who published the next chart highlighting the key amounts of resistance at $60, $74 and $95.

The analyst stated,

“Double bottomed after breaking lower in the wedge and rebounding greater. Among the first to bounce from the bottom and could be headed to $48.”

The significance of maintaining the present cost levels seemed to be discussed by crypto trader and pseudonymous Twitter user Altcoin Sherpa, who published the next chart noting the bullish signal supplied by the medium-term EMAs.

Altcoin Sherpa stated,

“$SOL: Still a do or die area in low periods this is actually the very first time we have seen a few of the medium EMAs switch bullish since March. Longing mid $30s is my current plan like a scalp since i have missed rapid greater.”

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.