Locked crypto assets valued at $750 million are set for release by December 2023, according to data gathered from the Token Unlocks platform.

A total of four decentralized blockchain protocols are looking to saturate the crypto market with their digital tokens.

Among these blockchain networks, the renowned decentralized exchange, dYdX, is scheduled to make the most significant release.

In an official announcement on X (formerly Twitter), the peer-to-peer (P2P) crypto asset platform disclosed its plan to release about 150 million tokens on December 1, 2023, at 12:00 noon UTC.

These digital tokens, valued at about $500 million in current market rates, were initially locked by investors, the founding team, and developers.

📢Token Unlock Update📢

dYdX Trading Inc., dYdX Foundation and certain parties to the Warrants to Purchase Tokens signed an amendment to, among other things, postpone the initial release date applicable to investor $DYDX tokens to Dec 1, 2023

Blog: https://t.co/froqUPL3ay

🧵👇🏻

— dYdX Foundation 🦔 (@dydxfoundation) January 25, 2023

The vested tokens were divided into 27.7% for past investors of dYdX Trading Inc., with founders, employees, advisors, and consultants getting 15.3% for both dYdX Trading Inc. and the dYdX Foundation.

Beyond the December 1 vesting release, dYdX has outlined a schedule to release 40% of its tokens in equal monthly installments from January 1 to June 1, 2024.

An additional 20% will be released from June 1 to June 1, 2025, and the final tranche of vested tokens will be completed by June 1, 2026, as indicated in dYdX’s blog post.

While dYdX leads the token release circle, other protocols are also introducing a sizable amount of vested tokens into the crypto market.

The popular automated market maker (AMM) protocol, 1Inch Network, plans to release 98.74 million 1INCH tokens on the same day as dYdX.

This will see 9.48% of its total supply hitting the market. The digital tokens are currently worth $33.76 million at the current price of the 1INCH asset.

Ethereum layer-2 protocol Optimism will also unlock 24.16 million of its OP tokens, worth about $41.55 million, by November 30. This will see a total of 2.74% of its over 4.2 billion total supply, making an entry into the crypto market.

Rounding up the mix is Move prover-powered proof-of-stake (PoS) blockchain protocol Aptos, which is set to undergo a token emission in excess of 24.84 million APT tokens, representing 8.97% of its circulating supply.

This release represents 8.97% of its circulating supply, with the tokens valued at $171.41 million.

Broader Market Performance Somewhat Bearish

The crypto market witnessed a significant downturn since the 2022 winter kicked off in May 2022 following the collapse of the Terra blockchain protocol.

Within a 12-month period, the nascent industry experienced an over 50% decline from its peak of $2.92 trillion, struggling to maintain a $1 trillion capitalization through much of the year.

Currently, the market dynamics are gradually shifting towards a bullish trend. This trend is currently being led by the foremost crypto asset, Bitcoin, which has since climbed above $35,000, given growing interest from mainstream legacy financial institutions.

Despite this positive momentum, the nascent industry still faces challenges, with its current market valuation stuck at $1.4 trillion after a 1.94% decrease in the last 24 hours.

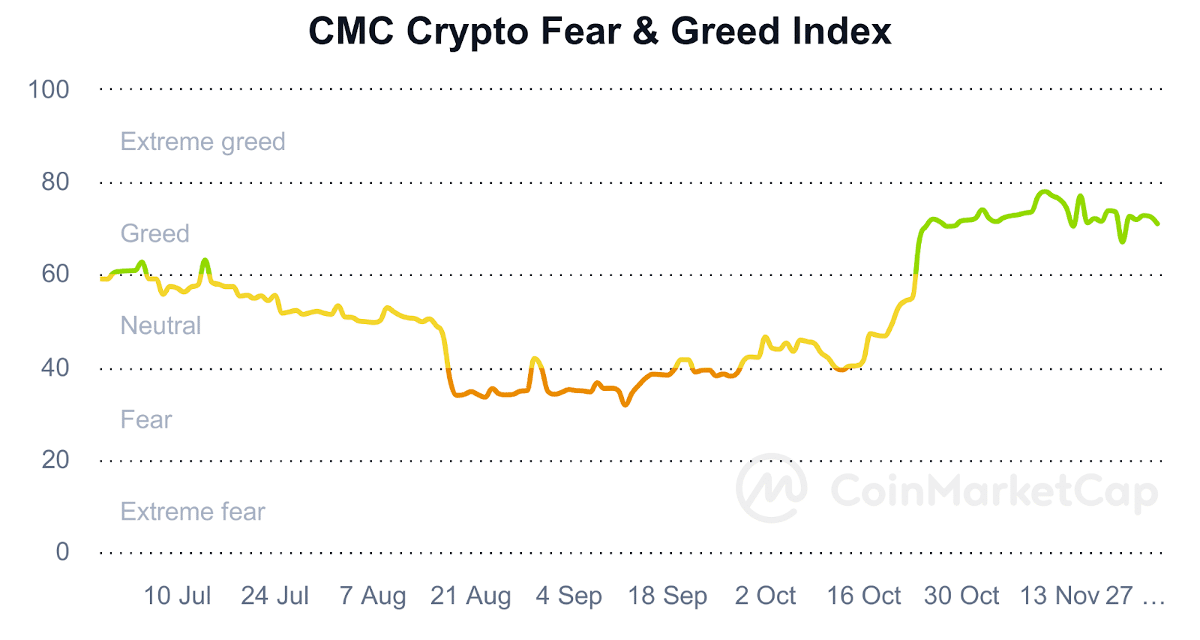

However, the bearish trend has not dampened the growing interest in the nascent industry. Data from CoinMarketCap reveals that the Crypto Fear & Greed Index (used to measure market sentiment) indicates strong greed among investors, with a 72.83 mark.

As a result, the scheduled token releases would likely have little impact on the long-term performance of the broader crypto market.