The plane touches lower and involves a halt. Going to passport control, among the passengers stops in a vending machine to purchase a container of soda — however the system is absolutely indifferent to all their charge cards, cash, coins and anything else. All that belongs to an overseas economy so far as the device is worried, and therefore, they’re not able to buy a droplet of Coke.

Within the real life, the device could have been pleased with a Mastercard or perhaps a Visa. And also the cash exchange desk in the airport terminal could have been just like happy arrive at the save (having a hefty markup, obviously). Within the blockchain world, though, the above mentioned scenario hits the place with a few commentators, as lengthy once we swap traveling abroad for moving assets in one chain to a different.

While blockchains as decentralized ledgers are very good at tracking transfers of worth, each layer-1 network is definitely an entity by itself, not aware associated with a non-intrinsic occasions. Since such chains are, by extension, separate entities vis-à-vis each other, they aren’t inherently interoperable. Which means you cannot make use of your Bitcoin (BTC) to gain access to a decentralized finance (DeFi) protocol in the Ethereum ecosystem unless of course the 2 blockchains can communicate.

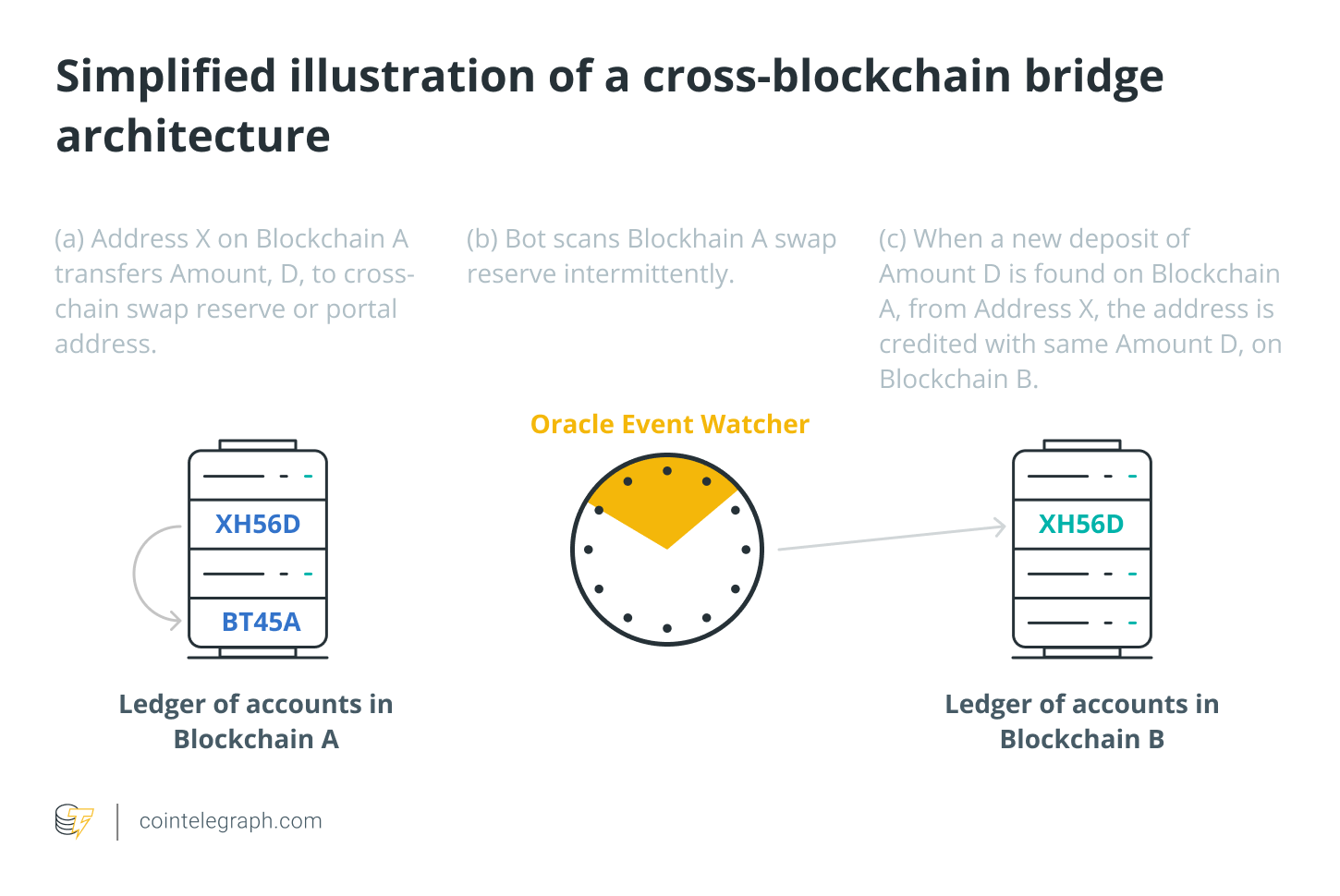

Powering this communication is really a so-known as bridge — a protocol enabling users to transfer their tokens in one network to a different. Bridges could be centralized — i.e., run by just one entity, such as the Binance Bridge — or created to different levels of decentralization. In either case, their core task would be to let the user to maneuver their assets between different chains, meaning more utility and, thus, value.

As handy because the concept sounds, it’s not typically the most popular one with lots of locally at this time. On a single hands, Vitalik Buterin lately voiced skepticism concerning the concept, warning that mix-chain bridges can enable mix-chain 51% attacks. However, spoofing-based cyberattacks on mix-chain bridges exploiting their smart contract code vulnerabilities, as was the situation with Wormhole and Qubit, motivated critics to ponder whether mix-chain bridges could be anything apart from a burglar liability in purely technological terms. So, are you ready to stop on the thought of an online of blockchains held together by bridges? Not always.

Related: Crypto, like railways, is probably the world’s top innovations from the millennium

When contracts get too smart

While details rely on the particular project, a mix-chain bridge linking two chains with smart contract support normally functions such as this. A person transmits their tokens (let’s give them a call Catcoins, felines are awesome, too) on Chain 1 towards the bridge’s wallet or smart contract there. This smart contract needs to pass the information towards the bridge’s smart contract on Chain 2, consider it’s not capable of contacting it directly, another-party entity — whether centralized or perhaps a (to some extent) decentralized intermediary — needs to carry the content across. Chain 2’s contract then mints synthetic tokens towards the user-provided wallet. There we go — the consumer presently has their wrapped Catcoins on Chain 2. It’s nearly the same as swapping fiat for chips in a casino.

To have their Catcoins back on Chain 1, the consumer would first need to send the synthetic tokens towards the bridge’s contract or wallet on Chain 2. Then, an identical process plays out, because the intermediary pings the bridge’s contract on Chain 1 to produce the right quantity of Catcoins to some given target wallet. On Chain 2, with respect to the bridge’s exact design and business design, the synthetic tokens that the user turns in are generally burned or locked in child custody.

Keep in mind that every step of the operation is really damaged lower right into a straight line sequence of smaller sized actions, the initial transfer is created in steps. The network must first see if the consumer indeed has enough Catcoins, take away them using their wallet, adding the right add up to those of the smart contract. These steps from the overall logic that handles the worth being moved between chains.

Within the situation of both Wormhole and Qubit bridges, the attackers could exploit flaws within the smart contract logic to give the bridges spoofed data. The concept was to obtain the synthetic tokens on Chain 2 without really depositing anything to the bridge on Chain 1. And truthfully, both hacks come lower as to the occur in most attacks on DeFi services: exploiting or governing the logic powering a particular process for profit. A mix-chain bridge links two layer-1 systems, but things engage in similarly between layer-2 protocols, too.

For example, whenever you stake a non-native token right into a yield farm, the procedure involves an interaction between two smart contracts — those powering the token and also the farm. Or no underlying sequences possess a logical flaw a hacker can exploit, the criminal is going to do so, and that’s just how GrimFinance lost some $$ 30 million in December. So, as prepared to avoid mix-chain bridges because of several problematic implementations, we may as well silo smart contracts, getting crypto to its very own stone age.

Related: DeFi attacks are rising — Will the have the ability to stem the tide?

A high learning curve to understand

There’s a larger point to make here: Don’t blame an idea for any problematic implementation. Online hackers always stick to the money, and also the more and more people use mix-chain bridges, the larger is the incentive to fight such protocols. Exactly the same logic pertains to something that holds value and it is attached to the internet. Banks get hacked, too, but, we’re in no hurry to shutter these since they’re an important bit of the bigger economy. Within the decentralized space, mix-chain bridges possess a big part, too, therefore it will make sense to have to wait our rage.

Blockchain continues to be a comparatively new technology, and also the community around it, as vast and vibrant because it is, is just working the best security practices. This really is much more true for mix-chain bridges, which try to connect protocols with various underlying rules. At this time, they’re a nascent solution opening the doorway to maneuver value and knowledge across systems that comprise something larger than the sum of the its components. There’s a learning curve, and it is worth mastering.

While Buterin’s argument, because of its part, goes past implementation, it’s still not without caveats. Yes, a malicious actor in charge of 51% of the small blockchain’s hash rate or staked tokens could attempt to steal Ether (ETH) locked around the bridge alternatively finish. The attack’s volume would hardly exceed the blockchain’s market capital, as that’s the utmost hypothetical limit about how much the attacker can deposit in to the bridge. Smaller sized chains have smaller sized market caps, therefore the resulting harm to Ethereum could be minimal, and also the roi for that attacker could be questionable.

Some of today’s mix-chain bridges aren’t without their flaws, it’s too soon to dismiss their underlying concept. Besides regular tokens, such bridges may also move other assets, from nonfungible tokens to zero-understanding identification proofs, which makes them hugely valuable for the whole blockchain ecosystem. A technology that contributes value to each project by getting it to more audiences shouldn’t be observed in purely zero-sum terms, and it is commitment of connectivity may be worth taking risks.

This short article doesn’t contain investment recommendations or recommendations. Every investment and buying and selling move involves risk, and readers should conduct their very own research when making the decision.

The views, ideas and opinions expressed listed here are the author’s alone and don’t always reflect or represent the views and opinions of Cointelegraph.

Lior Lamesh may be the co-founder and Chief executive officer of GK8, a blockchain cybersecurity company that provides a custodial solution for banking institutions. Getting honed his cyber skills in Israel’s elite cyber team reporting straight to the best Minister’s Office, Lior brought the organization from the beginning to some effective acquisition for $115 million in November 2021. In 2022, Forbes put Lior and the business partner Shahar Shamai on its 30 Under 30 list.