Development inside the Polkadot (Us dot) ecosystem continues to be gradually unfolding in the last year . 5, and also the work place in by developers is finally beginning to deal with fruit as parachain auctions finish and also the first chains launch around the mainnet.

The next thing of interoperability inside the ecosystem is placed to start since mix-chain functionality is going to go live. The following step allows Polkadot-based parachains to talk with one another and transfer assets between chains.

After passing community election, v0.9.19 continues to be enacted on Polkadot. This upgrade incorporated a load call upgrading Polkadot’s runtime to allow parachain-to-parachain messaging over XCM and upgrading #Statemint to incorporate minting assets (like NFTs) and teleports. pic.twitter.com/uqIB5di2Q1

— Polkadot (@Polkadot) May 4, 2022

Here’s a glance at exactly what the launch from the XCM messaging system method for the cost of Us dot, the choices which are available these days to Us dot holders and just how this development increases its functionality inside the Polkadot ecosystem.

Polkadot is unshackled

Up up to now, Us dot had limited uses and it was essentially isolated by itself network with little functionality. Its primary functions incorporated staking, governance and contribution in parachain crowdloans, which helped lessen the circulating supply but did very little else to actually spark demand.

The development of mix-chain communication enabled Us dot gets in various parachain systems and the amount of use cases for that Us dot token on parachains like Moonbeam and Astar Network.

1/ $Us dot has become live & functional in DeFi on Moonbeam!

After this morning’s #XCM release to @Polkadot, Moonbeam has added xcDOT, an XC-20 representation of Us dot on its parachain.https://t.co/gCXIqwlXWb

— Moonbeam Network (@MoonbeamNetwork) May 4, 2022

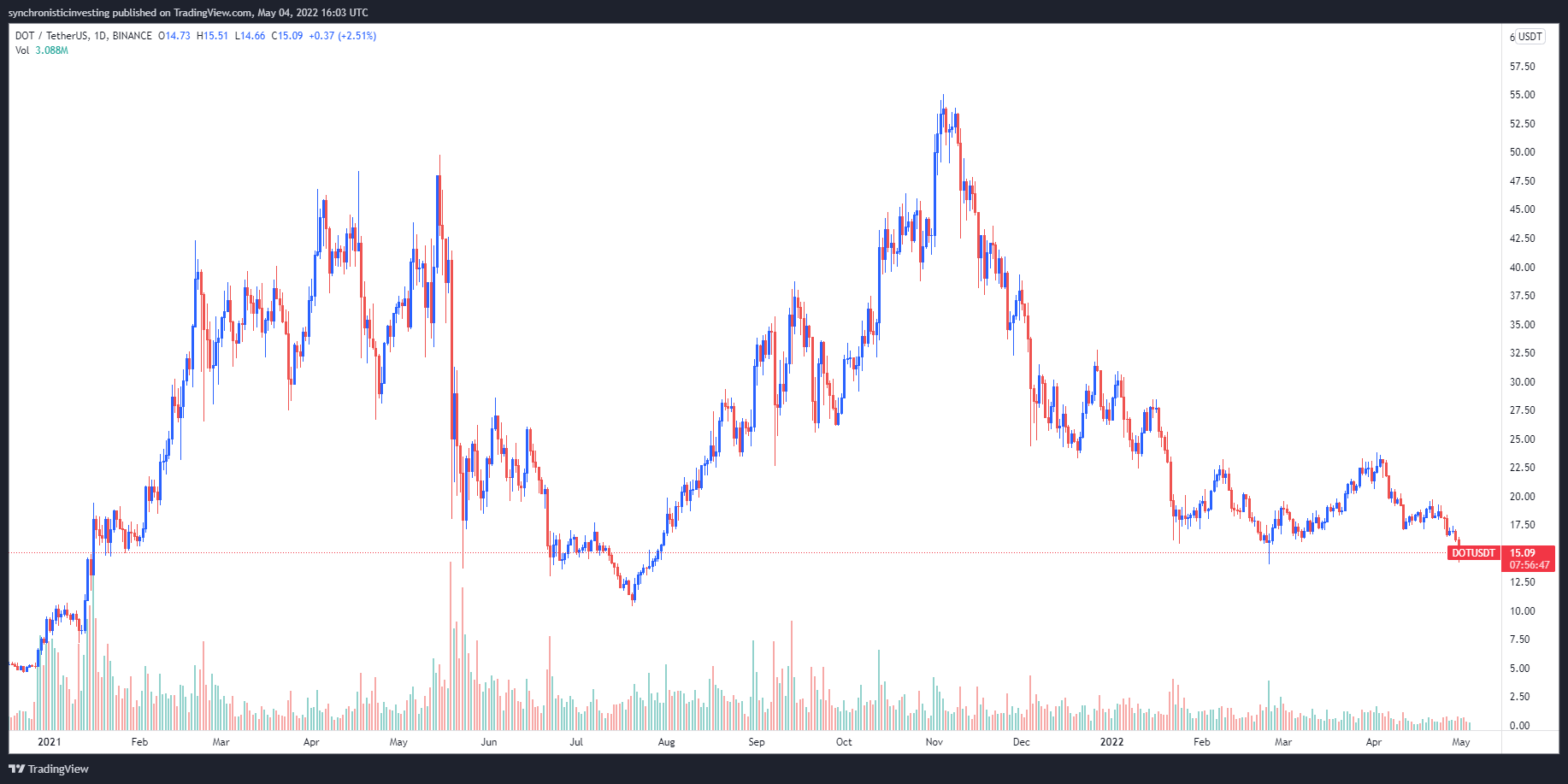

Data from Cointelegraph Markets Pro and TradingView implies that the cost of Us dot continues to be hard hit through the six-month downtrend within the crypto market since it’s cost has declined 73% from the all-time high at $55 on November. 4.

Using the token now buying and selling in a notable support/level of resistance, it remains seen if the opportunity to transfer Us dot across various parachains can help result in a rise in interest in Us dot.

Related: Polkadot launches mix-chain messaging system to resolve blockchain’s bridge problem

New use cases

One notable use for Us dot that’s been rising in recognition in recent several weeks is liquid staking and minting stablecoins by utilizing crypto assets as collateral.

Us dot is now able to used in the DeFi-focused Acala parachain and deposited in the liquid staking contract in return for LDOT, which could then be utilized for collateral to mint aUSD, the native decentralized stablecoin of Polkadot and Kusama.

This means it’s time for you to unbond $Us dot from @Polkadot for LDOT staking. Liquid Us dot staking, $LDOT, is going to go survive @AcalaNetwork

– Greater yield

– Keep earning Us dot staking rewards but get $LDOT to make use of in DeFi in order to mint $aUSD

– Instant unbonding

– Fully decentralized— Dan Reecer ️⚪️ (@danreecer_) May 3, 2022

Us dot may also be used in a variety of DeFi applications including yield farming, lending and borrowing. As the development of mix-chain communication spreads through the Polkadot ecosystem, additional ways to use Us dot will probably emerge, especially as parachains unveil elevated functionality.

The views and opinions expressed listed here are exclusively individuals from the author and don’t always reflect the views of Cointelegraph.com. Every investment and buying and selling move involves risk, you need to conduct your personal research when making the decision.