On November 25, Bitcoin, the key cryptocurrency, unsuccessful to interrupt over the $16,800 level and started to fall toward the 38.2% Fibonacci retracement level. Similarly, Ethereum, the 2nd best cryptocurrency, has adopted Bitcoin’s lead and it is presently buying and selling bearishly toward $1,160.

The reason behind the market’s risk-off sentiment might be associated with recent Hodlnaut updates.

Based on Bloomberg news, the Commercial Matters Department, the Singapore police’s white-colored-collar crime unit, is investigating Hodlnaut, a Singapore-based crypto loan provider that’s presently under interim judicial management.

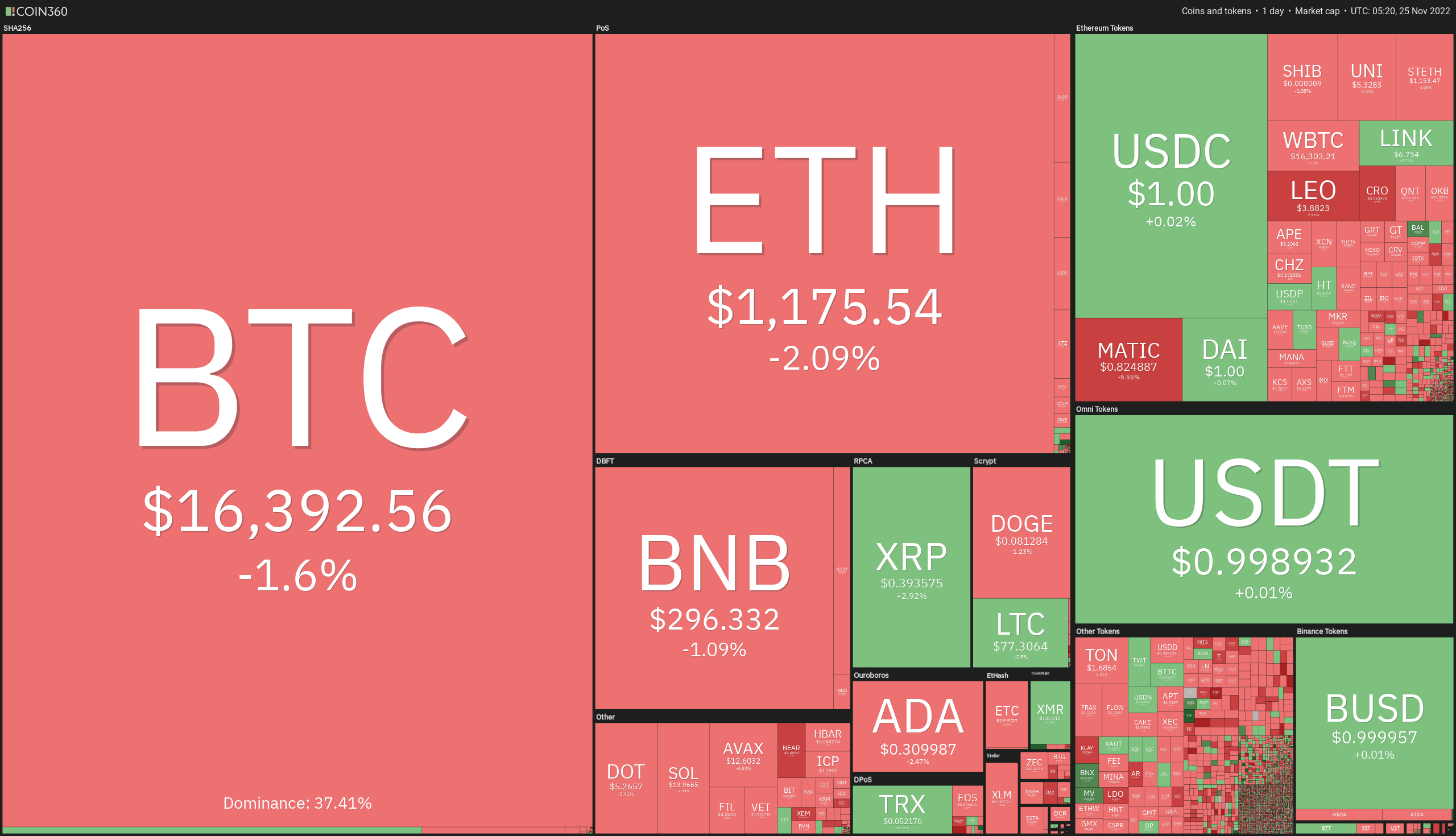

Crypto Market Cap Update

Major cryptocurrencies were buying and selling unevenly in early stages November 25th, because the global crypto market cap fell 1% to $828.27 billion on the day before. In comparison, the entire crypto market volume fell 47% within the last 24 hrs to $48.87 billion.

The general volume in DeFi was $3.21 billion, comprising 6% from the total 24-hour volume within the crypto market. The general amount of all stablecoins was $44.98 billion, comprising over 93% from the entire 24-hour amount of the crypto market.

Let us check out the very best 24-hour altcoin gainers and losers.

Top Altcoin Gainers and Losers

BinaryX (BNX), Huobi Token (HT), and Stacks (STX) are three from the best players coins which have acquired value within the last 24 hrs. The BNX cost has soared by greater than 7% to $169, the HT cost is continuing to grow by greater than 5% to $5.65, and also the STX cost has elevated by nearly 1.5%.

UNUS SED LEO (LEO), Klaytn (KLAY), and Arweave (AR) are three from the best players coins which have lost value within the last 24 hrs, where LEO and KLAY have forfeit over 7% to trade at $3.88 and $.17, correspondingly. Simultaneously, AR’s cost is lower over 6% to trade at $8.95.

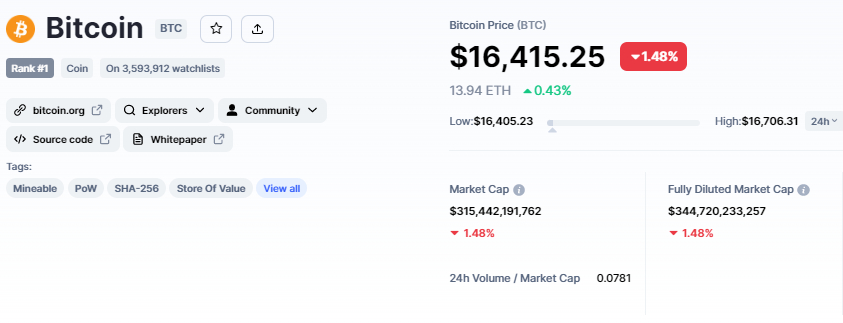

Bitcoin Price

The present Bitcoin cost is $16,418 and also the 24-hour buying and selling volume is $24 billion. Over the past 24 hrs, the BTC/USD pair has dropped nearly 1.5%, while CoinMarketCap presently ranks first having a live market cap of $346 billion, lower from $350 billion yesterday. It features a total way to obtain 21,000,000 BTC coins along with a circulating way to obtain 19,216,412 BTC coins.

Searching in the technicals, Bitcoin has yet to interrupt with the $16,785 barrier, despite dovish FOMC meeting minutes. Investors seem to be experiencing FUD because of FTX and today Hodlnaut news.

The BTC/USD pair is presently climbing down perfectly into a 38.2% Fibonacci retracement degree of $16,300. Around the 4-hour time-frame, it’s already entered underneath the 50-day moving average line, indicating a selling bias.

Similarly, the key technical indicators, like the RSI and MACD, are not far from entering a selling zone, and when this happens, BTC may break underneath the $16,300 mark and achieve an assistance degree of $16,000. A higher level of support is placed at $15,600.

A bullish breakout from the $16,785 level, however, could expose BTC towards the $17,000 or $17,550 level.

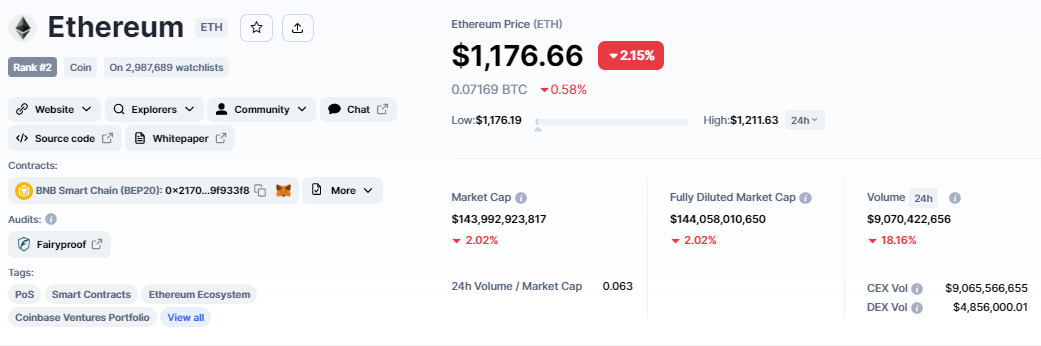

Ethereum Price

The present cost of Ethereum is $1,177, having a 24-hour buying and selling amount of $9 billion. Within the last 24 hrs, Ethereum has acquired over 2%. CoinMarketCap presently ranks #2, having a live market cap of $144 billion. It features a circulating way to obtain 122,373,866 ETH coins.

Around the 4-hour chart, Ethereum is buying and selling bearish at $1,176 and it has created a bearish engulfing candle, indicating the potential of an industry bearish bias.

ETH is presently testing the 50-day moving average line at $1,175 along with a bearish crossover below this level can lead to a 38.2% Fib degree of $1,160.

An additional break below this level might take ETH to $1,145 or $1,130 levels, which match 50% and 61.8% Fibo levels, correspondingly.

Around the upside, ETH’s major resistance remains at $1,216, along with a break above this might go towards the $1,250 level. Later today, investors should keep close track of the $1,160 level, as failure to interrupt below this level could cause a bullish bounce or the other way around.

Litecoin Jumps 23%

The present cost of Litecoin is $77, having a 24-hour buying and selling amount of $1.1 billion. Litecoin has acquired greater than 1% within the last 24 hrs, nevertheless its weekly gain is much more than 23%. CoinMarketCap is presently rated 13th, having a live market cap of $5.5 billion.

We have an 84,000,000 LTC gold coin maximum supply along with a circulating way to obtain 71,687,456 LTC coins.

Probably the most well-known experts within the cryptocurrency market have commented on Litecoin’s recent cost increase, predicting the cryptocurrency will undergo an enormous breakout following a “large accumulation” period that preceded its approaching halving event.

Pseudonymous crypto analyst Kaleo lately told their over 500K Twitter supporters that LTC’s recent surge seems is the “real thing” since the cryptocurrency continues to be “lengthy past due for any solid pump.”

Based on Kaleo, Litecoin’s cost has lengthy troughs where it moves gradually downward, adopted by rapid peaks.

After “a really substantial accumulation,” Smart Contracter, another well-known cryptocurrency expert, observed that LTC appears to become breaking from its range.

Per the analyst, BTC has a tendency to bottom roughly 500 days before its next halving event, and LTC’s breakthrough is going on less than 230 days in front of its very own halving.

Litecoin Cost Conjecture

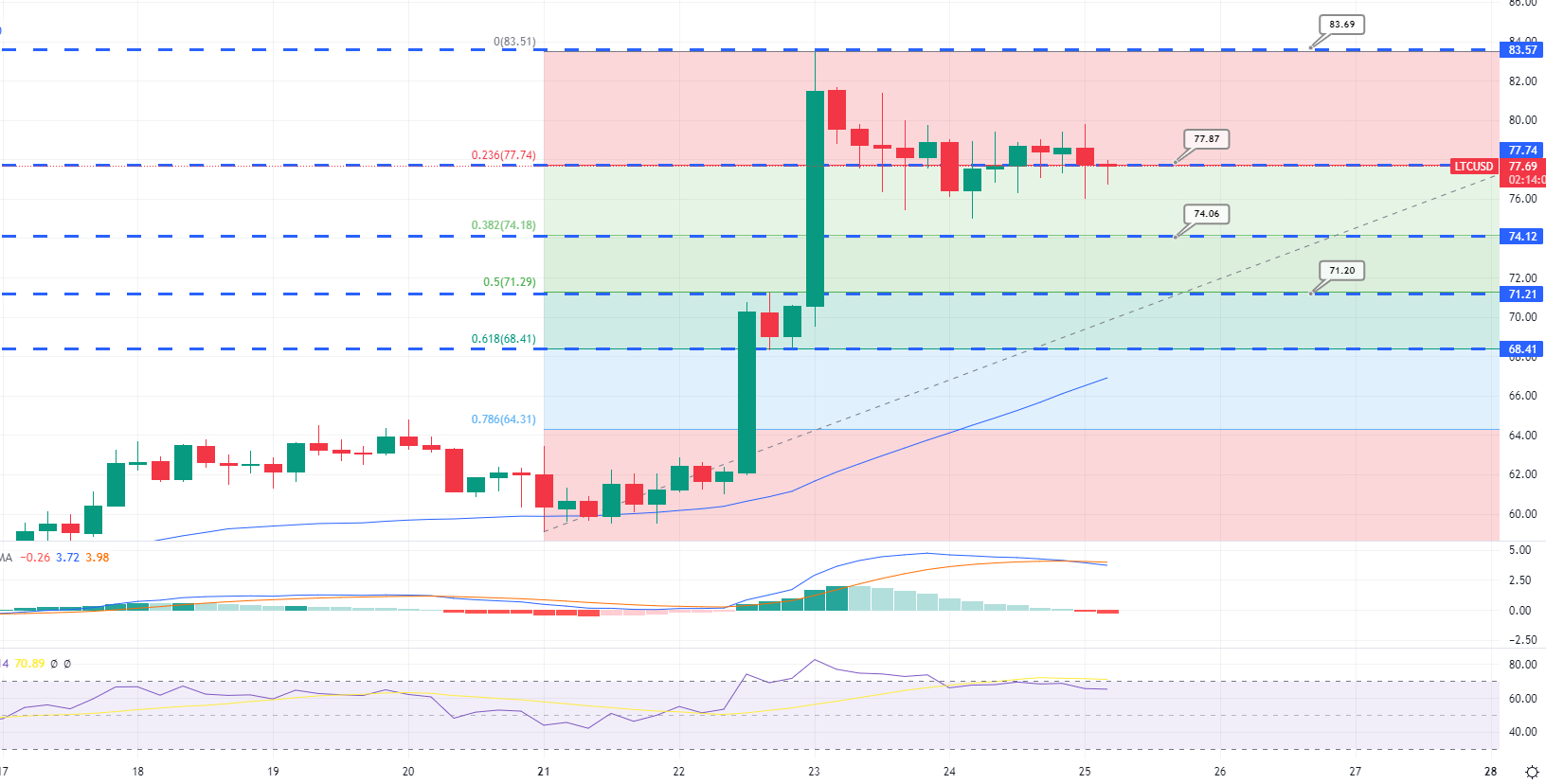

Litecoin was rejected underneath the $83.65 level of resistance around the technical front, and candle closings below this level triggered a bearish correction.

Litecoin has completed a 23.6% Fibonacci retracement and it is now climbing down toward $74, that is extended with a 38.2% Fibonacci retracement. The LTC/USD pair is anticipated to reverse bullishly over the $74 or $68.75 (61.8% Fibo level) support levels.

Presale Cryptocurrency With Enormous Potential Gains

Dash 2 Trade (D2T)

Dash 2 Trade is definitely an Ethereum-based buying and selling intelligence platform that gives traders of abilities with real-time analytics and social data, letting them make more informed decisions.

D2T, produced by the Learn 2 Trade service, provides investors with market-driven insights, buying and selling signals, and conjecture services. Customers will be presented enough information to create informed decisions, based on the cryptocurrency initiative.

D2T started selling tokens three days ago and it has elevated greater than $6.9 million. Following a presale, D2T is going to be for auction on LBank and BitMart, having a significant rise in asset cost expected.

The present worth of 1 D2T is .0513 USDT, however this is anticipated to increase to $.0533 within the next stage of sales and $.0662 within the final stage.

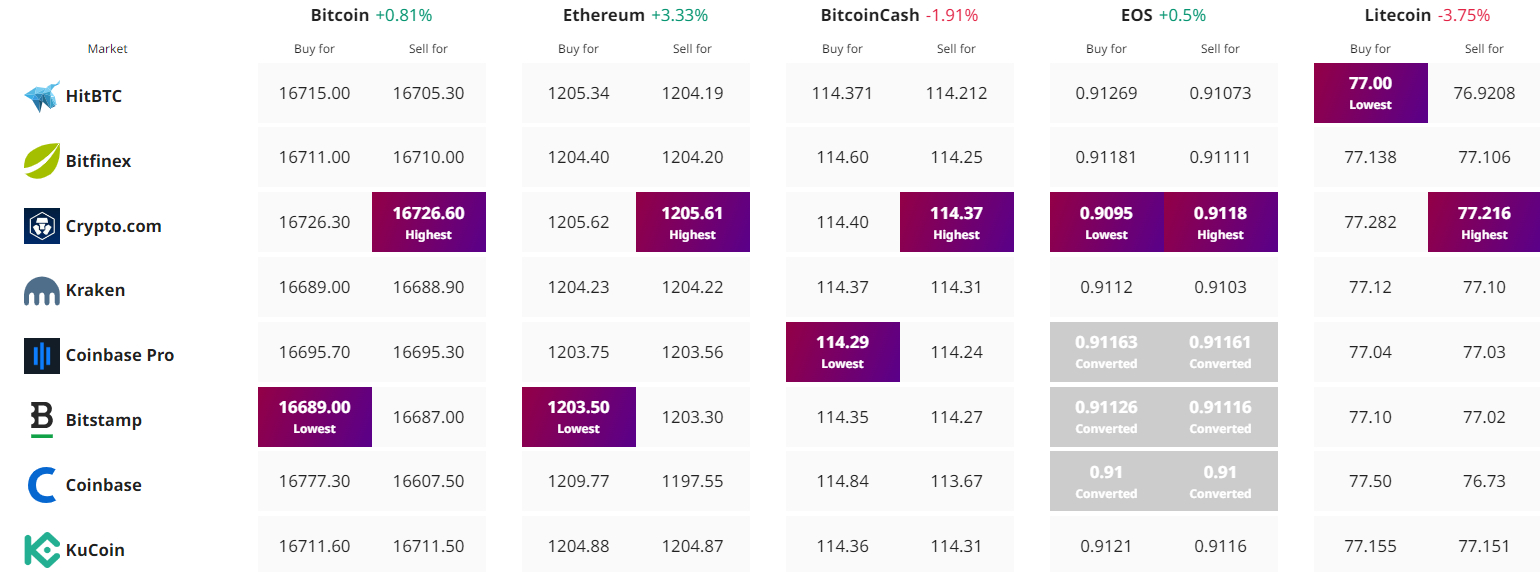

Get The Best Cost to purchaseOrMarket Cryptocurrency